Effortlessly improve your credit by removing Dynamic Recovery Solutions from your report.

Audit entries for inaccuracies, dispute with evidence, and engage in negotiations for swift resolution.

Consistent monitoring guarantees a speedier removal process, enhancing your overall creditworthiness. Take control of your financial future today.

Dynamic Recovery Solutions, a debt collection agency, may appear on your credit report, affecting your credit score and financial opportunities.

If you find Dynamic Recovery Solutions on your credit report, this guide will assist you in dealing with the collection account and pursuing its removal.

Understanding Your Rights under the FDCPA

Managing debt can be challenging, especially when dealing with debt collectors like Dynamic Recovery Solutions.

The Fair Debt Collection Practices Act (FDCPA) safeguards consumers, providing rights and means to challenge and validate debt information.

Knowing your rights empowers you to handle debt collectors fairly.

Coverage of the FDCPA

The FDCPA covers personal, family, and household debts, excluding business-related debts.

It encompasses debts from credit cards, auto loans, medical bills, and mortgages.

Prohibited Practices under the FDCPA

Dynamic Recovery Solutions is regulated to prevent abusive practices, including harassment, false statements, and threatening actions. Prohibited practices include:

Harassment

Debt collectors cannot harass, oppress, or abuse individuals. This includes making threats of violence, publishing debtor lists, using offensive language, or annoyingly calling someone.

False Statements

Dynamic Recovery Solutions must not deceive or lie during debt collection. False claims about being attorneys, government representatives, or misrepresenting the owed amount are strictly prohibited.

Threats and Actions

The agency cannot threaten legal actions that are not intended or permitted. Threatening to seize, garnish, attach, or sell property or wages is prohibited unless legally authorized.

Unfair Collection Practices

Dynamic Recovery Solutions is restricted from collecting more than owed, prematurely depositing checks, or insisting on collect calls, telegrams, or property retrieval unless legally permissible.

Guidelines for Contact Hours

Debt collectors cannot contact you before 8 AM or after 9 PM unless you permit. If you notify them that work calls are prohibited, they must respect this request.

Disputing the Debt

Your rights include:

- Receiving a validation notice within five days of contact, specifying the debt amount, creditor name, and steps if you dispute.

- Disputing the debt in writing within 30 days, halting collection activities until Dynamic Recovery Solutions verifies the debt.

When dealing with debt collectors; Dynamic Recovery Solutions

Requesting written communication is advisable to maintain a documented record, useful in case of disputes.

Dynamic Recovery Solutions must cease communication upon receiving a letter requesting cessation, except for legal notifications.

Stopping Communication

If you request Dynamic Recovery Solutions to stop contacting you, they must comply, except for legal notifications or termination updates.

Legal Representation

When represented by an attorney, Dynamic Recovery Solutions must direct communication to your attorney instead of contacting you directly.

Taking Legal Action Against Violations

In case of FDCPA violations, you have the right to:

- File a lawsuit against Dynamic Recovery Solutions within one year of the violation.

- Seek compensation for damages, court costs, and attorney fees.

- Report issues to the state’s Attorney General’s office and the FTC.

- States may have additional laws governing debt collection practices, and your Attorney General’s office can clarify your rights.

The FDCPA safeguards consumers from harassment and unfair practices. Understanding your rights is crucial in handling collection activities. Keep detailed records and adhere to specified time limits.

If feeling overwhelmed, seek guidance from a consumer rights attorney or credit counseling service to empower yourself with knowledge and take control of your situation.

FDCPA Protections

Dynamic Recovery Solutions must comply with FDCPA regulations, including:

- Avoid contacting you before 8 AM or after 9 PM.

- Refrain from calling your workplace if such calls are prohibited.

- Avoid harassment, oppression, or abuse in communication.

- Provide accurate information about the amount owed.

- Refrain from making false statements or threats.

By leveraging FDCPA protections, you ensure Dynamic Recovery Solutions follows regulations while attempting to collect debts.

Why Verify Your Debt with Dynamic Recovery Solutions?

When Dynamic Recovery Solutions contacts you about a debt, ensuring its validity and the collection agency’s authority is crucial.

Although not mandated by the Fair Debt Collection Practices Act (FDCPA), verifying your debt is a responsible step in managing financial obligations.

This examination delves into the reasons for debt verification and equips you with knowledge and tools to handle these situations effectively.

Understanding Debt Verification

Debt verification is a procedure empowering you to confirm the authenticity of the debt claimed by Dynamic Recovery Solutions, safeguarding against fraudulent collection attempts.

Reasons to Verify Your Debt

Accuracy:

Verify your debt to ensure the demanded amount is accurate, avoiding discrepancies due to mistakes, identity theft, or debt transfers.

Ownership:

Confirm the debt truly belongs to you, preventing communication about a debt resulting from mistaken identity or errors in records.

Statute of Limitations:

Determine if the debt falls within the legally enforceable time limit, protecting against attempts to collect expired debts.

Legitimacy:

Guard against attempts to collect debts already paid or resolved by verifying the debt’s legitimacy.

The Process of Debt Verification

-

Contact and Requesting Verification:

- Promptly request a “debt validation letter” from Dynamic Recovery Solutions upon contact.

- Submit the request in writing within 30 days, using certified mail for proof of receipt.

-

Include in Your Verification Request:

- Your name and address.

- A statement clearly indicating your intention to seek verification while disputing the debt.

-

Request Information from Dynamic Recovery Solutions:

- Ask for details about the debt amount, the creditor’s name, and how they determined the debt is yours.

-

Response from Dynamic Recovery Solutions:

- The collection activities must cease until they provide verification.

- If unable to verify, it’s illegal to continue collecting or reporting to credit bureaus.

-

Review the Verification:

- Ensure it includes the debt amount, history, information about the creditor, and evidence of the agency’s legitimate rights to collect.

-

Addressing Inaccuracies:

- If inaccuracies are found, file a dispute with credit bureaus, providing communication copies as evidence.

-

Valid Debt Resolution:

- If the debt is valid, proceed with resolving it, potentially through a payment plan or negotiation.

By following these steps, you empower yourself to navigate debt verification with Dynamic Recovery Solutions effectively.

Here are some tips to help you navigate through the process of debt verification;

Protecting Your Rights and Credit

Keeping detailed records is essential for effective communication and dispute resolution. Ensure to document all interactions, including representatives’ names and dates, to have a comprehensive record.

Awareness of Your Rights Under the FDCPA

Understanding your rights under the Fair Debt Collection Practices Act (FDCPA) is crucial. It empowers you to identify any violations committed by collection agencies like Dynamic Recovery Solutions.

Caution in Sharing Information

Be cautious about sharing sensitive information. Only provide details like social security numbers or financial account information after verifying the debt’s validity.

Acting Promptly for Verification

Act promptly, especially if within the 30-day window for requesting debt verification from Dynamic Recovery Solutions. Verification involves requesting a debt validation letter, which should include:

- The amount owed.

- The name of the creditor.

- A statement assuming validity if not disputed within 30 days.

- A commitment to provide verification upon dispute.

Disputing Incorrect Debts

If you believe the debt is incorrect, outdated, or doesn’t belong to you, dispute it. Dynamic Recovery Solutions must remove it from your credit report if unable to verify.

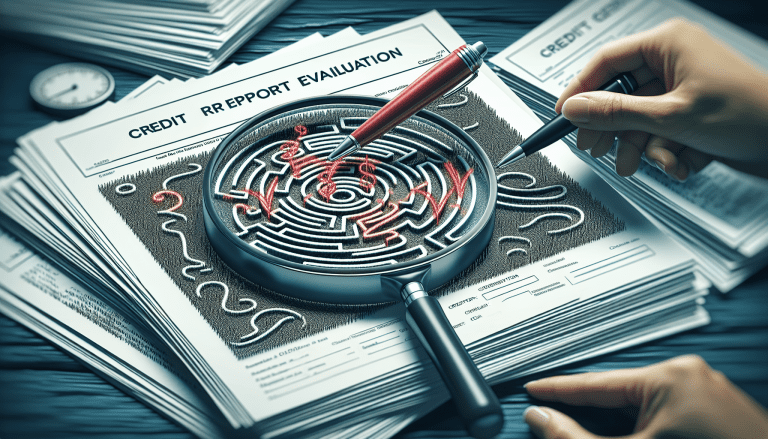

Validating a Debt and Checking for Errors

Validating a debt involves checking for inaccuracies. This step is crucial for legally challenging the accuracy of information provided by Dynamic Recovery Solutions. Checking for errors is vital for:

-

Protecting Your Credit Score:

- Errors in debt collection can harm your credit score. Ensure correct information to prevent unwarranted damage.

-

Preventing Wrongful Collections:

- Avoid collections for debts that are paid, inaccurately reported, or not yours due to mistaken identity or fraud.

-

Legal Compliance:

- Debt collectors must prove the debt’s validity and correct amount. Checking for errors ensures legal compliance.

-

Financial Accuracy:

- Ensure the amount you pay is correct if you decide to settle the debt.

Steps in Checking for Errors

-

Request a Debt Validation Letter:

- Ask Dynamic Recovery Solutions for a debt validation letter upon contact.

-

Review the Details Thoroughly:

- Scrutinize the validation information for accuracy.

-

Compare with Your Records:

- Cross-check the collector’s information with your financial records.

-

Identify Inconsistencies or Errors:

- Look for incorrect amounts, unrecognized debts, late listings, or duplicate entries.

-

Dispute Any Inaccuracies:

- Draft a dispute letter, clearly identifying each inaccuracy.

-

Follow-up:

- Ensure credit bureaus investigate disputes within the 30-day period.

Documentation to Gather

- Personal financial records.

- Credit reports from all three bureaus.

- Previous correspondence with creditors or debt collectors.

Writing the Dispute Letter to Dynamic Recovery Solutions

A well-constructed dispute letter should include:

- Personal information.

- A clear statement of disputing the debt.

- Detailed explanations backed with evidence.

- A request for correction or removal.

- A deadline for the agency to respond.

Legal Recourse against Dynamic Recovery Solutions

If errors persist or the debt collector fails to validate the debt, you may have grounds for legal action under the FDCPA. File a complaint with the Consumer Financial Protection Bureau (CFPB) or seek legal counsel.

Why Errors Can Occur

Errors in debt validation can happen due to:

- Sale and transfer of debt.

- Human error in data entry.

- Outdated information.

- Identity theft.

Checking for errors during the debt validation process is an essential right and responsibility. By carefully examining the debt collector’s claims and comparing them with your records, you can protect yourself from potential errors that could harm your financial standing. Always maintain good records and act quickly upon receiving a debt validation letter. If uncertain, consult with a consumer rights attorney or a financial advisor to navigate the process effectively. Ensuring the accuracy of debt is crucial for your financial well-being.

Even if the debt is valid, there can be errors in how it’s reported. Scrutinize your credit report for any discrepancies related to the Dynamic Recovery Solutions entry. Common errors include:

- Incorrect amounts.

- The same debt is listed multiple times.

- Debt that is past the statute of limitations for your state.

- Debt that is not yours due to identity theft or mistaken identity.

If you find any errors, file a dispute with the credit bureaus. They are required to investigate and remove any inaccuracies they find.

Negotiate a Pay-for-Delete Agreement

If you’ve determined that the debt is valid and Dynamic Recovery Solutions can verify it, consider exploring negotiation options or alternative avenues for resolution.

Negotiate a Pay-for-Delete Agreement

One option is negotiating a pay-for-delete agreement. In this arrangement, you agree to pay the debt, and Dynamic Recovery Solutions agrees to remove the entry from your credit report. While not all debt collectors may agree, some might consider it if it ensures payment.

- Ensure all negotiations are documented in writing.

- Do not make any payments without a written agreement stating the removal upon payment.

- Keep detailed records of payments and the corresponding agreement.

Goodwill Deletion Request

Another approach is requesting a goodwill deletion. If you’ve paid the debt, write a letter to Dynamic Recovery Solutions explaining circumstances leading to the debt. Express your commitment to improving your credit. Some collectors may grant a goodwill deletion if the debt is settled, and you’ve demonstrated responsible payment behavior.

File a Complaint

If Dynamic Recovery Solutions violates the Fair Debt Collection Practices Act (FDCPA), file a complaint with relevant authorities such as the Consumer Financial Protection Bureau (CFPB), the Federal Trade Commission (FTC), or your state’s Attorney General. If found in violation, you may be entitled to damages, and the negative entry could be removed.

Seek Professional Assistance

If the process becomes overwhelming or Dynamic Recovery Solutions is unresponsive, consider working with a credit repair agency or a lawyer specializing in debt collection cases. Thoroughly research service providers to choose a reputable and effective option.

Stay Informed about Your Credit

Managing Your Credit Score involves several key factors:

- Payment History: Pay your bills on time to avoid negative impacts on your credit score.

- Credit Utilization Ratio: Keep credit utilization below 30% for a positive effect on your credit score.

- Length of Credit History: Maintain older accounts to show a longer credit history.

- Credit Mix: Have a variety of credit types to positively influence your score.

Stay on top of your credit by regularly checking for inaccuracies, making timely payments, and being cautious about new accounts. These positive habits can improve your credit score over time and mitigate the impact of collection accounts.

Dealing with Dynamic Recovery Solutions on your credit report can be stressful, but various approaches, including debt negotiation, goodwill requests, and filing complaints, can help address the situation. Approach the process methodically, understanding your rights under the FDCPA. If uncertain or facing resistance, seek professional assistance. Remember, repairing your credit involves not just removing negative entries but also building positive credit habits for the future.

Table of Contents

Get Your Credit Repaired With credit-repair.com

Google Review:

or

WHY CHOOSE US

We also would counsel you on real, legal, and ethical credit repair for clients rebuilding their life and credit ratings after hardship. Achieving financial freedom is the ultimate dream allowing you to live the life you want to enjoy. Get the help of a professional credit repair company by contacting us.

Our credit restoration services are tailored to your unique situation, and we never make you pay for anything you don’t need. When you sign up for either our Essentials or Essentials Plus packages, you can rest assured that you’ll be receiving the bare minimum of care necessary for your specific situation. You can opt for additional customization options to further tailor our offerings to your specifications. In this manner, you won’t overpay for perks you don’t use. This is the essence of adaptability.