Valuable insights into your financial standing with crucial credit score statistics for 2023. Stay informed about the latest trends and metrics shaping creditworthiness. Understanding these credit score statistics is essential for making informed decisions about loans, credit cards, and other financial endeavours in the upcoming year. Stay ahead of the curve and proactively manage your credit profile by delving into the credit score statistics you need to know in 2023.

Credit scores is essential for anyone who wants to secure their financial future. A credit score is a three-digit number that evaluates an individual’s creditworthiness based on their credit history.

By understanding credit scores, individuals can make informed financial decisions and take the necessary steps to improve their creditworthiness. A good credit score not only increases the likelihood of loan approvals but also enables access to lower interest rates and better credit card rewards. Furthermore, understanding credit scores helps individuals identify and correct any errors or discrepancies that may be negatively impacting their creditworthiness.

Current credit score statistics

Current credit score statistics provide valuable insights into the financial health of individuals and the overall economy. As of 2023, the average credit score in the United States stands at 711, which is considered a good score. However, it is alarming to note that around 30% of Americans have a credit score below 601, categorizing them as subprime borrowers. This means they may face challenges in obtaining credit or may have to pay higher interest rates.

Furthermore, credit score statistics reveal that credit card debt remains a major concern. The average credit card debt per individual is $5,315, with 53% of Americans carrying a balance. High levels of credit card debt can negatively impact credit scores and limit financial opportunities.

It is crucial to stay informed about credit score statistics to understand where you stand in the context of these figures. In the following section, we will discuss the factors that influence credit scores and provide actionable tips to maintain and improve them. Don’t miss out on these valuable insights!

Factors Affecting Credit Scores

Your credit score is determined by several key factors that lenders use to assess your creditworthiness. Understanding these factors can help you make informed decisions to improve your credit score. Here are the most important factors:

Payment history:

This is the most significant factor, accounting for 35% of your credit score. Making payments on time is crucial to maintaining a good credit score. Late payments, missed payments, or defaulting on loans can have a significant negative impact.

Credit utilization:

Your credit utilization ratio, which is the percentage of your available credit that you’re currently using, accounts for 30% of your credit score. It’s important to keep your credit utilization below 30% to show that you can manage credit responsibly.

Length of credit history:

The length of time you’ve had credit accounts for 15% of your credit score. Having a longer credit history demonstrates stability and reliability, which can positively impact your score.

Credit mix:

Lenders like to see a mix of different types of credit, such as credit cards, loans, and mortgages. Having a diverse credit portfolio can account for 10% of your credit score.

New credit applications:

Opening multiple credit accounts within a short period can be seen as a sign of financial distress and can negatively impact your credit score. It’s essential to avoid unnecessary credit inquiries.

By understanding these factors and taking proactive steps to improve them, you can work towards achieving a higher credit score.

5. Strategies to improve and maintain credit scores

We have a better understanding of the key factors that influence your credit score, let’s explore some actionable strategies to help you improve and maintain a healthy credit score in 2023.

Pay your bills on time:

As we mentioned earlier, your payment history plays a significant role in determining your credit score. Make it a priority to pay all your bills, including credit card payments, loans, and utilities, on time. Consider setting up automatic payments or reminders to ensure you never miss a due date.

Reduce your credit utilization:

Aim to keep your credit utilization below 30% of your available credit. If you’re currently using a higher percentage, consider paying down your balances or requesting a higher credit limit. Be cautious not to increase your spending after obtaining a higher credit limit.

Monitor your credit report:

Regularly review your credit report for any errors or discrepancies that could negatively impact your credit score. Report any inaccuracies to the credit bureau and follow up until they are resolved.

Limit new credit applications:

Opening multiple credit accounts within a short period can lower your credit score. Be selective about the credit applications you submit and only apply for accounts that you genuinely need.

Maintain a long credit history:

The length of your credit accounts for 15% of your credit score, so try to avoid closing your oldest credit cards. Instead, use them occasionally and make timely payments to demonstrate responsible credit management.

Utilizing credit score statistics for financial planning

One important statistic to consider is the average credit score in your age group or demographic. This information can give you a benchmark to gauge how you compare to others and identify areas for improvement. Additionally, examining credit score distribution can help you understand the range of scores and where you fall within that range.

Another statistic to pay attention to is the impact of credit scores on interest rates. Lenders often use credit scores to determine the interest rates they offer. Knowing this information can motivate you to work towards improving your score to secure more favorable rates.

Lastly, keeping an eye on credit score statistics can help you identify any potential changes in the lending landscape. For example, if statistics show a decrease in average credit scores, it may indicate stricter lending criteria. By being aware of these changes, you can take proactive steps to maintain or improve your credit score to stay ahead in the financial market.

Credit scores are integral to personal finance, shaping eligibility for credit, loans, and financial products. In 2023, understanding key credit score statistics becomes paramount for effective financial management.

What Is a Credit Score?

A credit score, ranging from 300 to 850, reflects creditworthiness. Calculated based on factors like payment history, credit utilization, credit history length, and types of credit used.

Average Credit Score in 2023

Anticipated to hover around 720, the average credit score in 2023 displays a slight increase from the previous year, aligning with the ongoing trend of rising credit scores.

Factors Influencing Your Credit Score

Several elements can impact your credit score:

Payment History

Three-fifths of your credit score hinges on past payment reliability. Late or missed payments can significantly affect the score for up to seven years.

Credit Utilization

Credit utilization, representing the portion of available credit in use, can impact your score if it appears excessively utilized.

Length of Credit History

15% of your credit score is influenced by the duration of your credit history, with a longer credit history generally associated with a higher score.

Types of Credit Used

Credit score variation may result from the types and amounts of credit utilized. A diverse credit mix, including credit cards, loans, and mortgages, contributes positively to your score.

Credit Score Distribution in 2023

Distribution is expected to vary among age groups and demographics. Younger age brackets may have lower average scores (e.g., under 30 averaging 652), while older demographics exhibit higher averages (e.g., over 60 with an average score of 749). Additional factors such as income, employment history, and debt-to-income ratio impact scores. Distribution disparities also extend to geographic locations, highlighting the importance of understanding local averages for personal improvement strategies.

How Frequently Do Credit Scores Change?

Credit scores are subject to frequent fluctuations based on financial behavior. While monthly updates are common, significant changes, such as missed payments or new credit applications, can swiftly impact scores.

Decoding Credit Score Ranges

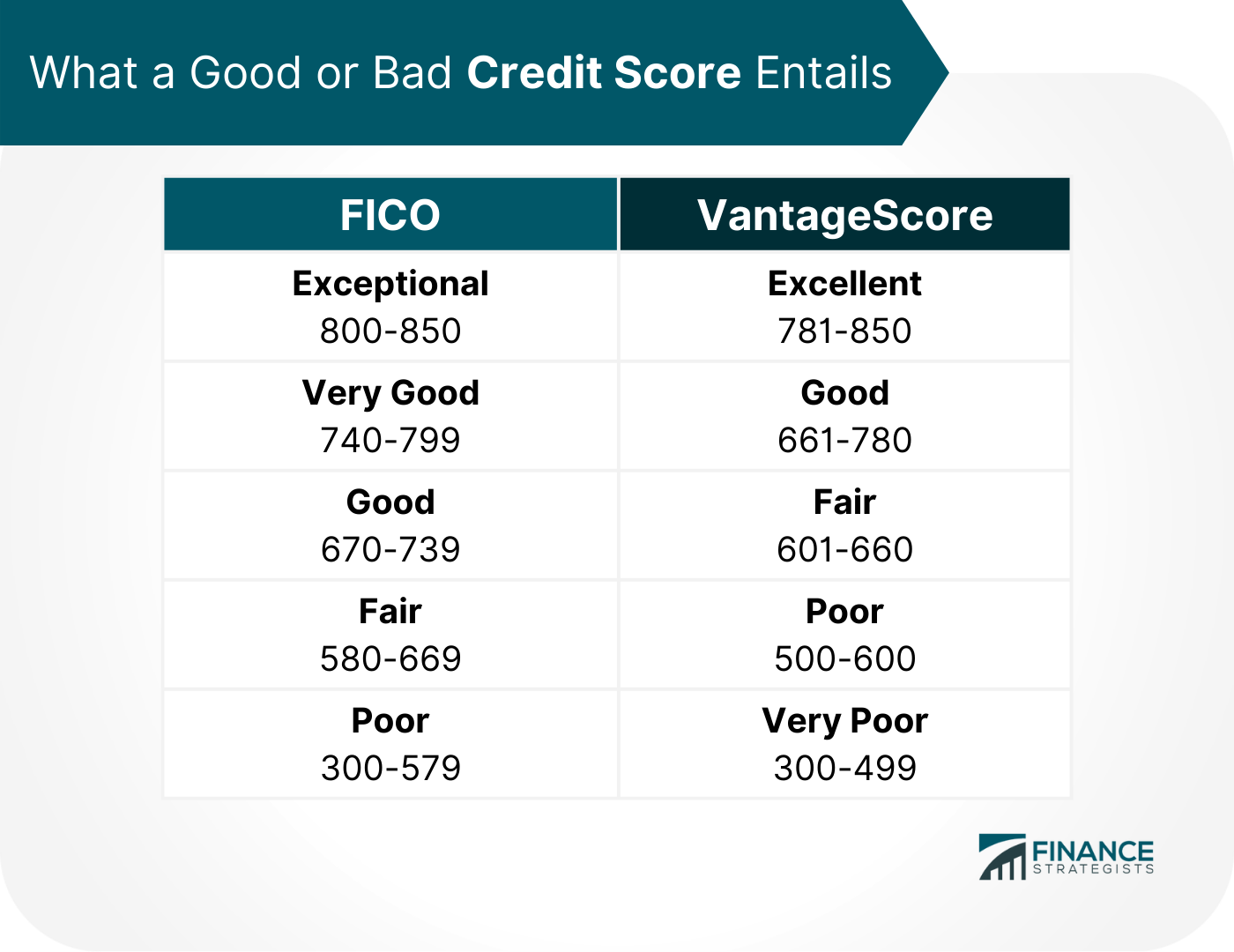

Credit scores fall into distinct ranges, each signifying varying levels of creditworthiness:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

Credit Score’s Influence on Mortgage Rates

Your credit score substantially influences the mortgage rates you qualify for. Excellent scores often secure the lowest rates, whereas poor scores may hinder mortgage approval.

Impact on Auto Loan Rates

Similar to mortgages, credit scores affect auto loan rates. Excellent scores lead to lower rates, while poor scores may result in higher interest rates or loan denial.

Role in Credit Card APR

Credit scores influence credit card APRs. Excellent scores yield low-interest rates, while poor scores may lead to high rates or denial.

Checking Your Credit Score

Monitor your credit score regularly using free services like Credit Karma and Credit Sesame. Regular checks ensure awareness of creditworthiness and verify the accuracy of your credit report.

Consequences of Missed Payments

Missed payments significantly harm credit scores, impacting future credit eligibility. Late payments can persist on credit reports for up to seven years.

Employment and Credit Scores

Certain employers may check credit scores during hiring, particularly for finance-related positions. However, laws limit this practice in some states.

Insurance Rates and Credit Scores

Credit scores influence insurance rates. Excellent scores often secure lower rates, while poor scores may result in higher insurance costs.

Strategies to Improve Credit Score

Enhance your credit score through responsible financial behavior: pay bills on time, reduce debt, and limit new credit applications.

FICO vs. VantageScore

FICO and VantageScore, two widely-used credit scoring algorithms, differ in methodologies and score ranges, though they share similar determining factors.

Debunking Credit Score Myths

Dispelling myths surrounding credit scores, such as the notion that checking it lowers the score or carrying a credit card balance improves it, is crucial for accurate understanding.

Credit Score and Identity Theft

Identity theft can severely impact credit scores. Regular credit report monitoring and proactive steps are essential for personal information protection.

Navigating Credit Scores Amid Divorce

Divorce can affect credit scores, especially with joint accounts. Understanding rights and obligations is vital during and after a divorce.

Co-Signing Loans and Credit Scores

Co-signing a loan can impact both parties’ credit scores. Awareness of risks and responsibilities is crucial before agreeing to co-sign.

Conclusion

Credit scores play a significant role in our financial lives, impacting our ability to qualify for credit, loans, and insurance rates. It’s essential to understand the factors that impact credit scores, how to check and monitor them, and how to improve them over time. By following responsible financial practices, you can maintain a healthy credit score and financial future.

Get a Credit Repair Service

FAQs

- How high of a credit score is considered excellent?

- A credit score of 850 is considered excellent.

- How long does a late payment stay on your credit report?

- The negative effects of a payment delay might be shown for as long as seven years.

- Does checking your credit score lower it?

- Your credit score will not drop just because you checked it.

- Can you get a loan with a poor credit score?

- It may be more challenging to qualify for a loan with a poor credit score, but it’s still possible.

- How often should you check your credit score?

- It’s recommended to check your credit score at least once a year, but you can check it more frequently for free through various online services.