Credit Score Statistics You Need to Know in 2023

Are you curious about credit scores and how they affect your financial life? In this article, we’ll dive into 30 credit score statistics you should know in 2023. From average scores to the impact of missed payments, we’ll cover it all.

Credit scores are an essential part of personal finance, and they play a crucial role in determining whether or not you qualify for credit, loans, and other financial products. In 2023, credit scores will continue to play a critical role in people’s financial lives, making it essential to understand the key statistics related to credit scores.

What Is a Credit Score?

Your creditworthiness is measured by a three-digit figure, often in the range of 300 to 850. Your credit score is calculated based on various factors, including payment history, credit utilization, length of credit history, and types of credit used.

Average Credit Score in 2023

According to the latest data, the average credit score Credit Score Statistic in 2023 is expected to be around 720. This is a slight increase from the previous year and reflects the overall trend of increasing credit scores in recent years.

Factors That Affect Your Credit Score

Your credit score can be affected by a number of things, including:

Payment History

With a weight of 35%, payment history is the single most important component in calculating your credit score. Late payments and missed payments can significantly impact your credit score and remain on your credit report for up to seven years.

Learn more about Credit Score Facts Statistics.

Credit Utilization

The term “credit utilization” refers to the extent to which a person uses their available credit. High credit utilization can negatively impact your credit score, as it suggests that you may be overextended financially.

Length of Credit History

The length of your credit history accounts for 15% of your credit score. A higher credit score is typically associated with a longer credit history.

Types of Credit Used

The kind of credit you utilize also has an effect on your score. Having a mix of credit types, such as credit cards, loans, and mortgages, can help boost your score.

Credit Score Distribution in 2023

In 2023, it’s likely that the distribution of credit scores Credit Score Statistic will continue to vary among different age groups and demographics. According to recent data, younger age groups tend to have lower credit scores, with those under 30 averaging a score of 652, while those over 60 have an average score of 749. Additionally, certain factors such as income level, employment history, and debt-to-income ratio can impact credit scores. It’s important to note that credit score distribution can also vary by location, with some states having higher average credit scores than others. Understanding the distribution of credit scores can help individuals better understand where they stand and identify areas for improvement to achieve a better score.

How Often Do Credit Scores Change?

Credit scores can change frequently based on your financial behavior. Typically, credit scores update monthly, but significant changes, such as missed payments or applying for new credit, can impact your score more quickly.

Credit Score Ranges and What They Mean

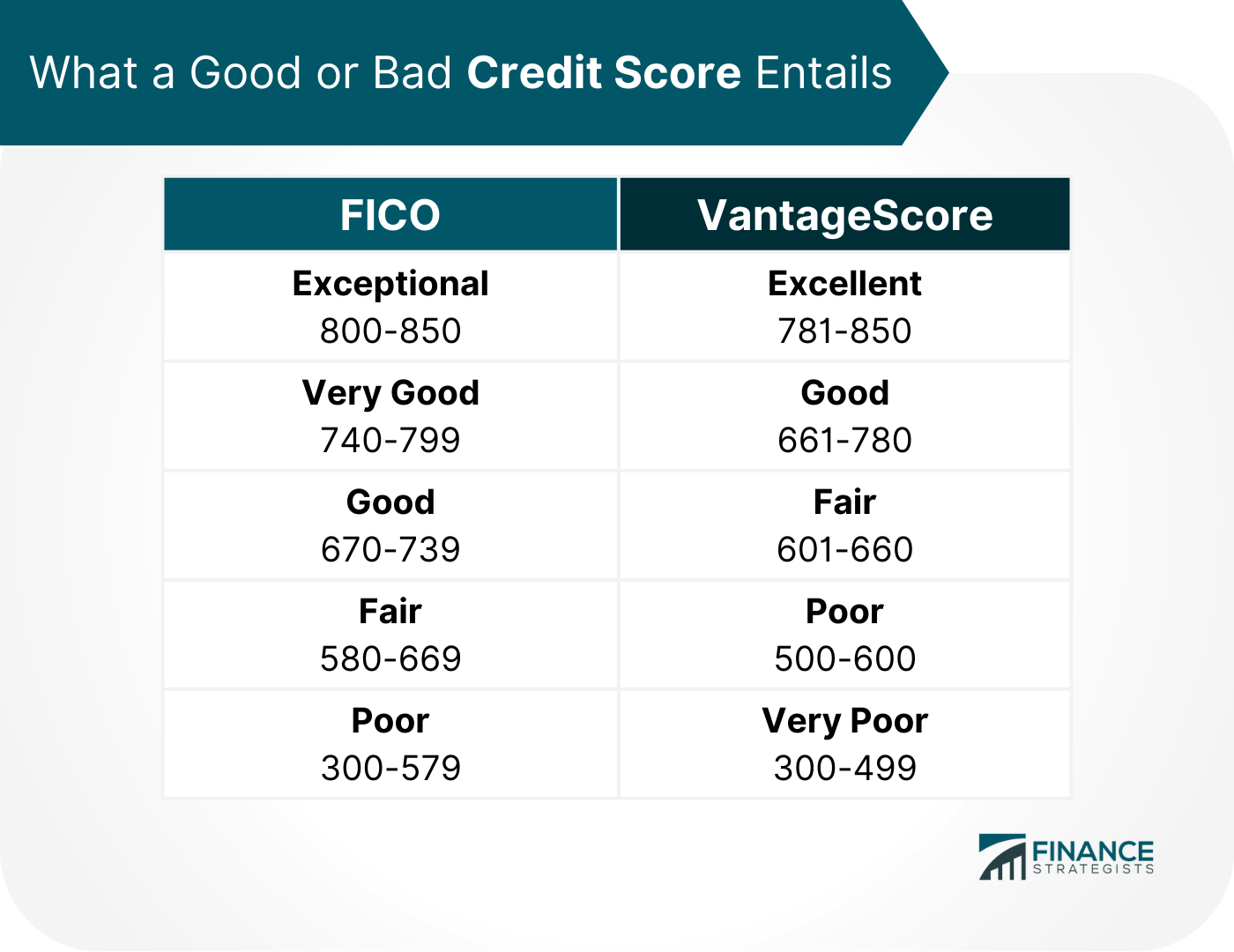

Credit scores are typically categorized into ranges, each representing a different level of creditworthiness. The ranges and their meanings include:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

Credit Score and Mortgage Rates

Your credit score can significantly impact the mortgage rates you qualify for. People with excellent credit scores are likely to receive the lowest mortgage rates, while those with poor credit scores may not qualify for a mortgage at all.

Credit Score and Auto Loan Rates

Similar to mortgage rates, your credit score can impact the auto loan rates you qualify for. People with excellent credit scores are likely to receive the lowest auto loan rates, while those with poor credit scores may face high-interest rates or not qualify for an auto loan at all.

Credit Score and Credit Card APR

Credit card APRs can also be impacted by your credit score Credit Score Statistic . People with excellent credit scores may receive low-interest rates, while those with poor credit scores may face high-interest rates or not qualify for credit cards at all.

How to Check Your Credit Score

Credit Karma and Credit Sesame are just two of several free internet programs that let you keep tabs on your credit score. It’s essential to monitor your credit score regularly to stay informed about your creditworthiness and ensure the accuracy of your credit report.

Impact of Missed Payments on Credit Scores

Missed payments can have a significant negative impact on your credit score and financial health. Late payments can stay on your credit report for up to seven years and can impact your ability to qualify for credit in the future.

Credit Score and Employment

Some employers may check your credit score as part of the hiring process, particularly for jobs that involve handling money or sensitive financial information. However, not all employers check credit scores, and many states have laws limiting employers’ ability to use credit scores in hiring decisions.

Credit Score and Insurance Rates

Your credit score can also impact the insurance rates you qualify for. People with excellent credit scores may receive lower insurance rates, while those with poor credit scores may face higher insurance rates. You can also be a cosigner if you have good credit score.

How to Improve Your Credit Score Credit Score Statistics

Improving your credit score requires a combination of responsible financial behavior and time. Some tips to improve your credit score include paying bills on time, paying down debt, and limiting new credit applications.

FICO vs. VantageScore

Two of the most widely used credit scoring algorithms are FICO and VantageScore. While they use similar factors to determine credit scores, there are some differences in their methodologies and score ranges.

Credit Score Myths Debunked

There are many myths surrounding credit scores, such as the idea that checking your credit score will lower it or that carrying a balance on a credit card will help your score. It’s essential to debunk these myths and understand the reality of credit scores.

Credit Score and Identity Theft

Identity theft can have a severe impact on your credit score and financial health. It’s important to monitor your credit report regularly and take steps to protect your personal information.

Credit Score and Divorce

Divorce can also impact your credit score, particularly if you have joint accounts or shared debt with your former spouse. It’s essential to understand your rights and obligations related to your credit score during and after a divorce.

Credit Score and Co-Signing Loans

Co-signing a loan can impact both your credit score and the credit score of the person you are co-signing for. If they fail to make payments on time or default on the loan, it can negatively impact both of your credit scores. It’s important to understand the risks and responsibilities of co-signing a loan before agreeing to do so.

Conclusion

Credit scores play a significant role in our financial lives, impacting our ability to qualify for credit, loans, and insurance rates. It’s essential to understand the factors that impact credit scores, how to check and monitor them, and how to improve them over time. By following responsible financial practices, you can maintain a healthy credit score Credit Score Statistic and financial future.

FAQs

What is the highest credit score you can have?

An 850 credit score is the maximum possible..

How long does a late payment stay on your credit report?

The negative effects of a payment delay might be shown for as long as seven years..

Does checking your credit score lower it?

No, checking your credit score Credit Score Statistic does not lower it.

Can you get a loan with a poor credit score?

It may be more challenging to qualify for a loan with a poor credit score, but it’s still possible.

How often should you check your credit score Credit Score Statistic ?

It’s recommended to check your credit score at least once a year, but you can check it more frequently for free through various online services.