Embark on a journey into the intricate realm of college student spending habits for 2024 with our Ultimate Guide. Unveiling the dynamic financial landscape, this comprehensive resource delves into trends shaping the academic experience.

Explore the nuances of tuition management, digital subscriptions, and lifestyle choices, empowering both students and stakeholders with valuable insights for informed decision-making. Stay ahead of the curve with the ultimate resource on college expenditures in 2024.

In the dynamic world of higher education, staying abreast of the latest trends is crucial, especially when it comes to the spending habits of college students. As we step into 2024, this comprehensive guide aims to shed light on the financial behaviors that define the college experience. From essentials to indulgences, we delve into the intricate web of college student spending.

Navigating Necessities – The Core of College Expenses

1.1 Tuition and Fees: Beyond the Price Tag

Explore the evolving landscape of tuition and fees, considering factors such as rising education costs, student loan trends, and the impact of financial aid on the overall expenditure. Gain insights into how students are managing the financial burden of their education.

1.2 Living on a Budget: Accommodation and Meals

Dive into the world of housing and meal plans, analyzing the choices students make to strike a balance between comfort and affordability. Discover the latest trends in off-campus living, meal prepping, and the rise of budget-conscious culinary choices.

The Digital Wallet – Tech, Subscriptions, and Entertainment

2.1 Gadgets and Gizmos: Tech Trends on Campus

Uncover the tech-savvy world of college students as they invest in the latest gadgets, laptops, and software subscriptions. Delve into the impact of online learning on technology expenditures and explore the intersection of academics and entertainment in digital spending.

2.2 Subscriptions Galore: Streaming, Gaming, and Beyond

Analyze the subscription economy within the college demographic, highlighting the prevalence of streaming services, gaming platforms, and other digital subscriptions. Explore the factors influencing these spending decisions and the role of convenience and entertainment in the digital realm.

Balancing Act – Work, Internships, and Side Hustles

3.1 Student Employment Trends: Juggling Work and Studies

Examine the patterns of student employment, from part-time jobs on campus to remote freelancing opportunities. Understand the impact of employment on academic performance and how students navigate the delicate balance between work and studies.

3.2 Internships and Career Investments

Explore the growing importance of internships and career-focused investments among college students. Delve into the financial decisions made to enhance future employability, including expenses related to professional development, networking events, and career-building activities.

Lifestyle Choices – Health, Fitness, and Social Expenditures

4.1 Wellness Investments: Health and Fitness Trends

Survey the landscape of health and wellness spending, ranging from gym memberships to fitness apps. Uncover the choices students make to maintain physical and mental well-being, exploring the intersection of self-care and financial decisions.

4.2 Social Experiences: Balancing FOMO and Budgets

Examine the role of social activities in college life and how students navigate the balance between enriching social experiences and budget constraints. Explore spending patterns related to social events, outings, and the impact of the Fear of Missing Out (FOMO) on financial decisions.

Conclusion:

As we conclude our exploration of college student spending habits in 2024, it becomes evident that financial decisions are as diverse as the students themselves. From academic investments to lifestyle choices, this guide provides a panoramic view of the financial landscape, empowering both students and stakeholders with valuable insights. As the education landscape continues to evolve, understanding and adapting to these spending trends will be key to fostering a financially savvy and resilient student community.

Frequently Asked Questions:

Q1: How do college students manage the rising cost of tuition and fees?

College students employ a variety of strategies to handle tuition costs, including seeking financial aid, scholarships, and grants. Additionally, some students may choose part-time employment or explore alternative education models to mitigate the financial burden.

Q2: What are the prevalent trends in student housing and meal choices?

Current trends indicate a shift towards more budget-friendly off-campus housing options and an increased interest in meal prepping to save on dining expenses. Students are also exploring communal living arrangements and off-campus housing to optimize costs while maintaining a comfortable lifestyle.

Q3: How are digital subscriptions influencing student spending habits?

Digital subscriptions play a significant role in students’ lives, with streaming services, gaming platforms, and software subscriptions being popular choices. The convenience and entertainment value offered by these subscriptions often impact students’ discretionary spending, prompting a reevaluation of priorities.

Q4: Do college students prioritize professional development and internships financially?

Yes, there is a growing emphasis on professional development and internships among college students. Many allocate funds for networking events, career-building workshops, and expenses related to gaining practical experience, recognizing the long-term value these investments bring to their future careers.

Q5: How do students strike a balance between work, studies, and personal life?

Balancing work, studies, and personal life is a common challenge for college students. Many utilize time management techniques, prioritize tasks, and explore flexible employment opportunities. The key is finding a personalized approach that aligns with individual goals and values.

Q6: Are there any emerging trends in health and fitness spending among college students?

Yes, health and fitness spending among college students is witnessing a surge. The trends include investments in gym memberships, fitness apps, and wellness products. Students are increasingly recognizing the importance of maintaining both physical and mental well-being during their academic journey.

Q7: How do social experiences impact students’ financial decisions?

Social experiences play a crucial role in college life, influencing spending decisions. Students often face the challenge of balancing social outings with budget constraints. Strategies include exploring low-cost or free events, group activities, and prioritizing experiences that align with personal values and interests.

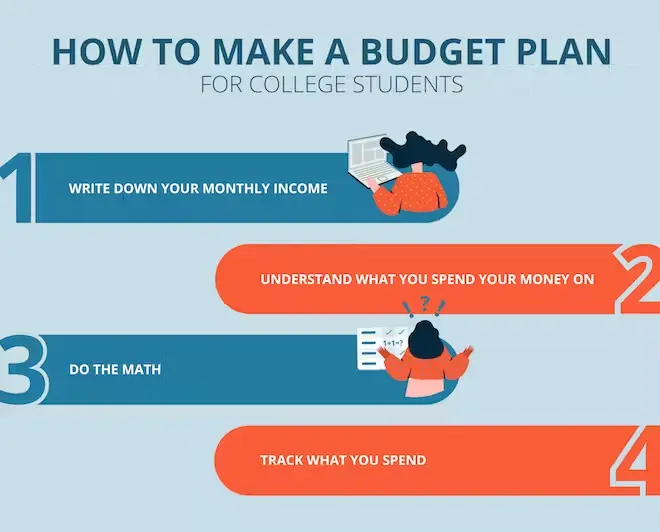

Q8: How can college students become more financially savvy?

Becoming financially savvy involves budgeting, setting financial goals, and making informed decisions. Students can benefit from financial literacy resources, workshops, and seeking advice from financial professionals. Establishing a budget and regularly reviewing spending patterns can contribute to long-term financial well-being.

Table of Contents

Get Your Credit Repaired With credit-repair.com

Google Review:

or

WHY CHOOSE US

We also would counsel you on real, legal, and ethical credit repair for clients rebuilding their life and credit ratings after hardship. Achieving financial freedom is the ultimate dream allowing you to live the life you want to enjoy. Get the help of a professional credit repair company by contacting us.

Our credit restoration services are tailored to your unique situation, and we never make you pay for anything you don’t need. When you sign up for either our Essentials or Essentials Plus packages, you can rest assured that you’ll be receiving the bare minimum of care necessary for your specific situation. You can opt for additional customization options to further tailor our offerings to your specifications. In this manner, you won’t overpay for perks you don’t use. This is the essence of adaptability.