In today’s context, having a credit score holds unprecedented significance. The ease with which one can secure loans, credit cards, rental agreements, and employment opportunities is contingent upon their creditworthiness.

Unfortunately, a substantial number of individuals find themselves with less-than-ideal credit scores due to late payments, high debt, or errors on their credit records. This is where the concept of credit repair becomes crucial.

Credit plays a pivotal role in nearly every facet of our lives, holding considerable importance within the banking system. It influences the interest rates on credit cards and determines our eligibility for loans to make purchases.

A credit score serves as a key indicator of one’s likelihood to repay a loan—an aspect scrutinized by lenders, landlords, insurance companies, and potential employers when making decisions that can significantly impact financial standing.

This article explores the paramount importance of rectifying one’s credit. It delves into how maintaining a positive credit history can substantially improve various aspects of life.

Beyond enumerating the benefits of possessing good credit, the article also addresses situations where credit repair becomes imperative.

The central message emphasizes the critical nature of taking proactive steps to repair and sustain credit for enduring financial stability and success.

Table of Contents:

What Does “Credit” Really Mean?

This chapter delves into the essence of credit and its profound implications in our daily lives. It explores how credit scores aid lenders in assessing an individual’s borrowing capacity and provides insights into understanding these numerical indicators.

Why Having Good Credit is Crucial

Examining the multifaceted impact of credit on life, this chapter discusses how good credit enables favorable loan terms with lower interest rates, expands living options, enhances job prospects, and secures lower insurance rates.

Consequences of Bad Credit

Conversely, this chapter explores the challenges associated with bad credit, including difficulties in obtaining loans and credit, elevated insurance costs, obstacles in renting or owning a home, and impediments to securing employment.

Instances Requiring Credit Repair

Shedding light on scenarios necessitating credit repair, this chapter addresses the correction of errors or missing information on credit reports. It also explores the need for improved credit when seeking loan terms for significant life events or financial goals, such as home ownership or entrepreneurial endeavors. Beyond debt resolution, achieving financial freedom serves as another compelling reason to undertake credit repair

To Rectify Your Credit: Essential Steps and Considerations

- Addressing and improving your credit is a pivotal undertaking in today’s financial landscape.

- Taking proactive measures is crucial, and this involves scrutinizing your credit records for any inaccuracies or gaps that require attention. It is imperative to dispute erroneous information with the relevant authorities.

- Additionally, cultivating a practice of timely bill payments and gradually building a positive credit score are paramount.

- Seeking external assistance, if needed, can streamline this process.

Dispelling Credit Repair Myths and Unveiling the Truth

- This chapter aims to debunk prevalent misconceptions surrounding credit repair and underscores how responsible actions can genuinely contribute to enhancing credit scores.

- It emphasizes the importance of avoiding scams associated with credit repair services, promoting a transparent and informed approach.

Embarking on the Journey to Financial Freedom

- In today’s world, understanding credit and credit scores is imperative for long-term financial well-being.

- This chapter explores the profound effects of poor credit, the steps required for remediation, and the significance of staying informed about the credit repair process.

Deciphering “Credit”

- Credit, fundamentally, is an agreement allowing individuals and businesses to borrow money or obtain goods and services with a commitment to repay the lender or provider at a specified date.

- This chapter delves into the various forms of credit, including credit cards, loans, mortgages, and lines of credit. Credit scores play a pivotal role in gauging creditworthiness, with the FICO score, ranging from 300 to 850, being a widely used model in the United States.

How Credit Scores Are Determined

Credit scores, within the range of 300 to 850, are computed based on factors such as payment history, credit utilization, credit history length, types of credit, and inquiries.

Responsible credit management positively impacts scores, while factors like bankruptcies, foreclosures, and accounts in collections can have adverse effects.

Exploring the Benefits of Good Credit

Good credit opens doors to numerous financial advantages. This section elucidates on the positive outcomes, such as favorable loan terms, lower interest rates, expanded living choices, increased job prospects, and cost savings on insurance premiums.

A high credit score can facilitate easier property acquisition, and even in the job market, it reflects responsibility and reliability to potential employers.

The Consequences of Poor Credit

Conversely, poor credit can have widespread ramifications. It may hinder credit approval, lead to higher interest rates, and complicate debt management.

Poor credit can also impede housing opportunities, limit mortgage options, affect job prospects, and elevate insurance costs.

Situations Where Credit Repair Is Necessary

Given the far-reaching impact of credit, there are instances where credit repair becomes imperative.

Subsections explore how to rectify mistakes and inaccuracies on credit reports, addressing issues like identity theft, late payments, or duplicated accounts.

It emphasizes adhering to legal time limits regarding bankruptcy or judgments on credit reports.

In essence, this comprehensive guide underscores the significance of undertaking credit repair measures, providing insights into debunking myths, understanding credit intricacies, and navigating the path toward financial freedom.”

Embarking on the Credit Repair Journey: A Comprehensive Guide

Credit repair is an essential undertaking to identify and rectify mistakes, ensuring that your credit report accurately reflects your creditworthiness.

When considering significant financial endeavors such as buying a house or a car, your credit score profoundly influences the terms and conditions of the loans available to you.

Potential challenges include increased interest rates, larger down payment requirements, and limited loan choices.

Undertaking credit repair becomes a pivotal step to secure favorable loan terms, leading to long-term cost savings.

Planning for Significant Life Events

Life’s major milestones, such as purchasing a home, starting a family, or pursuing higher education, often entail substantial financial commitments.

Maintaining good credit during these times can ease the process and make it more cost-effective.

For instance, a favorable credit score can impact the interest rate on your mortgage, potentially resulting in long-term financial benefits, such as becoming a landlord.

Achieving Financial Freedom through Credit Repair

Credit repair is viewed by many as a pathway to financial freedom. For those entangled in high-interest debt or facing challenges due to poor credit, repairing credit is a significant step toward debt resolution, improved financial health, and enhanced stability.

By organizing finances, rectifying credit issues, and working towards long-term goals, such as saving for retirement, individuals can gradually achieve financial independence.

Tips for Elevating Your Credit Score

Taking proactive steps to enhance your credit score involves a systematic approach:

1. Reading Your Credit Reports:

- Obtain copies of your credit reports from Equifax, Experian, and TransUnion annually through AnnualCreditReport.com.

- Scrutinize each report for mistakes, flaws, or inaccuracies, noting details such as creditor names, account numbers, and specific issues.

2. Dealing with Bills:

- Communicate with creditors to discuss payment plans, settlements, or “pay for delete” arrangements.

- Ensure timely bill payments to positively impact your credit score.

- Reduce outstanding balances to improve credit utilization rates.

3. Building a Good Credit History:

- Responsibly open new credit accounts, such as secured credit cards or credit builder loans, to establish a positive payment history.

- Maintain consistency in timely bill payments to steadily improve your credit score.

- Avoid closing accounts to preserve the length of your credit history.

4. Seeking Professional Help:

- Professional credit repair services offer assistance in analyzing credit records, identifying errors, and initiating dispute processes.

- These services may monitor credit reports and provide resources for clients to learn about credit and money management.

5. Dispelling Credit Repair Myths and Avoiding Scams:

- Distinguish between myths and facts related to credit repair, understanding that it is a gradual process, not a quick fix.

- Beware of scams by scrutinizing services that request payment upfront, make unrealistic claims, use pressure tactics, lack transparency, or operate without a written contract.

6. A Path to Financial Well-Being:

- Recognize the importance of fixing credit to influence credit approval, terms offered, and various aspects of life, including housing, jobs, and insurance.

- Understand the laws governing credit repair, consumer rights, and the role of acts such as the Fair Credit Reporting Act, Fair Debt Collection Practices Act, and Credit Repair Organizations Act.

This comprehensive guide covers the essentials of credit repair, offering insights into the intricacies of the process, considerations for self-repair versus professional assistance, and the significance of staying informed about one’s credit score.

The detailed table of contents provides a structured roadmap for navigating through various aspects of credit repair and achieving long-term financial well-being.

Employment Prospects: Certain employers may review the credit reports of job applicants, especially those seeking roles with significant responsibilities.

A positive credit score can potentially enhance job prospects.

Insurance Premiums: Insurance companies sometimes use credit scores to determine the premiums for auto and home insurance.

A higher credit score may lead to lower insurance rates.

Understanding these dynamics underscores the importance of maintaining a favorable credit score across various aspects of your financial life.

For instance, utility companies may assess fees differently based on credit scores, facilitating easier and more cost-effective service setup initially.

Given the impact of credit numbers on financial well-being, it becomes crucial to grasp how to manage and, if necessary, improve your credit.

-

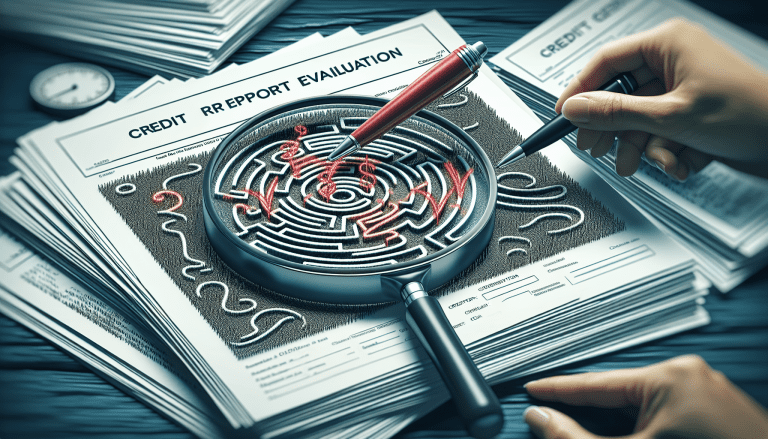

Navigating Credit Reports

2.1 Decoding a Credit Report

A credit report serves as a condensed overview of an individual’s credit history, compiled by credit bureaus using data from lenders, creditors, and public records. Your creditworthiness and credit score hinge on the information housed in your credit report.

In the United States, three major credit reporting agencies—Equifax, Experian, and TransUnion—offer credit reports.

Discrepancies may exist among the information provided by these agencies, necessitating a thorough review of all three to ensure accuracy.

2.2 Optimal Credit Report Retrieval

According to legal provisions, individuals are entitled to receive one annual copy of their credit report from each of the three major credit agencies.

To access these reports securely and accurately, visit AnnualCreditReport.com, a government-endorsed platform expressly designed for this purpose.

For ongoing credit monitoring throughout the year, it is advisable to stagger your requests and obtain a report every four months.

Additionally

- Recent credit application denial.

- Current unemployment status with plans to seek employment within 60 days.

- Receipt of government assistance.

- Presence of adverse information due to specific actions

- Within the details of your credit score, various elements come into play:Personal Information includes your name, address, Social Security number, date of birth, and employment history.Account Information provides insights into your credit accounts, encompassing loans, credit cards, and mortgages.

- It reveals the account type, balance, credit limit, payment history, and account initiation date.Public Records encompass significant entries like bankruptcies, tax liens, and other determinations impacting your credit score.Credit Inquiries identify entities, whether individuals or businesses, that have accessed your credit report.

- There are two types: hard inquiries (resulting from credit applications) and soft inquiries (occurring during pre-approval checks or when you review your own credit score).Rules safeguard individuals seeking credit repair, with the Fair Credit Reporting Act (FCRA) being a pivotal law governing the collection, sharing, and utilization of credit information. Key provisions include:

- Right to Access Credit Report: Individuals can annually request and receive a copy of their credit report from credit agencies.

- Disputing Inaccuracies: Mistakes found on the credit report can be challenged, obligating credit agencies to investigate and rectify them within a stipulated timeframe.

- Personal Information Protection: The FCRA mandates credit companies to maintain accurate and private credit information, ensuring the accuracy of data provided by businesses.

Reporting timeframes for events like payments or collection accounts generally span seven years, with bankruptcy information having a ten-year reporting period.

Creditors require written permission before accessing credit records. If declined for credit or employment due to credit report content, an action letter explaining the rejection’s basis is mandatory.

The Fair Debt Collection Practices Act (FDCPA) oversees debt collectors, emphasizing customer protection:

- Disputing Process: Consumers can dispute a debt within 30 days if they believe it is inaccurate, requiring debt collectors to provide proof.

- Communication Cessation: Customers can request a halt in communication with debt collectors in certain situations.

The Credit Repair Organizations Act (CROA) governs credit repair businesses, prohibiting certain practices and mandating transparency:

- Prohibited Practices: Credit repair companies cannot make false claims or charge upfront fees.

- Contracts and Disclosures: Signed contracts outlining services, payment terms, and duration are mandatory.

- Right to Cancel: Clients have the right to cancel contracts within three business days without penalties.

- Progress Reporting: Credit repair companies must furnish clients with written progress reports.

Part 4 explores self-credit repair:

4.1 Examining Credit Reports

Access your credit records from the three major agencies, scrutinizing them for errors such as personal details, unauthorized accounts, and discrepancies in payment records.

4.2 Identifying and Rectifying Errors

Challenge credit report errors by submitting detailed letters, supported by evidence, to the concerned credit bureau(s).

4.3 Resolving Outstanding Debts

Address overdue payments, charge-offs, and collections by engaging with creditors for payment plans or settlements. Timely payments and debt reduction positively impact credit scores.

4.4 Building a Positive Credit History

Initiate credit history by opening credit accounts, ensuring timely payments, and retaining open accounts for a favorable credit history.

4.5 Monitoring Progress

Regularly obtain updated credit reports, track credit scores, and remain patient and committed as credit improvement is an ongoing process.

Section 5 explores professional credit repair services:

5.1 How Credit Repair Services Operate

Professional services offer consultations, credit analysis, claim processes, follow-ups with creditors, monitoring, and educational resources.

5.2 Pros and Cons of Hiring Credit Repair Companies

Pros include expertise, convenience, and professional networks, while cons involve costs, no guaranteed outcomes, and potential for scams.

Section 6 delves into myths, scams, and red flags:

6.1 Debunking Myths

False notions include removing credit report information and starting over with a new credit identity.

6.2 Recognizing Credit Repair Scams

Warning signs include upfront fees, promises of guaranteed results, pressure tactics, lack of transparency, absence of a written agreement, and potential scams.

Section 7 concludes with the long-term benefits of credit repair:

-

A Secure Financial Future

Emphasizes the role of credit repair as a tool to enhance financial prospects, whether pursued independently or with professional assistance. Highlights the importance of vigilance against scams and underscores the enduring benefits of credit health through diligent efforts

Table of Contents

Get Your Credit Repaired With credit-repair.com

Google Review:

or

WHY CHOOSE US

We also would counsel you on real, legal, and ethical credit repair for clients rebuilding their life and credit ratings after hardship. Achieving financial freedom is the ultimate dream allowing you to live the life you want to enjoy. Get the help of a professional credit repair company by contacting us.

Our credit restoration services are tailored to your unique situation, and we never make you pay for anything you don’t need. When you sign up for either our Essentials or Essentials Plus packages, you can rest assured that you’ll be receiving the bare minimum of care necessary for your specific situation. You can opt for additional customization options to further tailor our offerings to your specifications. In this manner, you won’t overpay for perks you don’t use. This is the essence of adaptability.