Have you ever found yourself needing to rectify a credit mishap or seeking favor from a party not legally bound to assist? This could be due to a missed credit card payment, resulting in a credit score dip, or a dispute leading to a negative credit report mark.

In such scenarios, a goodwill letter proves invaluable for repairing relationships or restoring your credit standing. In this comprehensive guide, we’ll delve into the concept of goodwill letters, their significance, and provide a template for crafting an effective one.

What is a Goodwill Letter?

A goodwill letter serves as a written plea to a creditor or business, seeking their understanding and leniency in erasing negative credit information or forgiving a missed payment. While it doesn’t guarantee compliance, it demonstrates accountability and a commitment to making amends for one’s actions.

Reasons to Write a Goodwill Letter

There are several compelling reasons to consider composing a goodwill letter:

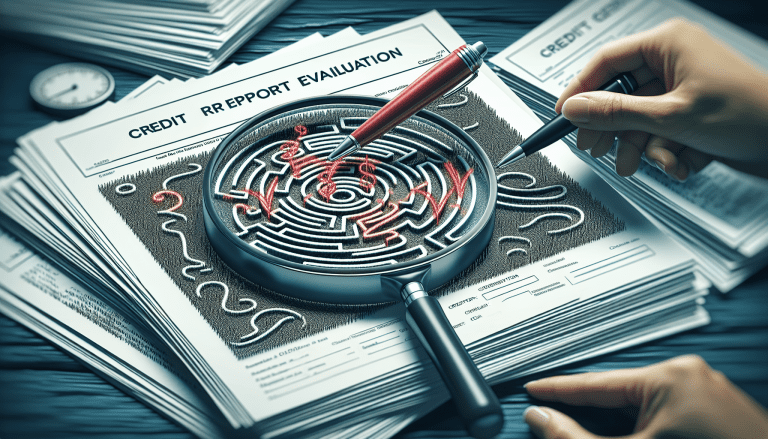

- Removing Negative Information from Your Credit Report: A goodwill letter can help request the removal of detrimental information, enhancing your creditworthiness.

- Repairing Damaged Relationships: If you’ve had a dispute, a goodwill letter can mend relations and showcase your dedication to resolving issues.

- Improving Approval Chances: When applying for loans or credit cards with a negative mark on your report, a goodwill letter can signal efforts to enhance your creditworthiness, potentially improving approval odds.

How to Write a Goodwill Letter

Be Honest and Sincere

Begin by honestly explaining the circumstances that led to negative credit information or a dispute. Take responsibility for your actions, express remorse, and showcase an understanding of the impact.

Don’t Waffle; Get Right to the Point

Keep your letter concise while covering all necessary information. Avoid excessive detail or excuses, emphasizing responsibility and commitment to resolution.

Explain Your Request

Detail your request clearly, articulating why it’s important and how it benefits you. If seeking the removal of negative information, provide reasoning. If seeking forgiveness for a missed payment, outline your plan for repayment and prevention.

Use Professional Language

Maintain professionalism in language, avoiding slang. Ensure a well-written, error-free letter to make a positive impression on the reader, typically a business or creditor.

Provide Supporting Documentation

Include any relevant documentation supporting your case, such as proof of payment or professional letters, to strengthen your request.

Goodwill Letter Template

[Your Name]

[Your Address]

[Date]

[Creditor/Business Name]

[Address]

[City, State ZIP Code]

Dear [Creditor/Business Name],

I am writing to request your understanding and leniency in removing the negative information from my credit report [or forgiving the missed payment]. [Explain the circumstances that led to the negative information, taking responsibility for your actions and expressing remorse or regret for any harm caused.]

I understand the importance of maintaining a positive credit history [or a good relationship with your business] and the impact that this negative information can have on my future creditworthiness [or business dealings]. I am committed to making things right and taking steps to ensure that this doesn’t happen again in the future.

[Explain your request and why it is important to you, providing any supporting documentation if necessary.]

Thank you for your time and consideration. I appreciate your understanding and hope that we can work together to resolve this issue.

Sincerely,

[Your Name]

FAQs

Q: Will a goodwill letter always result in the removal of negative information from my credit report?

A: No, there’s no guarantee, but it can improve your chances and show responsibility.

Q: How long should my goodwill letter be?

A: Keep it concise; one page is usually sufficient.

Q: Can I send a goodwill letter via email?

A: Yes, but follow up with a physical letter for good measure.

Conclusion

A goodwill letter can be a powerful tool for repairing damaged relationships or restoring your credit score. By being honest, sincere, and specific in your request, you can show that you are taking responsibility for your actions and are committed to making things right. While there is no guarantee that a goodwill letter will result in the removal of negative information from your credit report or forgiveness of a missed payment, it can improve your chances of success and help you move forward with a clean slate. Use our template to get started and see what a difference a goodwill letter can make.

Table of Contents

Get Your Credit Repaired With credit-repair.com

Google Review:

or

WHY CHOOSE US

We also would counsel you on real, legal, and ethical credit repair for clients rebuilding their life and credit ratings after hardship. Achieving financial freedom is the ultimate dream allowing you to live the life you want to enjoy. Get the help of a professional credit repair company by contacting us.

Our credit restoration services are tailored to your unique situation, and we never make you pay for anything you don’t need. When you sign up for either our Essentials or Essentials Plus packages, you can rest assured that you’ll be receiving the bare minimum of care necessary for your specific situation. You can opt for additional customization options to further tailor our offerings to your specifications. In this manner, you won’t overpay for perks you don’t use. This is the essence of adaptability.