National Credit Adjusters, LLC (NCA) is a well-known debt collection agency based in the United States.

Their primary objective is to help businesses in various sectors, including retail, healthcare, and financial services, manage and recover delinquent accounts receivable.

NCA plays a significant role in the financial services industry by efficiently handling businesses’ accounts receivable to enhance their cash flow.

To carry out their operations, NCA purchases debt portfolios from creditors or acts as a service provider on their behalf, commonly known as loan adjustment.

Once they acquire these debts, NCA implements a range of strategies to recover the owed amounts from debtors. Their methods may involve making phone calls, sending letters, and occasionally resorting to legal action.

It’s important to note that NCA’s practices adhere to the guidelines outlined by the Fair Debt Collection Practices Act (FDCPA), a federal law governing debt collectors’ interactions with debtors.

It becomes crucial to understand how National Credit Adjusters operates, especially if you find yourself in a situation involving them.

Being aware of their practices, credit management strategies, and the laws that regulate them can greatly assist you in navigating the often complex process of debt recovery.

As a debtor, it is vital to recognize and understand your rights. This knowledge forms the initial step in effectively dealing with a debt collection agency, such as NCA.

Who is National Credit Adjusters, LLC?

National Credit Adjusters, LLC, is based in Hutchinson, Kansas and is well-regarded in the debt collection industry.

Since its establishment in 2001, NCA has grown to become one of the leading agencies in debt recovery and credit management.

Their primary goal is to provide top-notch recovery and credit management services to clients, ultimately enhancing their financial performance and cash flow.

NCA is proud to employ a team of experienced professionals who specialize in debt recovery and credit management.

With their utilization of advanced technology and proven strategies, NCA excels in recovering overdue debts and assisting businesses in managing their credit reporting.

By having a grasp of credit management, debt recovery, and credit reporting, individuals can navigate their financial journey more effectively.

Is National Credit Adjusters a Real Company?

Yes, National Credit Adjusters is a legit and licensed debt collection company. They’ve been around 2001 and have made a noteworthy mark in the debt recovery and credit management field.

They are registered in multiple states and strictly adhere to all federal and state laws regarding debt collection practices, credit reporting, and loan adjustment.

However, like any other business, NCA has faced its fair share of complaints and legal issues.

Despite these challenges, NCA continues to operate and offer credit management and debt recovery services to various financial institutions.

If you ever find yourself contacted by a debt collection agency like National Credit Adjusters, it’s crucial to confirm their legitimacy.

You can easily do this by requesting written confirmation of the debt or getting in touch with your original creditor.

Remember, as a debtor, you have rights, and agencies like NCA are obligated to follow specific laws when it comes to their credit management and debt recovery practices.

Why is National Credit Adjusters Calling You?

National Credit Adjusters (NCA) plays a crucial role in the financial services sector, focusing on debt collection and credit management.

If NCA is giving you a call, it’s probably because you owe some money that they’re trying to collect.

This debt might be connected to various financial institutions and could be from unpaid credit card bills, medical bills, or other forms of consumer debt.

NCA buys these debts from the original creditor, usually at a reduced amount, and then makes an effort to collect the full sum from the person who owes it.

Dealing with debt recovery can be overwhelming and stressful. But it’s important to remember that NCA is simply doing its part in the credit management process.

Their main objective is to recover as much of the outstanding debt as possible. They employ different tactics, like multiple phone calls, letters, and sometimes even legal action.

Keep in mind, the Fair Debt Collection Practices Act (FDCPA) exists to protect consumers from any abusive, unfair, or deceitful practices by debt collectors.

If you believe NCA is violating your rights, it’s both your right and responsibility to report them to the Consumer Financial Protection Bureau (CFPB).

Does National Credit Adjusters (NCA) Sue?

Yes, you may be wondering whether National Credit Adjusters can actually sue debtors in certain situations.

Well, the answer is yes, they can. In cases where the debt amount is significant and the debtor is unresponsive or unwilling to work out a payment arrangement, NCA might decide to take the matter to court.

Now, it’s worth noting that going to court is usually a last resort for NCA, mainly because it can be quite expensive and time-consuming.

When NCA decides to file a lawsuit, their objective is to obtain a judgment against the debtor. What does that mean exactly?

A judgment is a court order that legally compels the debtor to repay the debt. If the court grants the judgment, NCA might have the ability to garnish the debtor’s wages, seize their bank accounts, or even put a lien on their property.

However, it’s important to keep in mind that not every case ends up in court.

In fact, many debtors are able to come to an agreement or set up a payment plan with NCA to avoid any legal action.

If you find yourself facing a lawsuit from NCA, it’s advisable to seek legal advice to fully understand your rights and explore your options.

Remember, it’s always best to be proactive and informed when dealing with such situations.

Navigating Debt Resolution with NCA

Dealing with a collection agency like National Credit Adjusters can feel overwhelming. But don’t worry, it’s important to approach the situation calmly and know your rights and choices.

First things first – verify the debt. According to the Fair Debt Collection Practices Act, you have the right to ask NCA to validate the debt.

They must show evidence that the debt is truly yours and that they have the authority to collect it.

If they confirm the debt, it’s time to consider your financial situation and figure out what you can realistically afford to pay. Take a moment to reflect on that.

Once you have a clear idea, reach out to NCA and talk to them about the possibility of setting up a payment plan or agreeing on a settlement.

Keep in mind that NCA is interested in recovering as much of the debt as possible, so they are often open to negotiation.

Now, if you’re unable to meet the payment requirements or if you genuinely believe the debt is not yours, seeking guidance from a consumer rights attorney or a debt resolution specialist may be a good idea.

They can offer valuable assistance throughout the process and help you understand the available options.

Perhaps you can dispute the debt altogether, settle for a lesser amount, or, in extreme cases, consider filing for bankruptcy.

Dealing with collection agencies can be intimidating, but with the right knowledge and approach, you can handle it appropriately.

Financial Literacy Resources

Financial literacy is a really important skill when it comes to handling and avoiding situations like the one you might be dealing with involving National Credit Adjusters.

Luckily, there are plenty of resources out there to help you wrap your head around your finances and make smart choices. The Federal Trade Commission (FTC) is a great place to start.

They have a ton of information on things like credit, debt, and how to deal with debt collectors.

The Consumer Financial Protection Bureau is another awesome resource that can help you navigate the debt collection process.

On top of these government services, there are also nonprofits that offer free or low-cost financial education and counseling.

knowledge is power. The more you know about your finances and your rights as a consumer, the better armed you’ll be to work your way through the debt collection process and find a solution.

Making a Payment to National Credit Adjusters

When it comes to making a payment to National Credit Adjusters (NCA), a major player in the financial services sector, they have made sure to simplify the process to cater to the different preferences and capabilities of their clients.

The most popular and convenient method is through their user-friendly online platform.

NCA has developed an efficient website where clients can easily log into their accounts, check their outstanding balances, and make payments.

To ensure the privacy of personal and financial information, this credit management system is equipped with advanced encryption technologies.

The online payment portal offers a variety of payment options to suit everyone’s needs. Clients can choose to pay using their credit cards, debit cards, or even through direct bank transfers.

However, for those who prefer more traditional methods, NCA also accepts payments through checks and money orders sent by mail. Although this method may take a little longer compared to online payments, it provides a physical record of payment.

When using this option, clients are advised to include their account number and personal details to facilitate the payment processing.

Additionally, it’s recommended to send payments via certified mail for extra security and to ensure that the payment safely reaches NCA.

For added convenience, clients also have the option to make payments over the phone.

NCA has a dedicated payment hotline staffed by a team of professional customer service representatives who are well-trained in handling payments and answering any queries regarding accounts.

Payments made via phone are processed immediately, providing clients with instant confirmation of their payment.

Services Offered by National Credit Adjusters

National Credit Adjusters specializes in a range of services geared towards debt recovery and credit management.

Their primary focus lies debt collection, as they collaborate with various financial institutions like banks, credit card companies, and healthcare providers to retrieve outstanding debts.

To ensure maximum recovery of these owed amounts, NCA employs a blend of traditional and modern debt collection strategies, including direct mail, phone calls, digital communications.

In addition to debt collection, NCA offers another noteworthy service known as debt buying. This entails the purchase of debt portfolios from creditors at a fraction of their face value.

Upon acquiring the debt, NCA assumes responsibility for the collection process, aiming to recuperate the complete debt amount from the debtor.

This service proves to be highly advantageous for creditors looking to write off uncollected debts and enhance their credit reporting.

Furthermore, NCA provides account management services. By closely collaborating with creditors, they offer regular updates on the status of each account within their debt portfolios.

This service empowers creditors to concentrate on their core business operations while entrusting the experts at NCA with the task of debt recovery and credit repair.

Reaching out to National Credit Adjusters’ Team

Reaching out to the National Credit Adjusters’ team is super easy.

You can simply get in touch with their customer service department, which is available over the phone during their operating hours.

These customer service pros are trained to handle all kinds of questions, like payment issues, account updates, and resolving disputes.

They’re all about being prompt and accurate when it comes to answering your queries.

If you prefer written communication, NCA has got you covered with an email contact.

This option works great for detailed inquiries or when you need to attach some supporting documents.

Don’t worry, they check their email regularly and usually get back to you within one business day.

Now, if you want that face-to-face interaction, NCA has a physical office where you can drop by.

The folks there are well-trained to assist with a variety of client issues and provide immediate help.

Just make sure to bring any relevant documents along to help speed up the resolution process.

But hey, if visiting the office isn’t possible for you, no problem at all! You can always send a letter to NCA’s postal address.

Sure, it takes a bit longer, but at least you’ll have a physical record of your communication.

National Credit Adjusters and Your Credit Report

National Credit Adjusters (NCA) is a well-known player in the financial services industry, specializing in debt collection and credit management.

When NCA appears on your credit report, it usually means that they have taken up a debt you owe, possibly due to late payments.

As a third-party debt collection agency, NCA acquires overdue debts from different creditors, becoming the new owners responsible for collecting the outstanding amount.

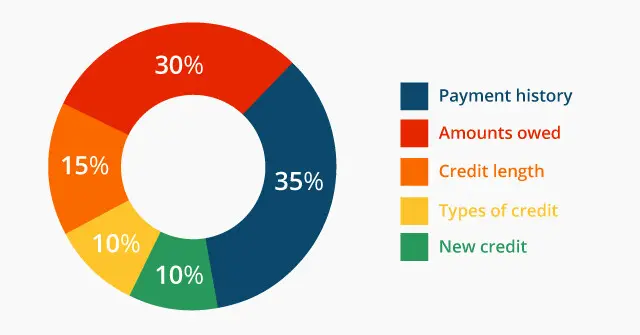

Having NCA listed on your credit report can significantly impact your credit score.

This aspect carries immense weight in credit reporting as it acts as a signal to potential lenders about past difficulties in managing your debts.

Consequently, it can make obtaining loans or credit more challenging, highlighting the importance of credit repair.

Addressing this matter promptly is crucial to minimize potential harm to your credit score. The Fair Credit Reporting Act (FCRA) governs the duration NCA can be present on your credit report.

Generally, most negative information, including collections, remains on your report for seven years.

However, if NCA persists on your credit report for a debt older than seven years, you might have grounds to contest its presence.

National Credit Adjusters on Your Credit Report: What Does it Mean?

If you see National Credit Adjusters listed on your credit report, it means they’ve taken over a debt that you owe.

This debt could be from various sources like credit card companies, medical institutions, or other lenders.

Once NCA takes charge, they’ll try to recover the full amount of your debt, often using aggressive methods. This entry on your credit report can cause your credit score to drop.

And a lower credit score can make it harder for you to get new credit, secure a loan, or even find a place to live. That’s why it’s crucial to take immediate action to repair your credit.

You can do this by negotiating with NCA, exploring debt settlement options, or seeking advice from a legal expert. Don’t forget, you have rights under the Fair Debt Collection Practices Act (FDCPA).

These rights include the ability to request validation of the debt and dispute any inaccurate information. If NCA fails to validate the debt, they’re obligated to remove it from your credit report.

Who Does National Credit Adjusters Collect For?

National Credit Adjusters specializes in debt collection services for a wide range of original creditors, including credit card companies, banks, retail stores, and other financial institutions.

They also work with healthcare providers, utility companies, and telecommunications firms. In essence, any business that offers credit or loans may engage NCA to recover delinquent debts.

Once NCA acquires the debt, they become the entity responsible for collecting it. Their collection efforts may involve making phone calls, sending letters, and reporting the debt to credit bureaus.

However, it’s important to note that despite the change in collection agency, your rights remain unaffected. If you have any doubts regarding a debt or suspect a mistake, it is crucial to request debt validation.

This valuable right, granted by the FDCPA, ensures that you are not burdened with paying a debt that is not rightfully yours.

In the event that NCA fails to validate the debt, they are legally obligated to discontinue their collection efforts and have the entry removed from your credit report.

How to Dispute Credit Report Errors Caused by NCA

When it comes to managing your credit, disputing any errors associated with National Credit Adjusters (NCA) is a crucial task that requires careful attention.

The first step is to obtain a comprehensive credit report from the three major credit reporting bureaus: Experian, Equifax, and TransUnion.

These reports play a vital role in maintaining a healthy credit score as they provide a detailed summary of your credit history and current standing.

Once you’ve identified any errors, the next step is to draft a dispute letter and send it to the credit reporting agencies.

In this letter, clearly outline the inaccuracies you’ve discovered, including any supporting documentation that backs up your claim.

To ensure that your letter is received and acknowledged, it’s recommended to send it via certified mail and request a return receipt.

This approach guarantees that your correspondence reaches its intended destination and provides you with proof of your communication, a crucial aspect of the credit repair process.

Once the credit reporting agencies receive your dispute, they are legally obligated to investigate it within a 30-day timeframe.

During this period, they will work with NCA to verify the information in question.

Keep in mind that this process can take some time, so it’s important to stay in touch with the credit bureaus to ensure that the necessary changes are.

Removing National Credit Adjusters From Your Credit Report

Removing National Credit Adjusters from your credit report can be achieved with the right approach. To start, you’ll need to request a debt validation from NCA.

This is a legal right granted by the Fair Debt Collection Practices Act (FDCPA).

If NCA can’t provide evidence that the debt is indeed yours, they are obligated to remove it from your credit report. This is a vital step in repairing your credit and settling your debt.

On the other hand, if NCA validates the debt but you still believe it isn’t yours or it has surpassed the statute of limitations, you have the option to dispute it with the credit bureaus.

This involves sending a dispute letter, similar to the one I mentioned earlier, explaining why the debt is invalid.

Should the credit bureaus agree with your dispute, they will take action to remove NCA from your credit report.

By following these steps and exercising your rights, you can work towards a cleaner credit report and a healthier financial future.

It’s important to take control of your credit and address any discrepancies that may negatively impact your financial well-being.

1 method for removing ERC from your credit

Everyone deserves a fair and accurate representation of their credit history.

Legal Aspects of Dealing with National Credit Adjusters

Understanding the legalities when it comes to dealing with National Credit Adjusters is really important.

There’s this thing called the Fair Debt Collection Practices Act (DCPA) that’s super crucial because it makes sure that consumers are protected from any shady stuff that debt collectors might try.

If NCA goes against any of the rules laid out in the FDCPA, you can totally take them to court. Now, another thing you should know about is the statute of limitations on debt.

It’s different for each state, but basically, once that time period is up, NCA can’t legally sue you for the debt anymore. However, they can still try to collect the money, so you gotta know your rights.

And listen, if NCA does end up suing you over a debt, you have the right to get yourself a lawyer.

And even if you can’t afford one, there might be some free legal help available to you. Just make sure to respond quickly if you do get sued so you can protect your rights.

Sending a Debt Validation Letter to NCA

Sending a debt validation letter to National Credit Adjusters is an important step when challenging a debt.

In this letter, make sure to ask NCA for proof that the debt actually belongs to you. Don’t forget to include your personal information, like your name, address, and the account number linked to the debt.

It’s a good idea to send the letter through certified mail with a return receipt. This way, you can be sure that NCA receives it and you’ll have proof of delivery.

NCA has a month to respond and provide validation for the debt. If they don’t meet this deadline, they must stop their collection efforts and remove the debt from your credit report.

It’s crucial to keep copies of all your correspondence with NCA and the credit bureaus. Having this documentation can be really helpful if you need to dispute the debt further or take legal action.

Understanding Your State’s Statute of Limitations

In the world of credit management, it’s crucial to grasp the concept of the statute of limitations. This plays a vital role the process of collecting debts, as it determines the legal timeframe within which financial institutions can take legal action for debt recovery.

The statute of limitations varies from state to state, and it starts either from the date of the last payment or from when the debt becomes delinquent.

Depending on the state and the type of debt, the statute of limitations can range from three to fifteen years. Keep in mind that credit card debt might have a shorter statute of limitations compared to student loans or mortgages.

It’s important for people involved in credit management to understand that the statute of limitations doesn’t wipe away the debt, but it does restrict the legal options for debt recovery.

There are certain actions that can reset the statute of limitations, such as making a payment or admitting to the debt in writing. These actions essentially restart the clock, potentially giving more time for debt recovery.

For this reason, it is absolutely essential to seek legal advice before taking any action regarding a debt that is close to or has already exceeded the statute of limitations.

Even after the statute of limitations has expired, debt collection efforts may still persist. Financial institutions can continue to contact the borrower, send letters, or even report the debt to credit reporting agencies.

However, once the statute of limitations has passed, they can no longer utilize the legal system for debt recovery.

Therefore, having knowledge of your state’s specific statute of limitations is a fundamental aspect of credit management and debt recovery.

Negotiating a Debt Settlement with NCA

When it comes to dealing with debt collection, negotiating a debt settlement with National Credit Adjusters (NCA) can be an effective credit management strategy.

A debt settlement involves agreeing to pay a portion of the total debt, which satisfies the debt completely once paid. This process requires careful planning and negotiation, often with the assistance of credit repair professionals.

Before starting negotiations with NCA, it’s important to verify the debt. According to the Fair Debt Collection Practices Act (FDCPA), debtors have the right to request a debt validation letter.

During debt settlement negotiations, it is recommended to start with a lower offer to allow room for further negotiation.

It’s worth noting that debt settlement can have a negative impact on your credit score, as it often involves late or missed payments.

However, it can also provide relief from debt collection efforts and potentially save money in the long term.

It’s crucial to carefully consider these factors as part of your credit management and credit repair journey.

What Legal Actions Can National Credit Adjusters Take Against You?

National Credit Adjusters (NCA), just like any other debt collection agency out there, has a range of actions at their disposal when it comes to recovering debt.

One of the most significant steps they can take is to file a lawsuit.

Success in the lawsuit could lead to judgments, like wage garnishment or property liens.

Debt collectors, including NCA, must adhere to the Fair Debt Collection Practices Act, prohibiting unfair tactics.

Additionally, it’s worth mentioning that NCA cannot sue for a debt that has surpassed the statute of limitations.

If they attempt such a move, the debtor can use the expired statute of limitations as a defense in court.

Nonetheless, it’s important for the debtor to furnish evidence showing that the statute of limitations has indeed expired.

Lastly, NCA is required to provide written notification of the debt and give the debtor an opportunity to challenge it. If the debtor believes the debt isn’t theirs or disagrees with the amount, they possess the right to contest it.

Being aware of these rights and having a grasp of the legal actions that debt collectors are permitted to take is essential in managing debt collection and safeguarding one’s financial well-being.

Reviews and Complaints About National Credit Adjusters

National Credit Adjusters (NCA), a prominent player in the realm of debt collection and credit management, has garnered a range of feedback from consumers.

Many complaints have been lodged against NCA, with a significant focus on their approach to communication.

Certain individuals have shared experiences of receiving constant and forceful phone calls from NCA, a worrisome practice that has raised eyebrows within the financial services industry.

Another prevalent grievance revolves around NCA’s debt recovery methods.

Instances have even surfaced where NCA purportedly furnished incorrect details to credit reporting agencies, leading to adverse consequences for consumers’ credit scores.

It’s important to note that NCA operates within the confines of the Fair Debt Collection Practices Act (FDCPA).

This legislation safeguards consumers’ rights and shields them from unfair debt collection practices.

In the event that individuals believe their rights under the FDCPA have been violated, they may have valid grounds to pursue legal action against NCA.

National Credit Adjusters: Complaints and Bad Reviews

National Credit Adjusters, despite serving a legitimate purpose in the financial services sector, has faced a significant number of complaints and negative reviews, particularly concerning their debt recovery practices.

Many of the lodged complaints highlight potential infractions of the Fair Debt Collection Practices Act (FDCPA).

This issue is particularly concerning, given the importance of credit management.

Furthermore, individuals have expressed their frustration regarding NCA’s communication strategies, citing relentless calls during inconvenient hours and the use of abusive or threatening language.

Sadly, instances of NCA providing inaccurate information to credit reporting agencies have also come to light.

If you find yourself in a situation where you believe your rights under the FDCPA have been violated by National Credit Adjusters, it is advisable to consider seeking legal counsel. Your rights and financial well-being deserve protection.

Happy Customers: Reviews About National Credit Adjusters

There’s been a lot of talk about National Credit Adjusters lately, and while some people have voiced their concerns, there are also those who have had positive experiences with them.

These satisfied customers have mentioned how professional and polite NCA was when they interacted with them. What stood out to them was the clear and concise information provided by the company regarding their debt and repayment options, showing NCA’s dedication to effective credit management.

Another point of praise is NCA’s willingness to work out reasonable repayment plans, which is a crucial aspect of successful debt settlement.

Customers appreciated that NCA understood their financial situation and offered flexibility when it came to repayment.

This kind of willingness to negotiate and cooperate is definitely a positive aspect of NCA’s operations.

It’s crucial for consumers dealing with NCA to know their rights under the Fair Debt Collection Practices Act (FDCPA) and seek legal advice if they believe those rights have been violated. Being aware and informed is the best way to navigate these situations.

In conclusion, National Credit Adjusters has received both positive and negative feedback.

While some customers have had good experiences with their professionalism and willingness to work out reasonable repayment plans, it’s essential to approach any dealings with them cautiously and be aware of your rights under the FDCPA.

How to Beat National Credit Adjusters in Court

Beating National Credit Adjusters (NCA), a major player in the debt collection and financial services sector, in court requires a strategic understanding of credit management.

In this process, the Fair Debt Collection Practices ActFDCPA) plays a crucial role. It ensures that debt recovery agencies don’t employ abusive or deceptive practices.

Knowing these regulations can help you build a solid defense against any unlawful actions by NCA.

A key part of successful credit management involves meticulous documentation.

Preparation is vital for successful credit repair. This means understanding the court process, being aware of your rights, and being ready to effectively present your case.

If possible, consider seeking the assistance of a lawyer who specializes in debt settlement cases.

They can provide valuable insights and help navigate the complexities of dealing with financial institutions and their debt recovery processes.

When in court, maintaining a professional demeanor is crucial.

Despite the potentially emotional stress that accompanies credit reporting and debt recovery, it’s important to stay calm and focused.

Stick to the facts, present your case logically, and remember that the judge’s decision is based on the evidence and the law.

Get Answers to Common Questions About NCA

NCA is a major player in the world of debt collection and credit management. A lot of people are curious about how NCA operates, particularly when it comes to credit reporting and debt recovery.

One common question that pops up is whether NCA has the power to sue you.

Well, the answer is yes, they can take legal action in order to collect a debt, but they have to follow the rules laid out by the FDCPA.

Another question people often ask is if’s possible to dispute a debt with NCA. The answer to that is also yes.

If you believe that the debt doesn’t belong to you or that the amount is incorrect, you have the right to dispute it.

This is an important step in the process of fixing your credit.

Like all debt recovery agencies, NCA has to verify the debt before they can proceed with any collection efforts. Another question that often comes up is whether NCA can garnish your wages.

The answer is yes, but only if they have obtained a court judgment against you. This is a common method used in debt settlement.

However, there are limits to how much can be garnished, and certain types of income are exempt from being garnished. Lastly, people often want to know how long NCA can keep pursuing a debt.

Table of Contents

Get Your Credit Repaired With credit-repair.com

Google Review:

or

WHY CHOOSE US

We also would counsel you on real, legal, and ethical credit repair for clients rebuilding their life and credit ratings after hardship. Achieving financial freedom is the ultimate dream allowing you to live the life you want to enjoy. Get the help of a professional credit repair company by contacting us.

Our credit restoration services are tailored to your unique situation, and we never make you pay for anything you don’t need. When you sign up for either our Essentials or Essentials Plus packages, you can rest assured that you’ll be receiving the bare minimum of care necessary for your specific situation. You can opt for additional customization options to further tailor our offerings to your specifications. In this manner, you won’t overpay for perks you don’t use. This is the essence of adaptability.