Experiencing a medical emergency can not only take a toll on your health but also lead to financial challenges. Medical debt may accumulate, potentially resulting in medical bankruptcy. In this article, we’ll explore the concept of medical bankruptcy, its impact on credit, and alternatives to consider.

Understanding Medical Bankruptcy:

Medical bankruptcy is a legal process where individuals file for bankruptcy due to overwhelming medical debt. This specialized form of bankruptcy, often under Chapter 7 or Chapter 13, aims to provide relief to those struggling with medical expenses.

Distinguishing Medical Bankruptcy from Regular Bankruptcy:

While regular bankruptcy covers various reasons like credit card debt or student loans, medical bankruptcy is specifically tailored for those burdened by medical expenses. The key focus is on addressing the challenges posed by medical debt.

Common Causes of Medical Bankruptcy:

Several factors contribute to filing for medical bankruptcy, including high medical expenses, loss of income due to a medical emergency, and the financial strain of pre-existing medical conditions.

Filing for Medical Bankruptcy:

Eligibility criteria must be met to file for medical bankruptcy. Proof of significant medical debt, completion of credit counseling, and providing details about income, expenses, and assets are essential steps in the process.

Types of Medical Bankruptcy:

Medical bankruptcy options include Chapter 7, involving asset liquidation, and Chapter 13, which reorganizes debts with a repayment plan. The choice depends on factors like the amount of debt and available assets.

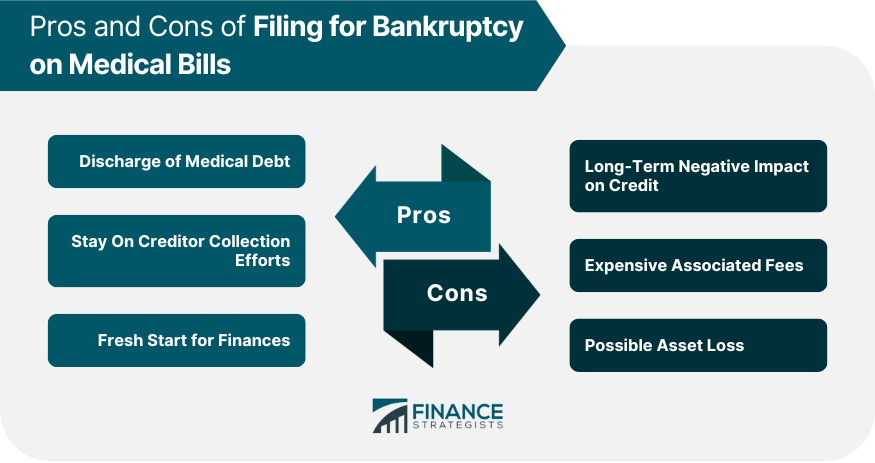

Benefits of Medical Bankruptcy:

Filing for medical bankruptcy can offer relief from overwhelming medical debt, protection from creditors through an automatic stay, and a chance for a fresh financial start.

Drawbacks of Medical Bankruptcy:

While it provides relief, medical bankruptcy can negatively impact credit scores for up to ten years, involve legal fees, and may require liquidation of assets.

Alternatives to Medical Bankruptcy:

Consider alternatives such as negotiating payment plans or bill reductions with healthcare providers, debt consolidation for simplified repayments, and credit counseling to create a structured debt payoff plan.

Navigating the complexities of medical bankruptcy requires careful consideration of its benefits, drawbacks, and potential alternatives to make informed decisions about your financial future.

Impact of Medical Bankruptcy on Credit Scores

Filing for medical bankruptcy can wield a considerable influence on your credit score, potentially reducing it by up to 200 points. This significant impact is reflected in your credit report for a duration of ten years. Despite this, there are ways to gradually rebuild your credit score by adopting responsible financial practices.

Rebuilding Credit Post Medical Bankruptcy

To embark on the journey of rebuilding your credit post-medical bankruptcy, consider the following steps:

- Timely Payments: Ensure punctual payments across various aspects, including rent, utilities, and other bills.

- Secured Credit Card: Opt for a secured credit card, allowing you to make modest purchases and promptly settle the balances each month, contributing to credit building.

- Credit Report Monitoring: Regularly scrutinize your credit report to identify and rectify any errors or inaccuracies promptly.

Dispelling Misconceptions about Medical Bankruptcy

Several misconceptions surround medical bankruptcy, and it’s essential to clarify these:

- Ease of Obtaining Medical Bankruptcy: Contrary to common belief, acquiring medical bankruptcy is not a straightforward process; specific eligibility criteria must be met.

- Complete Debt Elimination: Medical bankruptcy does not wipe out all debts, and its suitability varies for each individual.

- Credit Rebuilding After Medical Bankruptcy: It is indeed feasible to rebuild your credit score after medical bankruptcy by adhering to responsible credit practices.

Conclusion

While medical bankruptcy offers relief for those grappling with overwhelming medical debt, its impact on credit scores may make it unsuitable for everyone. If contemplating this legal process, consult a bankruptcy attorney to explore options. Alternatives like negotiating with healthcare providers, debt consolidation, and credit counseling also merit consideration. Although filing for medical bankruptcy has drawbacks, it provides an opportunity for a fresh financial start, allowing gradual reconstruction of both finances and credit scores.

Frequently Asked Questions (FAQs)

- Chapter 7 vs. Chapter 13 Bankruptcy: Chapter 7 involves asset liquidation, while Chapter 13 entails debt reorganization and a repayment plan.

- Filing Medical Bankruptcy Without a Lawyer: Possible but recommended to consult a bankruptcy attorney.

- Duration on Credit Report: Medical bankruptcy may stay on your credit report for up to 10 years.

- Minimum Credit Score Requirement: No minimum credit score is required for filing medical bankruptcy.

- Removal from Credit Report: Medical bankruptcy cannot be removed but has a diminishing impact on your credit score over time.

Table of Contents

Get Your Credit Repaired With credit-repair.com

Google Review:

or

WHY CHOOSE US

We also would counsel you on real, legal, and ethical credit repair for clients rebuilding their life and credit ratings after hardship. Achieving financial freedom is the ultimate dream allowing you to live the life you want to enjoy. Get the help of a professional credit repair company by contacting us.

Our credit restoration services are tailored to your unique situation, and we never make you pay for anything you don’t need. When you sign up for either our Essentials or Essentials Plus packages, you can rest assured that you’ll be receiving the bare minimum of care necessary for your specific situation. You can opt for additional customization options to further tailor our offerings to your specifications. In this manner, you won’t overpay for perks you don’t use. This is the essence of adaptability.