How Credit Fix Lawyers Can Help Dispute Inaccuracies on Your Credit Report

Discover how credit fix lawyers can assist in disputing inaccuracies on your credit report in our blog ‘How Credit Fix Lawyers Can Help Dispute Inaccuracies on Your Credit Report’.

Building a Stronger Financial Future with Credit Repair Strategies

Take charge of your financial future with effective credit repair strategies from ‘Building a Stronger Financial Future with Credit Repair Strategies’.

Navigating Financial Recovery: How a Credit Report Consultation Can Change Your Life

Transform your financial future with a credit report consultation – discover how in ‘Navigating Financial Recovery: How a Credit Report Consultation Can Change Your Life’.

Financial Improvement Tips: Strategies to Increase Your Credit Score

Boost your financial improvement journey with effective strategies to raise your credit score in our blog ‘Financial Improvement Tips: Strategies to Increase Your Credit Score’.

How a Thorough Credit Score Analysis Can Unlock Better Loan Rates

Optimize your loan rates with a comprehensive credit score analysis from ‘How a Thorough Credit Score Analysis Can Unlock Better Loan Rates’.

Financial Improvement Tips: Strategies to Increase Your Credit Score

Introduction to Financial Improvement and Credit Scores Improving your finances begins with understanding your credit score. Think of your credit score like a financial report card that lenders use to decide if they want to lend you money or give you a credit card. It shows how good you are at paying back money you […]

Navigating Financial Recovery: How a Credit Report Consultation Can Change Your Life

Introduction to Credit Health: Why It Matters A good credit score is your financial passport. Everywhere you go—want to take out a loan? Buy a house? Maybe lease a car? Your credit health decides if you can and on what terms. Think of it as a report card but for your finances. High scores? Banks […]

2024’s Top 5 Credit Repair Services: A Comprehensive Guide

2024’s Top 5 Credit Repair Services: A Comprehensive Guide In today’s fast-paced financial world, managing one’s credit score has become paramount, especially for those dealing with credit card debt, collections, or bankruptcy. A free credit report often reveals issues that need addressing, from identity theft to errors by credit bureaus like Experian, Equifax, and others. […]

Best Credit Repair Services

In today’s world, maintaining a good credit score is more important than ever. Your credit report is a reflection of your financial responsibility and can impact your ability to secure loans, credit cards, or even rent an apartment. If you are struggling with a low credit score and are in need of professional help, credit […]

How To Fix Your Credit In 7 Easy Steps

If you have found yourself with a less than perfect credit score, you may be wondering what the fastest way is to repair it. A good credit score is essential for obtaining loans, credit cards, and even renting an apartment. Luckily, there are ways to improve your credit score quickly and efficiently. In this article, […]

Steps To Fixing Your Credit On Your Own

Having good credit is essential for financial success, but what do you do if your credit is less than stellar? Many people wonder if they can fix their credit themselves, or if they need to seek professional help. Correcting errors on credit reports, paying off debts, and establishing good spending habits are all steps you […]

How To Fix Your Credit

Understanding Your Credit Score Having a good credit score is crucial for your financial health and well-being. If you have a low credit score, it can affect your ability to qualify for loans, credit cards, and even housing rentals. Fortunately, there are steps you can take to improve your credit score and fix any issues […]

How To Repair Credit

Repairing your credit can seem like a daunting task, but with the right strategies and tools, it is possible to improve your credit score and financial health. From disputing errors on your credit report to creating a budget and sticking to it, there are many steps you can take to repair your credit. Assessing your […]

How Long Does A Repo Stay On Your Credit

Credit reporting and repossession When it comes to managing your credit report, understanding the impact of a repossession is crucial. A repossession can have a significant and long-lasting effect on your credit score, making it difficult to secure loans and credit cards in the future. But how long does a repossession actually stay on your […]

How To Choose The Best Credit Repair Service

Credit repair can be a daunting and overwhelming process for individuals looking to improve their credit scores and financial standing. With so many companies and services claiming to be the best in the business, it can be difficult to determine which ones are legitimate and trustworthy. We will explore the top credit repair companies in […]

I Need My Credit Repaired

If you are struggling with a poor credit score and need help repairing it, you are not alone. Many individuals face challenges with their credit and finding solutions can be overwhelming. Fortunately, there are credit repair services available that can help you navigate the process of improving your credit score. What is Credit Repair? Credit Repair involves removing incorrect […]

A Plus Emergency Credit Repair

In today’s world, credit plays a crucial role in one’s financial stability and opportunities. However, for many individuals, maintaining a good credit score can be a challenge. Unexpected financial emergencies, unforeseen circumstances, or even past mistakes can result in a damaged credit history. That’s where A Plus Emergency Credit Repair comes in. With years of […]

How To Generate Credit Repair Leads

Generating credit repair leads is a crucial aspect of running a successful credit repair business. However, it can be a challenging and time-consuming task if you don’t have a solid strategy in place. The value of credit repair leads Understanding the value of credit repair leads is essential for the success of your credit repair […]

30 Day Credit Repair

In today’s world, a good credit score is crucial. It determines your ability to secure loans, rent an apartment, and even get a job. But what happens when your credit score is less than stellar? The good news is that there are steps you can take to repair your credit and improve your financial standing. […]

Free AI Credit Repair

Why is credit repair important? In today’s digital age, credit scores play a crucial role in determining financial stability and opportunities. However, many individuals find themselves burdened with low credit scores due to various circumstances. Fortunately, advancements in artificial intelligence (AI) technology have paved the way for innovative solutions, such as free AI credit repair […]

American Credit Acceptance Repo Policy

American Credit Acceptance (ACA) is a leading auto finance company in the United States that specializes in helping consumers with less than perfect credit obtain financing for their vehicle purchases. As part of its lending practices, ACA has a repossession policy in place to protect its interests in the event of loan default. Importance of […]

Metro 2 Credit Repair

Metro 2 Credit Repair is a professional service that specializes in helping individuals improve their credit scores. A good credit score is essential for financial stability and success, as it impacts everything from obtaining loans and credit cards to securing favorable interest rates on mortgages and car loans. Unfortunately, many people find themselves with a […]

Is a 727 Credit Score Good?

Your credit score is a measure of your financial health. This familiar statement emphasizes the importance of having a good credit score. Your credit score plays a crucial role in determining your eligibility for loans, credit cards, and even certain job opportunities. But what exactly does a credit score of 727 mean? In this article, […]

Self Credit Card – A Complete Detailed Analysis

A self credit card is a financial tool that allows individuals to build or rebuild their credit history. It is specifically designed for those who may have limited or poor credit scores and helps them establish a positive credit profile. Unlike traditional credit cards, self credit cards require collateral or a deposit as security, giving […]

Removing Transworld Systems from Your Credit Report

Taking proactive steps to remove Transworld Systems from your credit report is essential for improving your creditworthiness. Begin by obtaining a copy of your credit report from major credit bureaus and thoroughly review any entries associated with Transworld Systems. Identify inaccuracies, such as discrepancies in account details or outdated information, and promptly dispute these errors […]

Eradicating CBE Group from your Credit Report

Eradicating CBE Group from your credit report requires a strategic and methodical approach to rectify any inaccuracies or discrepancies that may have negatively impacted your credit score. Begin by obtaining a copy of your credit report from major credit bureaus to identify any entries related to the CBE Group. Carefully scrutinize each item for errors […]

National Credit Adjusters – Key Strategies to remove from credit report

National Credit Adjusters, LLC (NCA) is a well-known debt collection agency based in the United States. Their primary objective is to help businesses in various sectors, including retail, healthcare, and financial services, manage and recover delinquent accounts receivable. NCA plays a significant role in the financial services industry by efficiently handling businesses’ accounts receivable to […]

Revco Solutions Guide to Removing from Credit Fast

Empower yourself with the Revco Solutions Guide to Removing from Credit Fast and take control of your credit profile. Obtain a comprehensive understanding of effective strategies and steps to swiftly eliminate Revco Solutions entries from your credit report. This insightful guide equips you with the knowledge needed to dispute inaccuracies, negotiate settlements, and restore your […]

AmSher Collection Services

Navigating through interactions with AmSher Collection Services and other debt collection agencies can be a challenging and overwhelming experience. Empowering yourself with the right knowledge is a crucial step toward gaining control over your financial future, especially in the context of resolving debts and addressing related concerns. This article delves into essential insights about the […]

Westlake Portfolio Management on your credit Report?

Explore the ways Westlake Portfolio Management can elevate your loan servicing experience through its essential services and benefits. This guide covers everything from gaining insights into the company to optimizing partnership potential. Dive in to discover how leveraging Westlake’s offerings can lead to a successful outcome in portfolio management. Uncover the advances that partnering with […]

1 Method For Removing Hunter Warfield Off My Credit Report

Feel overwhelmed by Hunter Warfield’s incessant tactics? Don’t fret! With the necessary knowledge, aid, and strategies you can defeat their aggressive debt collection measures. Equip yourself with insights about your rights for effective communication as well as viable debt settlement opportunities to help take control of this financial obstacle. Key Takeaways Understand Hunter Warfield’s practices […]

1 Method for Removing Enhanced Recovery Company (ERC)

Are you facing challenges with Enhanced Recovery Company (ERC) debt collectors? This post offers insights into effective strategies for managing their collections. From understanding the types of debts ERC handles to exploring legal avenues, we’ll cover tactics to confront them and ways to avoid future encounters. Gain valuable tools to regain control over your finances […]

1 Way to Stop Remove Dynamic Recovery Solutions from Credit Report

Effortlessly improve your credit by removing Dynamic Recovery Solutions from your report. Audit entries for inaccuracies, dispute with evidence, and engage in negotiations for swift resolution. Consistent monitoring guarantees a speedier removal process, enhancing your overall creditworthiness. Take control of your financial future today. Dynamic Recovery Solutions, a debt collection agency, may appear on your […]

Complete Guide to Getting to Know Covington Credit

In the dynamic world of finance, Covington Credit stands out as a prominent player, offering a diverse range of financial services. This guide explores its history, services, and more. Early Beginnings Covington Credit, with a history spanning decades, emerged in the latter part of the 20th century. Founded in South Carolina, the company focused on […]

Who Owns Shell Federal Credit Union 2024

In 2024, gaining clarity on “Who Owns Shell Federal Credit Union” is crucial for understanding its financial standing and leadership structure. Delve into the ownership details to uncover insights into the institution’s ownership landscape, providing valuable information about its stability and decision-making processes. Stay informed about the ownership dynamics of Shell Federal Credit Union in […]

1 New Way To Negotiate with Wakefield & Associates 2024

A revolutionary approach in 2024 with “1 New Way To Negotiate with Wakefield & Associates.” This innovative method promises a streamlined and effective negotiation process with Wakefield & Associates. Discover the latest strategies and techniques to navigate discussions successfully, ensuring a more favorable resolution to your financial matters. Embrace this new avenue for negotiations in […]

Who is Identity iq Ultimate Identity Theft Protection

In today’s dynamic digital landscape, safeguarding your identity is paramount. Enter Identity IQ, the 2023 solution for robust identity theft protection. Discover its features, positive customer reviews, and protection strategies. Key Highlights (Identity IQ): IdentityIQ offers personalized identity protection, with up to $1 million in insurance and four tailored plans. Positive customer reviews highlight IdentityIQ’s […]

Protect Yourself From Midland Credit Management

Envision an unexpected call from a debt collector like Midland Credit Management. This guide equips you to handle debt challenges, protect rights, and restore financial stability. Key Points: Grasp Midland Credit Management’s tactics to shield yourself from aggressive debt collection practices. Understand your rights under FDCPA, report violations, verify, dispute debts, request validation, and maintain […]

Lvnv Funding llc: How to Negotiate down your debt

Navigating interactions with debt collectors, particularly with a formidable agency like LVNV Funding LLC, can be overwhelming. To empower individuals facing such situations, we’ve compiled crucial insights into your rights under the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA). This knowledge equips consumers to confidently engage with LVNV Funding, […]

1 Way to Negotiate Debt Radius Global Solutions

Explore a game-changing strategy for negotiating debt with Radius Global Solutions – the “1 Way to Negotiate.” In 2024, empower yourself with this singular approach that promises a more effective and efficient resolution process. Uncover the latest insights and techniques to navigate debt negotiations successfully. Don’t miss out on this innovative method; seize control of […]

Who Owns Space Coast Credit Union (SCCU) 2024

Space Coast Credit Union is a leading financial institution dedicated to serving the needs of its members in Florida. With a commitment to providing excellent customer service, competitive rates, and a wide range of financial products and services, Space Coast Credit Union has become a trusted resource for individuals and businesses alike. Whether you’re looking […]

How to Raise Credit Score 100 Points Overnight Fast

Effective techniques on how to raise your credit score by 100 points with our comprehensive guide. Learn proven strategies for responsible credit management, timely payments, and debt reduction to achieve a significant improvement in your creditworthiness. Take control of your financial health and embark on the journey to a higher credit score today. While a […]

1 Way To Negotiate Your SYNCB/PPC Debt

Have you ever found yourself perplexed by the term SYNCB/PPC appearing on your credit report? Deciphering this enigma is essential for comprehending its implications for your credit score. In this blog post, we delve into the realm of PayPal Credit and its collaboration with Synchrony Bank. By the end, you’ll be well-prepared to rectify SYNCB/PPC […]

How Long Do the Presence of Hard Inquiries Stay on Your Credit Report?

Maintaining a good credit score is essential for financial stability and access to credit. One factor that can impact your credit score is the presence of hard inquiries on your credit report. A hard inquiry occurs when a lender or creditor pulls your credit report for the purpose of evaluating your creditworthiness. These inquiries can […]

Is credit repair a illegal or Scam?

Navigating the realm of credit repair can raise questions about its legitimacy and potential scams. “Is credit repair illegal or a scam?” emerges as a common query for individuals seeking financial stability. It’s essential to clarify that credit repair, when conducted within legal boundaries, is a legitimate process aimed at rectifying inaccuracies on credit reports. […]

What happens to your credit when you pay off collections accounts

Navigating Collections: Understanding and Managing Debts Part 1: Unveiling Collections Accounts 1.1 What Are Collections Accounts? Collections accounts arise when a debt becomes significantly overdue, leading to either its sale to a collection agency or assignment for collection. This section sheds light on the sources and nature of these accounts, such as credit card bills, […]

What is CareCredit. Where to Use It and How It Operates

CareCredit, a specialized healthcare credit card, is designed to aid individuals in handling various health and wellness expenses not fully covered by insurance. Moreover, if you’re wondering about CareCredit’s nature and where to use it, the answer lies in its widespread acceptance. You can utilize CareCredit at over 200,000 enrolled healthcare providers throughout the United […]

The damaging effect of voluntary repossession on credit

When someone voluntarily goes through repossession, whether for a car or any other valuable item, it can have lasting effects on their credit report and overall creditworthiness. Exploring credit repair becomes crucial in such situations. Let’s delve into what voluntary repossession means and how it impacts your credit score. Understanding Voluntary Repossession Defining Voluntary Repossession […]

Best way to remove medical bills from credit report

The best way to remove medical bills from your credit report involves a strategic and systematic approach. Start by thoroughly reviewing your credit reports from major bureaus like Equifax, Experian, and TransUnion to identify any inaccuracies or discrepancies. If you find medical bills that are erroneously reported or need resolution, initiate a dispute with the […]

How to Remove Court Judgments from Your Credit Report

Efficiently removing court judgments from your credit report requires a strategic and meticulous approach. Begin by thoroughly reviewing the judgment information on your credit report to ensure accuracy. If discrepancies exist, promptly dispute them with the credit bureaus. Negotiating a “pay-for-delete” arrangement with the judgment creditor, where payment is made in exchange for removing the […]

How to get rid of bank repossession from your credit

Bank repossessions can be a major setback, impacting your credit and financial prospects. Whether it’s a car, house, or valuable asset, the repercussions can be daunting. Learn effective strategies to address and eliminate bank repossessions from your credit report, reclaiming financial control. Understanding Bank Repossessions: Implications on Your Credit Explore the complexities of bank repossession […]

Find out Easy Ways to Get the Credit Card Debt Relief You Need

Dealing with credit card debt can cast a shadow over one well well-being. The combination of interest rates, late fees, and increasing balances can feel like being stuck in a cycle of debt. However, there are ways to find relief. In this guide, we will explore straightforward methods to tackle credit card debt and regain […]

Tri-Merge Credit Report: What Is It Exactly?

In the dynamic world of credit and finance, tri-merge credit reports emerge as pivotal tools. Professionals, including lenders and real estate agents, heavily rely on these reports to unravel the intricate details of an individual’s creditworthiness, especially in the context of mortgage applications. Decoding the Tri-Merge Credit Report: A 3-Bureau Financial Compass Explore the essence […]

4 Life Goals of a Credit Repair Service

Unlock the doors to your life goals with the invaluable assistance of a credit repair service. Achieving significant milestones becomes not only possible but also more accessible when you prioritize credit repair. Whether you aspire to own a home, upgrade your vehicle, launch a business, or enjoy a stress-free retirement, a strengthened credit score is […]

How credit repair.com works

In today’s context, having a credit score holds unprecedented significance. The ease with which one can secure loans, credit cards, rental agreements, and employment opportunities is contingent upon their creditworthiness. Unfortunately, a substantial number of individuals find themselves with less-than-ideal credit scores due to late payments, high debt, or errors on their credit records. This […]

Maximizing Financial Potential with an 806 Credit Score

Congratulations on attaining an exceptional credit score of 806! Your dedication to responsible credit management positions you for lasting financial success. Delve into the significance of an 806 credit score, discover its benefits, and gain insights on leveraging it to maximize your financial potential. Understanding the Impact of an 806 Credit Score An 806 credit […]

Achieving Your Path to 785 Credit Score Financial Success

A credit score of 785 is considered excellent and opens up a world of financial opportunities. It reflects your responsible credit management and serves as a testament to your financial discipline. In this article, we will explore what a 785 credit score means, discuss the factors that influence it, and provide strategies to achieve and […]

Credit Privacy Number (CPN) is A SCAM BEWARE

Stay vigilant and safeguard your financial well-being as the Credit Privacy Number (CPN) is a scam. Beware of fraudulent schemes posing as legitimate avenues. Exercise caution and protect yourself from potential financial risks associated with deceptive Credit Privacy Number practices. What is a Credit Privacy Number (CPN)? In this digital age, mastering the intricacies of […]

What to Do With Your Tax Refund

As tax season concludes, many taxpayers eagerly await their refunds. While spending it on indulgences might be tempting, there are smarter ways to utilize this extra cash. This article explores seven ideas to maximize the benefits of your tax refund. Receiving a tax refund may feel like a windfall, but it’s crucial to recognize that […]

What is Overdraft Protection and Is It Worth It

Navigating unexpected expenses or errors in our finances can often result in costly overdraft fees from our banks. To address this, many banks offer overdraft protection—a service designed to cover the shortfall in your account and avoid these fees. This article delves into the concept of overdraft protection, its mechanics, the advantages and disadvantages of […]

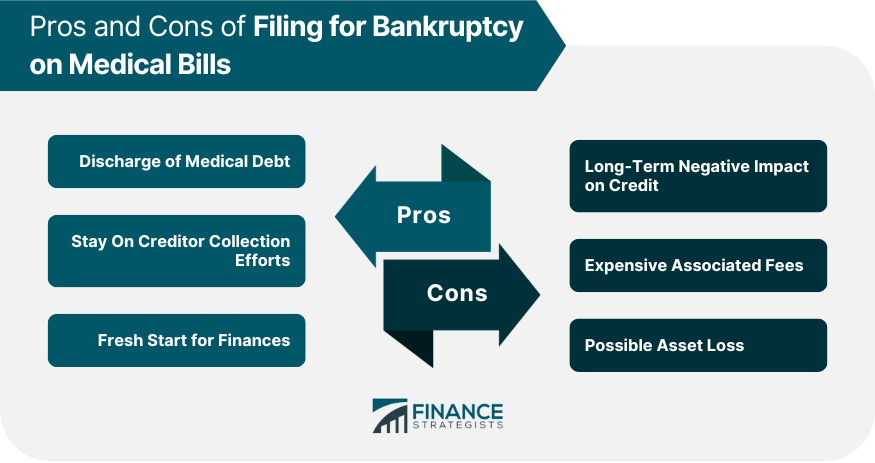

What is Medical Bankruptcy and How it Affects Your Credit

Experiencing a medical emergency can not only take a toll on your health but also lead to financial challenges. Medical debt may accumulate, potentially resulting in medical bankruptcy. In this article, we’ll explore the concept of medical bankruptcy, its impact on credit, and alternatives to consider. Understanding Medical Bankruptcy: Medical bankruptcy is a legal process […]

609 dispute letter

Discover the ins and outs of credit repair with a focus on the potent “609 dispute letter” strategy. Dive into understanding what a 609 dispute letter entails, its functionality, and whether it truly holds the key to elevating your credit score. What is a 609 Dispute Letter? Explore the concept of a 609 dispute letter […]

What is a Credit Card Security Code

In the dynamic world of financial transactions, understanding the layers of security that protect your money is vital. One crucial aspect of this security arsenal is the Credit Card Security Code. Let’s embark on a journey to demystify this code, exploring its purpose, types, and how it shields you from potential threats. Decoding the Credit […]

1 Best Thing you need to know as a co-signer

The role of a co-signer is not to be taken lightly, and the singularly crucial aspect to grasp as one embarks on this financial commitment is the responsibility it entails. The best thing you need to know as a co-signer is the potential impact on your own credit and financial well-being. While your intention may […]

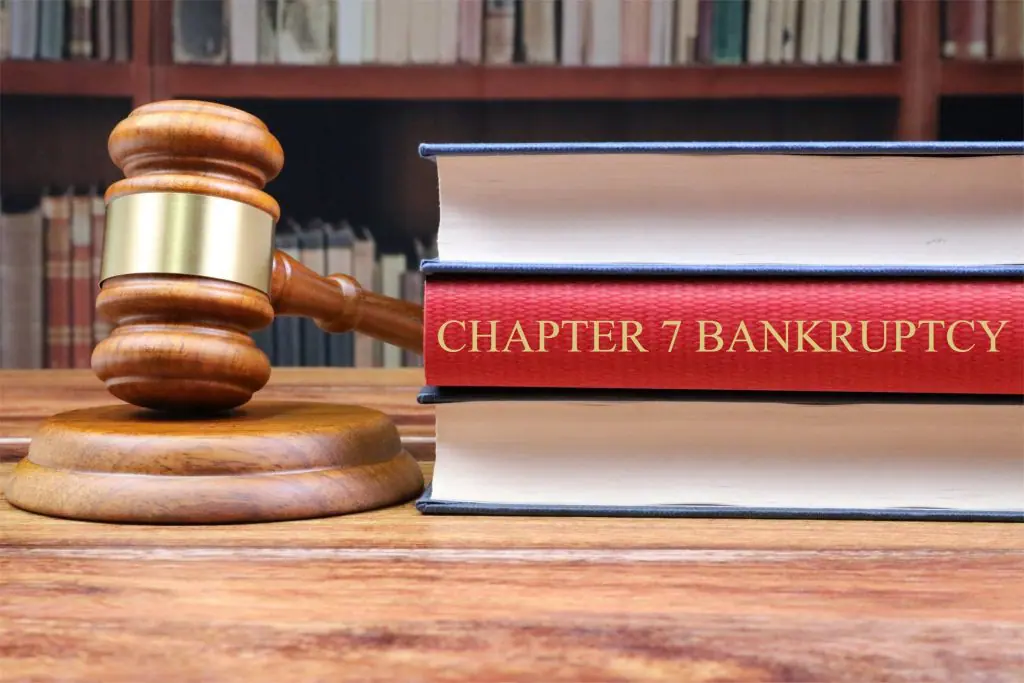

1 Thing To Know Which Debt Can Survive Bankruptcy

When contemplating bankruptcy, it’s pivotal to understand the critical aspect encapsulated in the phrase “1 Thing To Know Which Debt Can Survive Bankruptcy.” This highlights the essential realization that not all debts are discharged through bankruptcy. Certain obligations, such as specific tax debts, student loans, and child support, may persist even after the bankruptcy process. […]

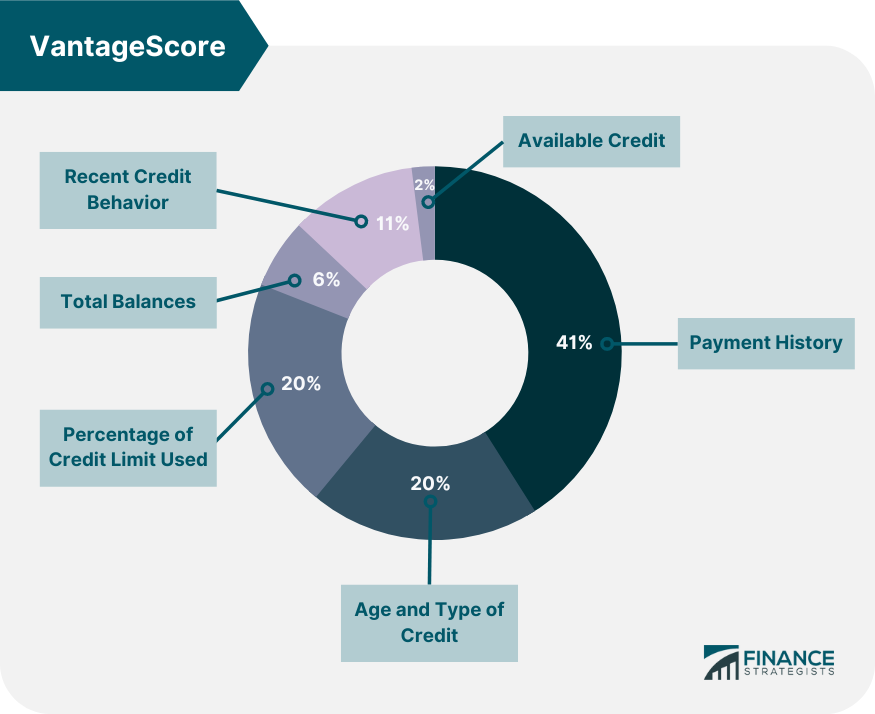

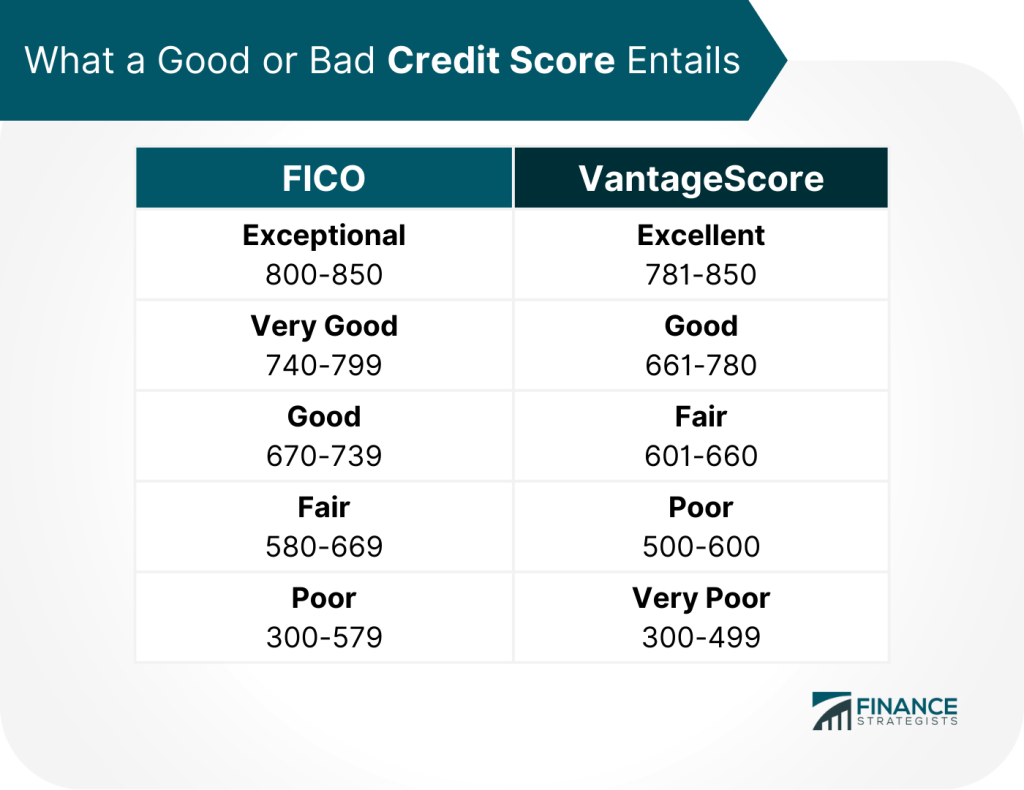

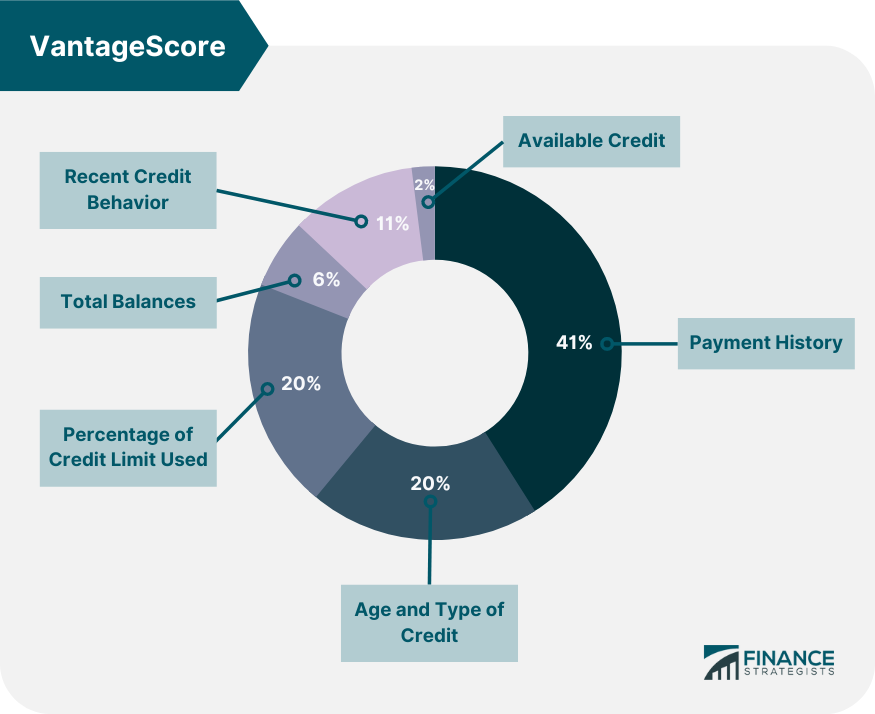

What Credit Score do Mortgage lenders

Understanding how mortgage lenders assess your creditworthiness is crucial when applying for a mortgage. Primarily, lenders rely on credit scores, with the FICO Score taking center stage in the United States. FICO Score Unveiled: Primary Choice: FICO scores are the go-to metric for most U.S. mortgage lenders, ranging from 300 to 850. The higher the […]

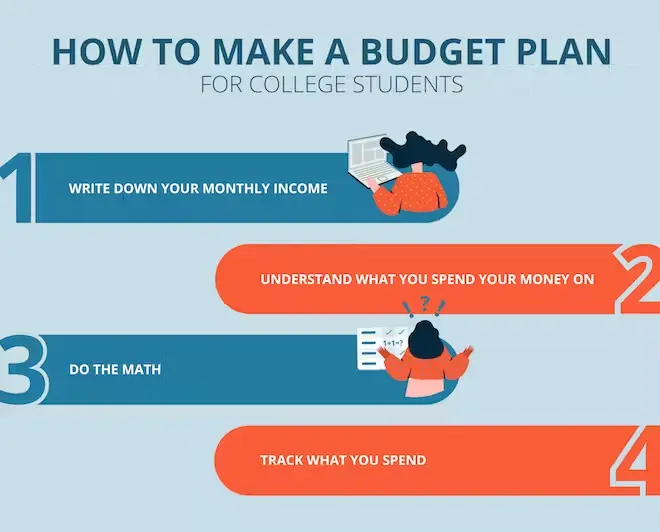

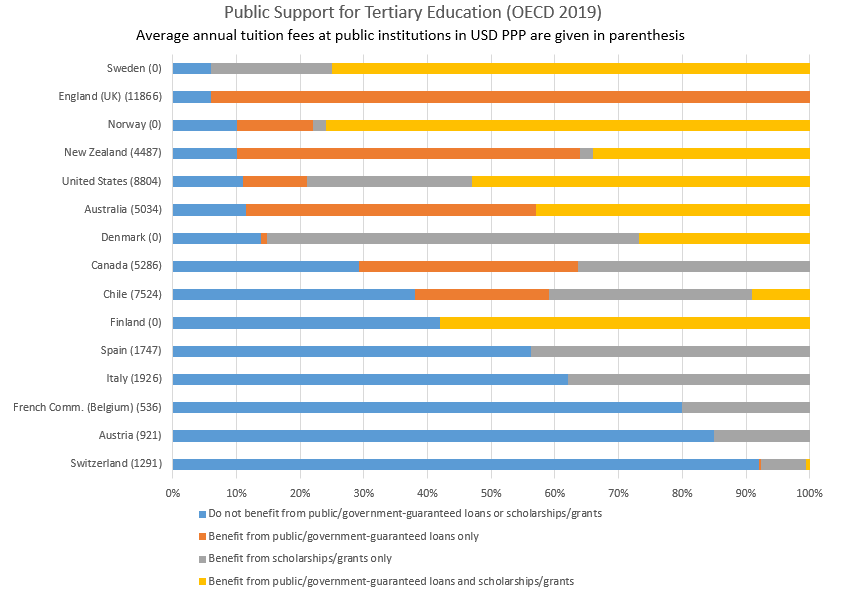

The Ultimate Guide to College Student Spending Habits for 2024

Embark on a journey into the intricate realm of college student spending habits for 2024 with our Ultimate Guide. Unveiling the dynamic financial landscape, this comprehensive resource delves into trends shaping the academic experience. Explore the nuances of tuition management, digital subscriptions, and lifestyle choices, empowering both students and stakeholders with valuable insights for informed […]

The Pros and Cons of Filing for Bankruptcy

Navigating the turbulent waters of financial hardship requires a thoughtful consideration of “The Pros and Cons of Filing for Bankruptcy.” Delve into this comprehensive guide to gain a nuanced understanding of the advantages and disadvantages associated with the bankruptcy process. Whether seeking a fresh start or evaluating alternatives, our resource provides valuable insights to empower […]

Goodwill letter

Have you ever found yourself needing to rectify a credit mishap or seeking favor from a party not legally bound to assist? This could be due to a missed credit card payment, resulting in a credit score dip, or a dispute leading to a negative credit report mark. In such scenarios, a goodwill letter proves […]

The Best Way to Pay off Debt

Debt can be a significant burden for many individuals and households, causing stress and limiting financial freedom. When it comes to paying off debt, some various strategies and approaches can be taken. However, not all methods are created equal, and it’s important to find the best way to pay off debt for your specific circumstances. […]

Statistics on Millennial Spending Habits for 2023

Millennials are a generation that has been revolutionizing the way we live, work, and shop. With over 72 million millennials in the United States alone, their purchasing power is not something that businesses can afford to ignore. As we enter 2023, it is important to understand the spending habits of this generation to make informed […]

statistics on Gen Z spending habits for 2023

Spending Patterns Of Generation Z In 2023 Data As we move further into the 21st century, we’re entering a new era of consumers. Generation Z, those born between 1996 and 2010, are coming of age and are increasingly becoming a powerful force in the economy. They are digital natives who have grown up with technology […]

sky blue credit vs lexington law

Credit repair companies are becoming increasingly popular as people look to improve their credit scores and financial health. Among the most popular ones are Sky Blue Credit and Lexington Law. Both companies offer similar services, but which one is better? In this article, we will provide a comprehensive comparison of Sky Blue Credit vs. Lexington […]

Pay for Delete Letter Template

When it comes to dealing with debt, negotiating with creditors can be a daunting task. However, there is a strategy that may help you to resolve your debts and improve your credit score. A pay for delete letter is a written request to a creditor asking them to remove a negative item from your credit […]

Multiple Bankruptcies

Bankruptcy is a multifaceted and potentially daunting process for both individuals and businesses. Whether you’ve already filed for bankruptcy and are contemplating a second filing, it’s crucial to comprehend the frequency limitations and the ramifications involved. In this comprehensive guide, we will explore the intricacies of multiple bankruptcies, dissecting the regulations governing filing frequency, the […]

Joint Credit Cards

Considering a joint credit card with your spouse, partner, family member, or friend? Before making this financial decision, explore the comprehensive guide below, covering everything you need to know – from the advantages and disadvantages to essential tips for responsible use. Understanding Joint Credit Cards Learn what a joint credit card entails, where two or […]

How to Write a Letter of Explanation for a Mortgage

If you’re in the process of applying for a mortgage, you may be asked to write a letter of explanation to clarify certain aspects of your financial history. This can be a daunting task, but with the right guidance, it can be done effectively. In this article, we’ll provide you with a step-by-step guide on […]

How to Remove Inquiries from a Credit Report

Maintaining a good credit score is crucial for financial success. Unfortunately, sometimes our credit reports contain inquiries that can negatively impact our scores. Whether these inquiries are legitimate or not, it’s important to address them and remove them from our credit reports. Understanding the impact of inquiries on your credit report It’s vital to understand […]

How to Read a Credit Report

Your credit report is crucial for financial management and credit score improvement. This guide provides a step-by-step approach to decoding your credit report, empowering you to make informed decisions about your finances. Get a credit repair service Get Professional Help Explore the benefits of credit repair services to enhance your credit journey. Unveiling the Credit […]

How to Prepare for a Recession

In today’s unpredictable economic climate, individuals and businesses must be prepared for a potential recession. While it can be difficult to predict when a recession will occur or how severe it will be, taking proactive steps to prepare can help mitigate the impact and ensure financial stability. Recessions are a natural part of the business […]

How to Increase Your Credit Score Fast

Your credit score plays a crucial role in your financial life. It determines your ability to access loans, secure favorable interest rates, and even rent an apartment. Despite its importance, many people find themselves with a less-than-ideal credit score. The good news is that there are steps you can take to increase your credit score […]

How to Get a Personal Loan after Bankruptcy

Bankruptcy can be a challenging and overwhelming experience, but it doesn’t mean you’re completely barred from accessing financial assistance in the future. If you need a personal loan after going through bankruptcy, there are still options available to you. This article will guide you through the process of obtaining a personal loan post-bankruptcy, providing you […]

how old do you have to get a credit card

When it comes to finances, understanding the rules and regulations around credit cards is crucial. Credit card applicants often wonder, “Is There a Required Minimum Qualification for a Credit Card?” This is a complicated question, and the answer relies on various circumstances, but we think we have it figured out. In this article, we will […]

How much does it cost to file bankruptcy

Filing for bankruptcy can provide individuals and businesses with a financial fresh start. However, before deciding to file, it is important to understand the costs involved. While the exact cost of filing for bankruptcy can vary depending on factors such as the complexity of the case and the location, certain expenses are common to most […]

How Long Does An Eviction Stay on Your Record

Navigating the aftermath of an eviction involves understanding its enduring impact on your record. “How Long Does an Eviction Stay on Your Record?” is a crucial question, and this article delves into the intricacies to provide clarity and empower individuals facing this challenge. The Seven-Year Mark: Understanding the Duration The duration an eviction stays on […]

How Long Does a Chapter 7 Bankruptcy Take

Are you considering filing for Chapter 7 bankruptcy? The question then becomes how long it will take. While there is no one-size-fits-all answer, as every case is different, understanding the general timeline can help you prepare for what’s to come. In this article, we’ll go over the key steps in a Chapter 7 bankruptcy case […]

Does Your Credit Score Affect Your Car Insurance

Your credit score plays a significant role in many aspects of your financial life, including your ability to secure loans, mortgages, and credit cards. But did you know that it can also impact your car insurance rates? Many insurance companies use credit-based insurance scores as a factor in determining premiums for auto insurance policies. How […]

Does unemployment affect your credit?

Unemployment can bring about a wave of financial uncertainty, with concerns about paying bills and meeting basic needs taking center stage. But beyond the immediate financial strain, many individuals may also wonder about the long-term consequences on their credit. Does unemployment affect your credit? Relationship between unemployment and credit Understanding the relationship between unemployment and […]

Does IRS Debt Show on Your Credit Report

One common concern among taxpayers is whether their IRS debt will show up on their credit report. As we all know, credit reports play a crucial role in determining our financial health and can impact our ability to secure loans, credit cards, and other financial opportunities. Therefore, it is essential to understand how IRS debt […]

Does Breaking a Lease Hurt Your Credit

Breaking a lease is a common occurrence in the rental market, as unforeseen circumstances or changing life situations can necessitate an early termination of a lease agreement. However, many tenants are concerned about the potential consequences of breaking a lease, specifically with regards to their credit score. The impact of breaking a lease on your […]

Does Bankruptcy Clear Tax Debt

Taxpayers experiencing financial hardships may explore bankruptcy to discharge certain tax debts. However, not all tax debts qualify for elimination, and the process is intricate. This article examines the potential impact of bankruptcy on tax debt and provides insights into the complex process. Owing money to the IRS creates significant financial stress, with accumulating tax […]

Debt Validation Letters Explained

Debt validation letters are an important tool in the world of debt collection and credit repair. When facing collection efforts, it is crucial to understand your rights as a consumer and the steps you can take to protect yourself. Debt validation letters play a key role in this process. Purpose and Importance of Debt Validation […]

Debt Collection Laws

Debt collection can be a complex and sensitive process, and it is important for both debtors and creditors to understand their rights and obligations under the law. Debt collection laws vary by jurisdiction, but they generally aim to protect consumers from abusive and unfair practices while also allowing creditors to pursue legitimate debts. Importance of […]

Credit Score Statistics You Need to Know in 2023

Valuable insights into your financial standing with crucial credit score statistics for 2023. Stay informed about the latest trends and metrics shaping creditworthiness. Understanding these credit score statistics is essential for making informed decisions about loans, credit cards, and other financial endeavours in the upcoming year. Stay ahead of the curve and proactively manage your […]

Credit Card vs. Charge Card

In the era of digital transactions, credit cards and charge cards have become the go-to choices for those avoiding traditional cash transactions. While they may seem similar, it’s crucial to grasp the significant distinctions between these two financial tools. Credit Cards: Borrowing with Flexibility A credit card allows users to borrow money up to a […]

Cash vs. Credit

In the realm of financial transactions, the eternal debate between cash and credit continues to shape consumer choices. Understanding the nuances of each payment method is crucial for making informed decisions in various situations. Let’s delve into the intricacies of “Cash vs. Credit” to explore the advantages, drawbacks, and optimal scenarios for using each. Benefits […]

Can a Collection Agency Report an Old Debt as New

Entering the realm of credit reporting and debt collection, a common query that looms is, “Can a Collection Agency Report an Old Debt as New?” This article aims to shed light on this perplexing question and provide insights into the intricacies of debt reporting practices. Understanding the Reporting Dynamics To grasp the nuances surrounding the […]

Buckle Up America

Buckle up, America” serves as a powerful call to action, urging individuals across the nation to prioritize safety on the roads. This simple yet impactful phrase encapsulates the importance of wearing seat belts, not just as a legal requirement but as a vital measure to safeguard lives. Whether embarking on a short commute or a […]

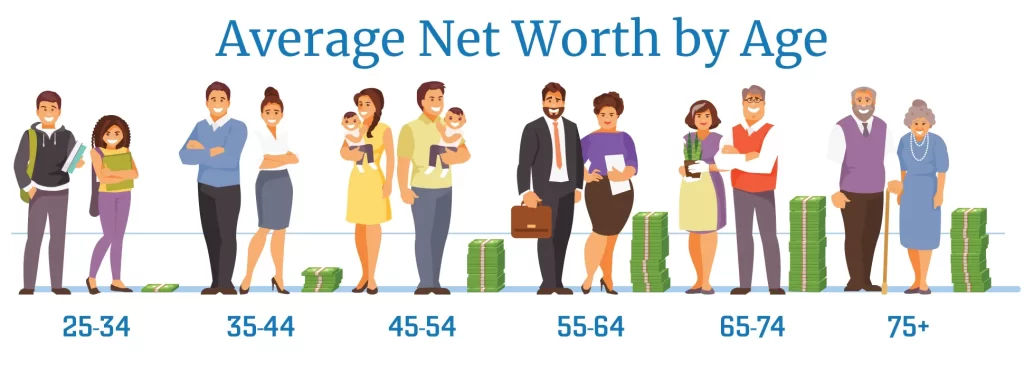

Average Net Worth by Age for Americans

Navigating the intricacies of personal finance involves a crucial exploration of the “Average Net Worth by Age for Americans.” This metric serves as a compass, providing valuable insights into one’s financial standing within their age group. Beyond being a simple numerical figure, average net worth encapsulates the sum total of an individual’s assets minus their […]

50 Important Welfare Statistics for 2023

In 2023, grasping global welfare is vital. “50 Important Welfare Statistics for 2023” offers insights. Explore these stats for a deep understanding of welfare’s impact on poverty, healthcare, education, employment, and the environment. Stay informed for inclusive and sustainable decisions shaping the global welfare landscape. Poverty and Income Struggles Worldwide This section sheds light on […]

18 Types of Credit Cards and Their Benefits

In the contemporary landscape, credit cards play a vital role in facilitating swift and convenient transactions, granting individuals easy access to credit. With diverse options available, each credit card type boasts unique benefits and features. This comprehensive overview explores 18 distinct credit cards and their advantages. Credit cards offer a seamless avenue for both shopping […]

15 Credit Facts Everyone Needs to Know in 2023

In 2023, staying informed about your financial well-being is paramount, and our guide on “15 Credit Facts Everyone Needs to Know in 2023” is your compass to navigate the complex landscape of credit. From the nuances of improving credit scores to understanding the impact of late payments, this comprehensive resource empowers individuals with crucial insights, […]

12 Credit Hacks to Help Increase Your Score Quickly

In the modern financial landscape, a strong credit score is vital for accessing credit cards, loans, and favorable financial terms. Discover 12 effective credit hacks to rapidly enhance your credit score. A robust credit score is essential for financial well-being, influencing access to credit cards, loans, and financial products. It determines interest rates and fees, […]