The role of a co-signer is not to be taken lightly, and the singularly crucial aspect to grasp as one embarks on this financial commitment is the responsibility it entails.

The best thing you need to know as a co-signer is the potential impact on your own credit and financial well-being.

While your intention may be to support a friend or family member in securing a loan, remember that, in the eyes of creditors, you are equally accountable for the debt.

Timely payments and responsible financial behavior are essential, as any misstep could affect your credit score and financial stability.

Being a co-signer is a powerful gesture of trust and support, but it necessitates a thorough understanding of the implications, reinforcing the importance of open communication and mutual responsibility in any co-signing arrangement

Explore what a cosigner is, their responsibilities, benefits, and drawbacks in this article.

Understanding the Role of a Cosigner

A cosigner takes on the financial responsibility of another person’s debt if the borrower can’t make payments.

Typically used for those with poor credit or low income, a cosigner provides assurance to the lender.

Who Can Be a Cosigner?

Anyone with a good credit score and willingness to take on financial responsibility can be a cosigner.

Usually, a family member, friend, or business partner fits this role.

How Does Cosigning Work?

Cosigning involves a legal agreement between the borrower, lender, and cosigner.

The cosigner guarantees repayment if the borrower defaults, common in car loans, student loans, and leases.

Risks and Benefits of Cosigning

Cosigning helps secure financing for borrowers but carries risks. If the borrower defaults, the cosigner is equally responsible, affecting credit scores.

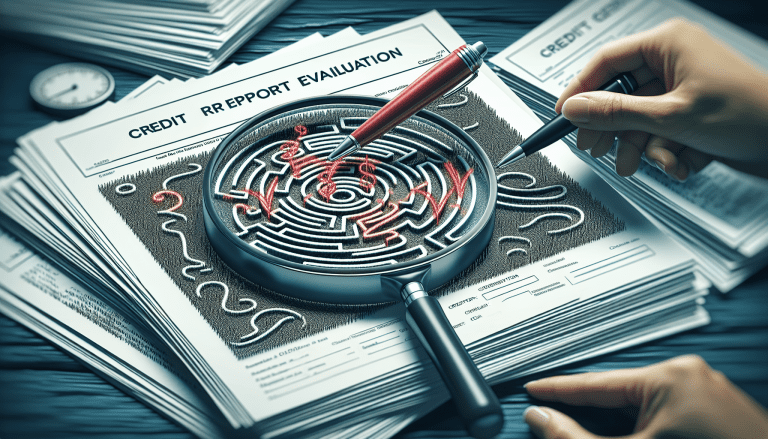

Impact on Credit Score

Cosigning can positively affect your credit if payments are on time. However, missed payments by the borrower can harm both credit scores.

Rights and Obligations of a Cosigner

As a cosigner, you have the right to loan-related documents and info on the borrower’s payment history. However, you’re obligated to make payments if the borrower defaults.

Default Consequences

Lenders pursue both borrower and cosigner for outstanding balances. Legal actions like wage garnishment can occur, impacting credit scores.

Can a Cosigner Be Removed?

Removing a cosigner depends on the lender and the borrower’s financial responsibility. Paying off the balance or refinancing are common ways.

Should You Use a Cosigner?

Consider cosigning carefully. While it aids financing, understand the financial and legal obligations involved.

How to Find a Cosigner

Family or friends are primary choices for cosigners. A cosigning service is an option but may involve additional fees.

Alternatives to Cosigning

Secured loans, building credit, finding a co-borrower, or working with a credit counselor are alternatives to consider.

Common Misconceptions

Misconceptions include thinking cosigning is insignificant, the cosigner’s credit score doesn’t matter, and it’s only for those with poor credit. It’s crucial to know the facts.

Tips for Cosigners

Understand the loan terms, keep documents, monitor payments, set up automatic payments, and communicate regularly with the borrower.

In Conclusion

Cosigning can assist those struggling with financing, but it comes with risks. Fully grasp the obligations, explore alternatives, and make informed decisions when considering cosigning.

FAQs

What is the difference between a cosigner and a co-borrower?

A cosigner is responsible for the loan if the borrower defaults, while a co-borrower is equally responsible for the loan from the beginning.

Can you remove a co signer from a loan?

In some cases, a cosigner can be removed from a loan by paying off the outstanding balance, refinancing the loan, or renegotiating the loan terms.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender can attempt to collect the outstanding balance from both the borrower and the co signer. Defaulting on a loan can also severely damage both parties’ credit scores.

Should I use a co signer?

Using a cosigner can be a helpful option if you have difficulty securing financing on your own, but it’s important to consider the risks and benefits carefully.

What are some alternative options to cosigning?

Alternative options to cosigning include applying for a secured loan, building your credit history, finding a co-borrower, or working with a credit counselor to improve your financial situation.

Table of Contents

Get Your Credit Repaired With credit-repair.com

Google Review:

or

WHY CHOOSE US

We also would counsel you on real, legal, and ethical credit repair for clients rebuilding their life and credit ratings after hardship. Achieving financial freedom is the ultimate dream allowing you to live the life you want to enjoy. Get the help of a professional credit repair company by contacting us.

Our credit restoration services are tailored to your unique situation, and we never make you pay for anything you don’t need. When you sign up for either our Essentials or Essentials Plus packages, you can rest assured that you’ll be receiving the bare minimum of care necessary for your specific situation. You can opt for additional customization options to further tailor our offerings to your specifications. In this manner, you won’t overpay for perks you don’t use. This is the essence of adaptability.