In 2023, staying informed about your financial well-being is paramount, and our guide on “15 Credit Facts Everyone Needs to Know in 2023” is your compass to navigate the complex landscape of credit.

From the nuances of improving credit scores to understanding the impact of late payments, this comprehensive resource empowers individuals with crucial insights, ensuring they make informed decisions for a robust financial future.

Explore the benefits of a stellar credit score, unravel the dynamics of credit inquiries, and master credit utilization to enhance your financial literacy and make the most of credit opportunities in the coming year.

In an era dominated by digitization, the importance of cultivating a robust credit score takes center stage.

Beyond just easing access to financial tools, a commendable credit score opens doors to better interest rates, promising substantial long-term savings.

Decoding the Essence of Credit Scores

Understanding the essence of credit scores is pivotal, as these numbers encapsulate your creditworthiness.

A stellar credit score communicates reliability to lenders, assuring them of your responsible credit management and heightened likelihood of loan repayment.

Conversely, a lower score may signal higher risk, potentially affecting your ability to secure loans.

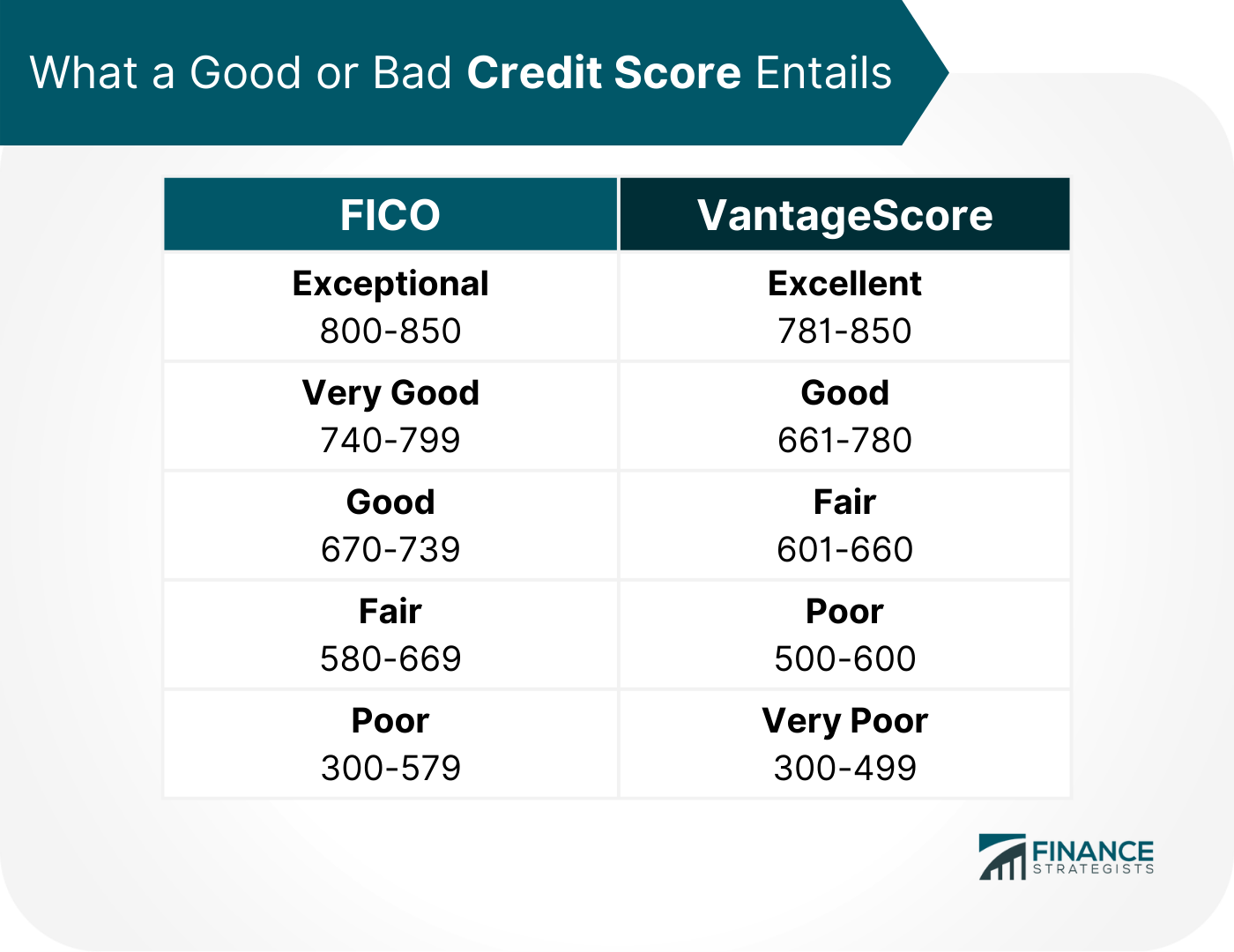

The Credit Score Spectrum: FICO’s Role

The credit score spectrum, ranging from 300 to 850, finds its most widespread expression in the FICO score, a numerical reflection used by a whopping 90% of lenders.

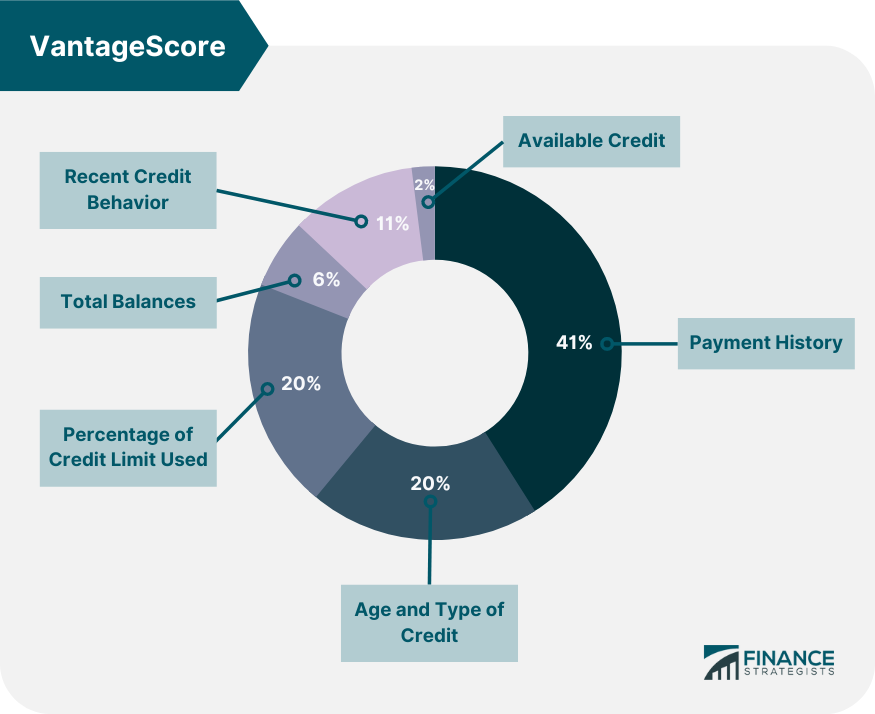

The Complex Web of Credit Score Determinants

Unraveling the intricacies of credit scores involves understanding multiple factors, including payment history, credit utilization, credit history length, types of credit, and new credit inquiries.

Among these, payment history and credit utilization wield significant influence, collectively constituting a major share (65%) of the FICO score.

Unveiling Your Credit Score: Where and How

Checking your credit score becomes an empowering act, and you can do so annually for free from Equifax, Experian, and TransUnion at AnnualCreditReport.com.

Alternatively, explore the convenience of credit monitoring services or obtain a free credit score from platforms like Credit Karma or Credit Sesame.

The Proactive Approach: Why Monitoring Matters

Beyond mere accessibility, monitoring your credit score proves crucial in keeping a vigilant eye on changes, spotting errors, and promptly addressing any fraudulent activities.

Setting up alerts becomes a strategic move, providing real-time notifications for any alterations to your credit report.

Conclusion: Empowering Financial Wellness in the Digital Age

Staying informed about your credit score transcends financial prudence; it evolves into a proactive strategy for maintaining robust financial health amidst the evolving landscape of the digital age.

As we navigate 2023, these 15 credit insights stand as beacons, guiding individuals toward informed and empowered financial decision-making.

Improving your credit score is a gradual process, but it’s within your control. Take strategic steps to kickstart the journey toward a better credit score, encompassing timely bill payments, prudent credit utilization, and a cautious approach to opening new accounts.

The Impact of Timely Payments

Late payments can significantly dent your credit rating. Even a single late payment can cause a drop in your score, and the prolonged delay exacerbates the negative impact. Swift action to catch up on overdue payments is crucial to mitigate potential damage.

Remedies for Missed Payments

If you miss a payment, swift resolution is key. Catch up on payments promptly and consider negotiating a payment plan with the lender to prevent further credit score deterioration.

The Perks of a Stellar Credit Score

A good credit score unlocks numerous advantages, from lower interest rates on loans and credit cards to elevated credit limits.

It enhances approval odds for loans and credit applications, simplifies apartment rentals, job applications, and can even lead to savings on insurance premiums.

Strategies for Building Credit

For those with limited credit history or a less-than-ideal credit score, options abound to kickstart credit-building.

Explore avenues such as secured credit cards, becoming an authorized user on another’s card, or opting for a credit-builder loan.

Navigating Credit Inquiries: “Hard” vs. “Soft”

Distinguish between hard and soft credit inquiries, with hard inquiries impacting your score temporarily.

Be mindful of the occasions you apply for loans or credit cards to minimize potential score fluctuations.

The Persistence of Unfavorable Information

Negative information, like late payments or collections accounts, can linger on your credit report for up to seven years.

Bankruptcies take up to a decade to drop off, but their impact on your score wanes over time.

The Dynamics of Closing a Credit Card Account

Closing a credit card account has ripple effects on your credit score. It can elevate your credit utilization and shorten your credit history, both potentially lowering your score.

Mastering Credit Utilization

Maintaining low credit utilization, ideally below 30%, is crucial for preserving a healthy credit score. Monitor and manage your credit usage to avoid negative impacts.

Shielding Against Credit Card Fraud

Credit card fraud is a looming threat, but proactive measures can fortify your defenses. Regularly monitor accounts, employ secure passwords, steer clear of phishing scams, and safeguard your card information.

Conclusion: Empowering Financial Wellness Through Credit Mastery

In the dynamic financial landscape of 2023, understanding and actively managing your credit is paramount.

Regularly check your credit score, monitor your credit report, and implement strategies to enhance your creditworthiness.

This not only saves you money but also opens doors to a plethora of credit opportunities in the future.

FAQs: Navigating Common Credit Queries

-

Can I get a loan with a low credit score?

- While possible, expect higher interest rates and limited options.

-

How often should I check my credit score?

- Check it at least annually, and more frequently if actively working to improve it.

-

How long does it take to improve your credit score?

- The timeline varies, but improvement may take several months or even years.

-

Can I dispute errors on my credit report?

- Yes, dispute errors by providing supporting documentation to the reporting agency.

-

What should I do if I suspect credit card fraud?

- Safeguard against credit card fraud by monitoring accounts, using secure passwords, and avoiding phishing scams.

Table of Contents

Get Your Credit Repaired With credit-repair.com

Google Review:

or

WHY CHOOSE US

We also would counsel you on real, legal, and ethical credit repair for clients rebuilding their life and credit ratings after hardship. Achieving financial freedom is the ultimate dream allowing you to live the life you want to enjoy. Get the help of a professional credit repair company by contacting us.

Our credit restoration services are tailored to your unique situation, and we never make you pay for anything you don’t need. When you sign up for either our Essentials or Essentials Plus packages, you can rest assured that you’ll be receiving the bare minimum of care necessary for your specific situation. You can opt for additional customization options to further tailor our offerings to your specifications. In this manner, you won’t overpay for perks you don’t use. This is the essence of adaptability.