Your credit score plays a significant role in many aspects of your financial life, including your ability to secure loans, mortgages, and credit cards. But did you know that it can also impact your car insurance rates? Many insurance companies use credit-based insurance scores as a factor in determining premiums for auto insurance policies.

How credit scores impact car insurance rates

Insurance companies use credit-based insurance scores to assess the risk of insuring a particular individual. Studies have shown that there is a correlation between credit scores and the likelihood of filing a claim. Insurers argue that people with lower credit scores are more likely to file claims and thus pose a higher risk.

When determining car insurance rates, insurers use a range of factors including driving history, age, vehicle type, and credit score. While each state has different regulations regarding the use of credit scores, many insurance companies rely on this information to calculate premiums.

It’s important to note that credit scores are just one piece of the puzzle. Insurance companies also consider other factors to determine your overall risk profile. However, improving your credit score can potentially lower your car insurance rates.

Factors taken into consideration by insurance companies

When it comes to determining car insurance rates, insurance companies do not rely solely on credit scores. In fact, there are several other factors that are taken into consideration when assessing your overall risk profile.

One of the most important factors is your driving history. Insurance companies will look at your past accidents or traffic violations to assess the likelihood of you being involved in future accidents. Additionally, factors such as the age and type of vehicle you drive can also impact your premiums. For example, sports cars tend to have higher insurance rates due to their increased risk of accidents and theft.

Insurance companies also consider other personal factors such as your age, gender, and marital status. Statistically, young drivers, particularly males, are considered to be more risky to insure.

Aside from these factors, insurance companies also take into account where you live. If you live in an area with high crime rates, or where accidents and theft are common, you can expect to pay higher premiums.

While credit scores are an important piece of the puzzle, it is crucial to understand that insurance companies look at a combination of these factors to determine your risk profile. So, while improving your credit score can potentially lower your car insurance rates, it is also important to focus on maintaining a clean driving record and reducing other risk factors. In the next section, we will discuss some practical steps you can take to improve your credit-based insurance score and save money on your car insurance premiums. Stay tuned!

The importance of maintaining a good credit score

We will be discussing the importance of maintaining a good credit score when it comes to car insurance rates. While insurance companies consider various factors when determining premiums, your credit score plays a significant role.

Having a good credit score demonstrates to insurance companies that you are financially responsible and less likely to file claims. On the other hand, a poor credit score suggests a higher risk of potential missed payments or filing claims.

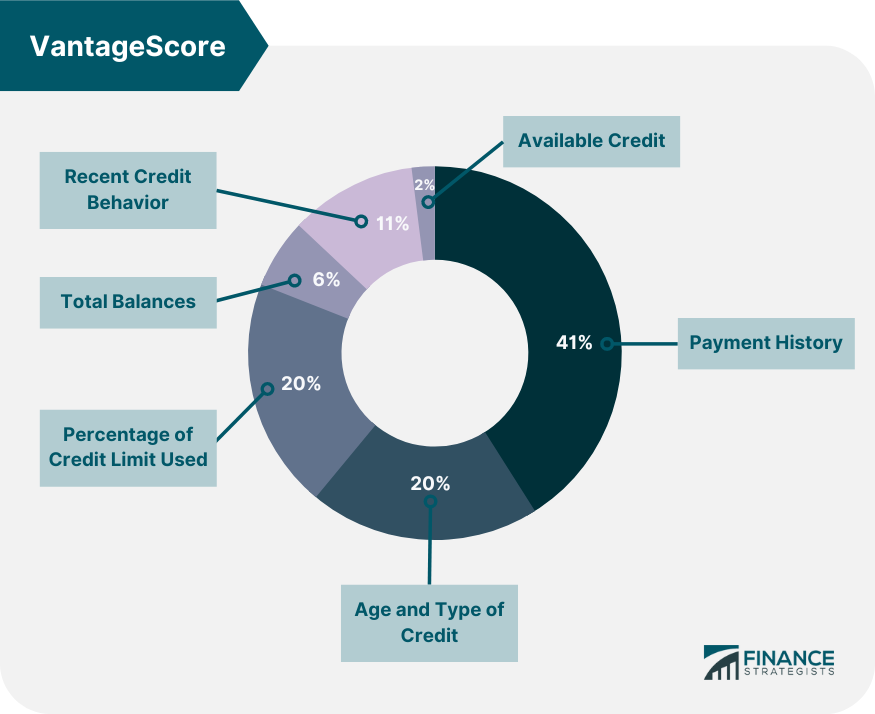

Insurance companies use a credit-based insurance score (CBIS) to assess your level of risk. This score is calculated based on your credit history, including factors such as your payment history, credit utilization ratio, and length of credit history.

By maintaining a good credit score, you can potentially qualify for lower insurance premiums. It is crucial to make timely payments, reduce outstanding debts, and avoid applying for unnecessary credit cards or loans. Regularly checking your credit report for inaccuracies and addressing any issues promptly can also help improve your score.

Steps to improve your credit score and potentially lower insurance rates

The impact of a credit score on your car insurance rates, let’s discuss some actionable steps you can take to improve your credit-based insurance score and potentially lower your premiums.

Pay your bills on time:

Late payments can have a negative impact on your credit score. Set up automatic payments or reminders to ensure you never miss a bill payment.

Reduce credit card balances:

High credit card balances can negatively affect your credit utilization ratio. Aim to keep your balances below 30% of your credit limit.

Avoid new credit applications:

Applying for multiple credit cards or loans within a short period can signal financial instability. Only apply for credit when necessary and avoid unnecessary inquiries.

Check your credit report regularly:

Monitor your credit report for any inaccuracies or fraudulent activities. Dispute any errors promptly to maintain an accurate credit score.

Maintain a long credit history:

The length of your credit history plays a role in calculating your credit-based insurance score. Avoid closing old credit accounts as they contribute to your overall credit history.

By implementing these steps, you can gradually improve your credit score and potentially qualify for lower car insurance rates. Remember, maintaining a good credit score is not only beneficial for insurance purposes but also for your overall financial well-being.

Complete guide about Convington Credit

Legalities and regulations surrounding the use of credit scores in car insurance

While credit scores are commonly used by insurance companies to determine car insurance rates, it is essential to be aware of the legalities and regulations that govern this practice. In the United States, the use of credit scores in insurance decisions is regulated at the state level.

Currently, most states allow the use of credit scores as a factor in determining insurance rates. However, some states have restrictions or limitations on how credit information can be used. For example, California, Hawaii, and Massachusetts prohibit the use of credit scores in determining car insurance rates.

It is crucial to understand your state’s specific regulations to know how your credit score may impact your car insurance premiums. Familiarize yourself with the laws and regulations, and consult with a professional or your insurance provider if you have any questions or concerns.

When it comes to purchasing car insurance, there are several factors that insurers consider before determining the rates. While many people are aware of the importance of factors like age, driving record, and type of vehicle, one of the lesser-known factors that can significantly affect your car insurance rates is your credit score.

Car insurance rates are based on a variety of factors, including your driving history, age, location, and the type of car you drive. However, one of the factors that you may not be aware of is your credit score. The sum of these parts is your credit score, a numeric representation of your creditworthiness. In this article, we will discuss the relationship between your credit score and car insurance rates.

Understanding Credit Scores

Before we dive into the relationship between your credit score and car insurance rates, let’s first understand what a credit score is. The three-digit number that represents your creditworthiness varies from 300 to 850. The higher your credit score, the more creditworthy you are considered to be by lenders and insurers.

Factors such as payment history, credit usage, length of credit history, different forms of credit, and new credit all play a role in determining your credit score. Payment history and credit utilization are the most significant factors, and they account for about 35% and 30% of your credit score, respectively.

How Do Insurers Use Credit Scores?

Insurers use credit scores as a factor to determine the likelihood of a customer filing a claim. Insurance claims are more common among those with lower credit scores, according to the aforementioned studies. As a result, insurers believe that customers with lower credit scores are riskier to insure and may charge them higher rates.

How Credit Scores Affect Car Insurance Rates

The impact of your credit score on your car insurance rates varies from state to state and from insurer to insurer. However, in most cases, people with lower credit scores can expect to pay higher car insurance rates than people with higher credit scores.

According to a study conducted by Consumer Reports, people with poor credit scores can pay up to twice as much for carinsurance as people with excellent credit scores. In some states, the difference can be even more significant. For example, in Michigan, people with poor credit scores can pay up to 65% more for car insurance than people with excellent credit scores.

States with Credit-Based Insurance Scores Ban

While many states allow insurers to use credit scores as a factor in determining car insurance rates, some states have banned the practice. Currently, California, Hawaii, and Massachusetts have banned the use of credit-based insurance scores. In addition, several other states have restrictions on how insurers can use credit scores.

Tips to Improve Your Credit Score

If you’re concerned about how your credit score may be affecting your car insurance rates, there are several steps you can take to improve your credit score. These include paying your bills on time, paying down your debts, keeping your credit utilization low, and avoiding opening new credit accounts.

Conclusion

Your credit score can significantly affect your car insurance rates. Insurers use credit scores to determine the likelihood of a customer filing a claim and

Insurers believe that customers with lower credit scores are riskier to insure and may charge them higher rates. While some states have banned the use of credit-based insurance scores, in most states, insurers can use credit scores to determine car insurance rates.

If you’re concerned about how your credit score may be affecting your car insurance rates, it’s important to take steps to improve your credit score. By paying your bills on time, paying down your debts, keeping your credit utilization low, and avoiding opening new credit accounts, you can improve your credit score over time and potentially lower your car insurance rates.

FAQs

- Can I get car insurance if I have a poor credit score? Yes, you can still get car insurance even if you have a poor credit score. However, you may end up paying higher rates than someone with a higher credit score.

- How often do insurers check credit scores? Insurers typically check credit scores when you first apply for insurance and when you renew your policy.

- How much can my credit score affect my car insurance rates? The impact of your credit score on your car insurance rates varies from state to state and from insurer to insurer. However, people with poor credit scores can expect to pay significantly higher rates than people with excellent credit scores.

- Can I dispute an insurance rate based on my credit score? Yes, you can dispute an insurance rate based on your credit score if you believe that the rate is unfair. However, you should back up your assertion with evidence.

- Is it legal for insurers to use credit scores to determine rates? Yes, in most states, it is legal for insurers to use credit scores as a factor in determining car insurance rates. However, some states have banned or restricted the use of credit-based insurance scores.

Table of Contents

Get Your Credit Repaired With credit-repair.com

Google Review:

or

WHY CHOOSE US

We also would counsel you on real, legal, and ethical credit repair for clients rebuilding their life and credit ratings after hardship. Achieving financial freedom is the ultimate dream allowing you to live the life you want to enjoy. Get the help of a professional credit repair company by contacting us.

Our credit restoration services are tailored to your unique situation, and we never make you pay for anything you don’t need. When you sign up for either our Essentials or Essentials Plus packages, you can rest assured that you’ll be receiving the bare minimum of care necessary for your specific situation. You can opt for additional customization options to further tailor our offerings to your specifications. In this manner, you won’t overpay for perks you don’t use. This is the essence of adaptability.