When it comes to managing your credit, two names that frequently pop up are FICO and Vantage Score. These credit scoring models are like the “heartbeats” of your credit health they determine your creditworthiness and ultimately decide if you’ll qualify for loans, credit cards, or even your dream home.

Let’s Analyze how these scores work and how they differ is crucial because they influence the financial decisions that shape our lives.

What is a Credit Score?

Before diving into the specifics of FICO vs. Vantage Score, let’s take a moment to understand what a credit score is.

A credit score is a three-digit number that reflects your creditworthiness. Think of it as a report card for your finances. The higher the score, the better you look to potential lenders.

If you’re applying for a credit card, a mortgage, or even renting an apartment, your credit score plays a huge role in whether you’re approved or denied. It’s one of those things you can’t ignore if you want to achieve financial stability.

The range of credit scores generally falls between 300 and 850, with higher scores indicating that you are a lower-risk borrower. For example, a score below 579 is considered poor, while a score of 800 or above is considered exceptional.

“As I reflect on my own experience, I remember being confused when I first saw the term “credit score.” I was applying for my first credit card, and I had no idea which score mattered. I quickly realized that there were different types of credit scores, this is where the concept of”

FICO Score and Vantage Score

The FICO Score was created by the Fair Isaac Corporation in 1989. It’s been around for a while and is by far the more widely used scoring model.

It’s used by 90% of top lenders to determine how risky a borrower might be. Think of FICO as the grandparent of credit scores, trustworthy, established, and relied on by nearly every institution.

Then, we have the Vantage Score, which was created in 2006 by the three major credit bureaus, Experian, Equifax, and TransUnion. Vantage Score is like the younger, fresher sibling of FICO, and while it’s not as widely used as FICO, it’s still a major player in the credit scoring world.

It was designed to give consumers a better sense of their credit status without the cost, which is why it’s popular on free credit monitoring websites like Credit Karma. See now video for FICO

But how do these two scoring models differ?

FICO vs. Vantage Score – A Comparison of Scoring Models

At first glance, FICO and Vantage Score may seem like two peas in the same pod because they both measure your creditworthiness, but there are subtle differences that can affect your score depending on which model is being used.

Let’s break them down.

| Criteria | FICO Score | Vantage Score |

| Developed By | Fair Isaac Corporation | Experian, Equifax, and TransUnion |

| Score Range | 300 – 850 | 300 – 850 |

| Calculation Timeframe | Takes into account the past 6 months | Can generate a score with 1 month of history |

| Late Payment Impact | Major impact, especially recent payments | A bit more lenient on recent payments |

| Credit Mix Consideration | Strongly consider

your mix of credit |

Also considers but with more weight on recent credit use |

| Impact of Collections | Paid collections under $100 are ignored | Paid collections are ignored completely |

Looking at the table, you can see that while both scores use a range of 300 to 850, their approaches to scoring can differ based on how they view certain factors.

For example, FICO is a bit stricter when it comes to late payments, even recent ones. This means if you’ve missed a payment in the last month or so, your FICO score could take a big hit.

Meanwhile, Vantage Score is a little more forgiving, and may not penalize you as much for recent missed payments.

Another difference is how quickly the score can be generated. FICO requires a longer credit history to calculate your score, usually at least 6 months of credit activity.

On the other hand, Vantage Score can calculate your credit score after just 1 month of history, which can be beneficial for someone who has recently started using credit.

Why Knowing Your Credit Score Matters?

So why should you care about understanding the difference between FICO and VantageScore?

For one, knowing which score your lender is using can make a world of difference when it comes to loan approval. A higher score can lead to lower interest rates, which means you’ll pay less money over time on credit cards, car loans, and mortgages.

I remember when I first checked my credit score and discovered it was quite a bit lower than I expected. It made sense later when I learned that the model I had used wasn’t the one my bank typically relied on. Even though my score on that site was decent, my actual FICO score was lower, and it did impact some of the loan offers I received. It’s a crucial lesson I’ve learned: always know which score your lender is using before applying for major credit.

How are FICO and Vantage Scores Calculated?

When you first start exploring FICO vs. Vantage Score, it can feel like you’re walking into a labyrinth of numbers and factors. But don’t worry, I’ve got your back!

Let’s break down how each scoring model calculates your credit score. Trust me, this is a game changer when it comes to understanding your financial picture-

Key Factors That Influence Your Credit Score

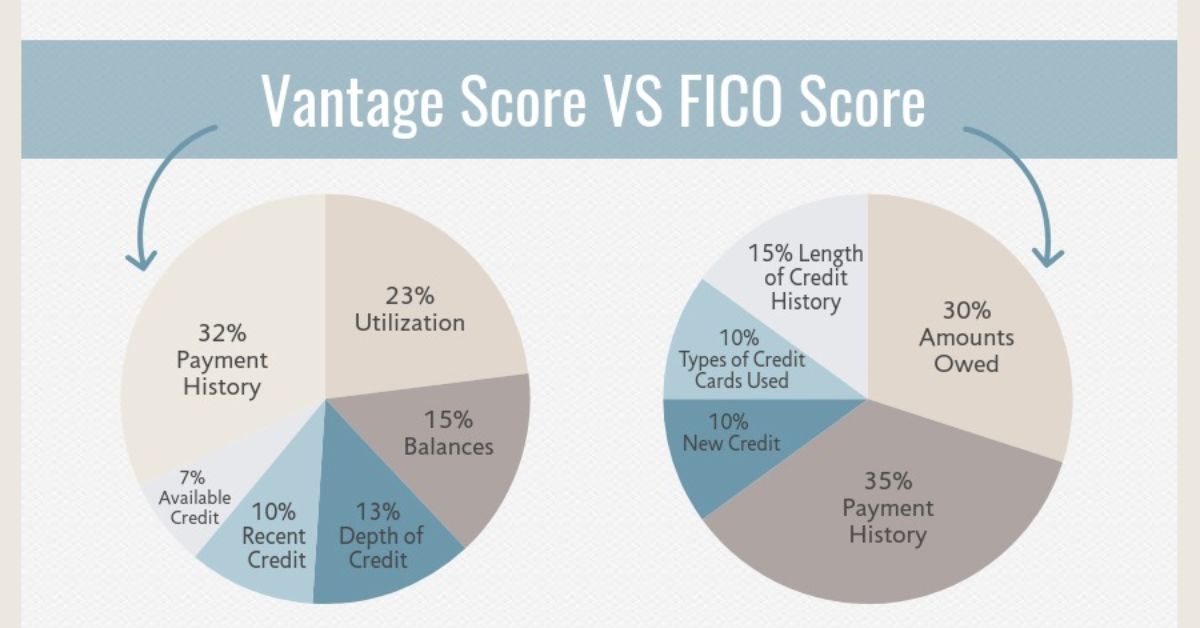

Both FICO and VantageScore use a set of similar factors to determine your creditworthiness. However, these factors are weighted differently by each scoring model. Understanding the key factors that affect your score can help you strategize and take control of your financial health.

Here’s a simple breakdown of the factors involved in both FICO and VantageScore:

| Factor | FICO | Vantage Score |

| Payment History | 35% | 40% |

| Credit Utilization | 30% | 20% |

| Length of Credit History | 15% | 20% |

| Types of Credit Used | 10% | 20% |

| New Credit Inquiries | 10% | 20% |

A. Payment History

If I’m being honest, this is the most important factor when it comes to your credit score. Both FICO and VantageScore place a heavy emphasis on whether you’ve paid your bills on time.

For FICO, payment history accounts for a whopping 35% of your score. Vantage Score is a little more generous with this factor, giving it 40% weight. This makes sense, right? Lenders want to know if you’re reliable when it comes to paying your bills, and the best way they can figure that out is by looking at your past behavior.

“Think of it this way: if your credit report were a movie, your payment history would be the plot twist. It’s the part that tells lenders whether they should cheer for you or be worried. If you’ve missed payments or have accounts in collections, you can bet that these will negatively impact your score.”

I remember when I missed a couple of payments on my first credit card. At the time, I didn’t think much of it, but when I checked my credit score later, I realized just how badly those late payments had affected me. If there’s one thing I’ve learned, it’s this: always, always pay your bills on time. Trust me on this one.

B. Credit Utilization

The next big factor is credit utilization, which refers to how much of your available credit you’re actually using. Imagine your credit card limit is a bucket. If you’re filling that bucket to the brim, you’re using a high percentage of your credit.

This signals to lenders that you might be relying too much on borrowed money, which can be a red flag.

For FICO, 30% of your score comes from credit utilization, while Vantage Score gives it 20% weight. So, even though both scoring models value this factor, FICO is a bit more sensitive to your credit usage.

A good rule of thumb is to keep your credit utilization below 30%. For instance, if your credit card limit is $1,000, try not to use more than $300. I’ve noticed that when I keep my balance low, my score tends to improve, without me even trying that hard.

C. Length of Credit History

The length of your credit history is another factor that plays a role in both FICO and Vantage Score calculations. FICO assigns 15% of your score to this factor, while Vantage Score gives it 20% weight. The longer your credit history, the more it shows that you’re experienced at managing credit, which is something lenders like to see.

It’s kind of like when you’re applying for a job, someone with more experience is generally seen as more reliable. Similarly, a longer credit history gives lenders more data on how you handle credit.

“For me, I’ve always kept my oldest credit card open (even if I don’t use it much). The reason? It’s been around for a long time, and it helps boost the length of my credit history. So, here’s a little pro tip: don’t close your old accounts, especially if they’re in good standing.”

D. Types of Credit Used

Both FICO and Vantage Score look at the types of credit accounts you have. Do you only have credit cards? Or do you have a mix of credit cards, car loans, and a mortgage? A diverse mix of credit accounts looks more favorable to lenders because it shows you can manage different types of debt.

For FICO, 10% of your score comes from this factor, and Vantage Score gives it a slightly higher 20%. A mix of credit accounts is especially important when it comes to your FICO score. So, if you’re only relying on one type of credit, like credit cards, it might be time to consider diversifying.

I remember getting my first auto loan and feeling proud of my “diversified” credit portfolio. Not only did it help my credit mix, but it also added some positive history to my credit report.

E. New Credit Inquiries

Lastly, both FICO and VantageScore consider new credit inquiries, this includes hard pulls from lenders when you apply for new credit. Each inquiry can drop your score a little, but don’t worry, a few inquiries here and there are not the end of the world.

FICO assigns 10% of your score to new credit inquiries, while VantageScore places more importance on it, giving it 20%. The reasoning behind this is simple: lenders want to know if you’re trying to open too many new credit accounts in a short period of time. It could indicate that you’re struggling financially.

I’ve learned that when you’re not applying for credit all the time, your score naturally benefits. Over the years, I’ve been mindful of how often I apply for new credit, and it’s helped me maintain a healthier score.

How FICO and Vantage Score Differ in Weighting Factors?

When you look at the factors above, it’s clear that both FICO and Vantage Score consider similar aspects of your credit behavior, but they weigh them differently. Here’s a quick comparison:

| Factor | FICO | Vantage Score |

| Payment History | 35% | 40% |

| Credit Utilization | 30% | 20% |

| Length of Credit History | 15% | 20% |

| Types of Credit Used | 10% | 20% |

| New Credit Inquiries | 10% | 20% |

As you can see, Vantage Score tends to place more emphasis on the length of credit history, types of credit used, and new credit inquiries. On the other hand, FICO puts more weight on payment history and credit utilization.

This could be why some people see a higher score with one model than the other, it all depends on which factors are more heavily weighted.

What This Means for You?

Understanding these nuances can help you make smarter financial decisions. For example, if you’re trying to boost your score for a specific purpose, like applying for a mortgage, you’ll want to focus on improving your payment history and credit utilization for FICO. But if you’re looking at your score on a site that uses Vantage Score, then you might want to focus more on length of credit history and new inquiries.

Now that we’ve covered the factors, you should have a better sense of how FICO vs. Vantage Score are calculated. But remember, knowing is half the battle. The real key to improving your credit score lies in being mindful of your credit habits and staying consistent.

How FICO and Vantage Score Differ in Terms of Credit Score Ranges?

Now that we’ve covered the factors that influence your credit score, let’s dive into how FICO vs. Vantage Score compare when it comes to credit score ranges. This is an important piece of the puzzle because understanding where you stand within these ranges can help you make better financial decisions.

It might seem like these two credit scoring models would use the same ranges, but actually, they don’t. FICO and Vantage Score use slightly different scales to determine your creditworthiness. This means that, while one model might give you a “good” score, the other might classify it as “fair.” Crazy, right?

FICO Score Range

The FICO score range typically falls between 300 and 850, and here’s a quick breakdown of what each range means:

| FICO Score Range | Category |

| 300 – 579 | Poor |

| 580 – 669 | Fair |

| 670 – 739 | Good |

| 740 – 799 | Very Good |

| 800 – 850 | Exceptional |

FICO is the more traditional of the two models, and it has been around since the 1950s. Because of its longevity, many lenders are more familiar with FICO scores and use them regularly in their decision-making process.

For example, when I was applying for a car loan, I remember my lender pulling my FICO score because it’s a widely accepted scoring model. My score was in the Good range, which I was pretty happy with. But, had they used the Vantage Score, my score might’ve been viewed differently based on the next section.

Vantage Score Range

In contrast, the Vantage Score range runs from 300 to 850 as well, but the model is a bit more flexible. Here’s the Vantage Score breakdown:

| Vantage Score Range | Category |

| 300 – 499 | Very Poor |

| 500 – 600 | Poor |

| 601 – 660 | Fair |

| 661 – 780 | Good |

| 781 – 850 | Excellent |

While the FICO score range has clearer delineations between each category, the Vantage Score range is a bit more generous when it comes to the “Good” and “Excellent” categories. It also has a larger gap between the “Fair” and “Poor” ranges compared to FICO.

One thing I found interesting is that Vantage Score is becoming more commonly used by credit bureaus and is now gaining traction among lenders as well. For example, if you check your score on Credit Karma, you’re actually getting your Vantage Score. It’s a bit of a different lens to look through, but it still gives you a general idea of where you stand.

How This Affects You: Real Life Example

Let me paint a picture for you. I once checked my Vantage Score on a popular credit website, and it showed a score of 705, which I thought was pretty good. But when I checked my FICO score through my credit card’s app, it was 680. That’s a significant difference!

Here’s where things get interesting: although both scores are in the “Good” range, my FICO score is a bit lower, so I might get a slightly higher interest rate if I apply for a loan that uses FICO. On the other hand, if I apply for something that uses Vantage Score, I might be offered a better deal since my score with them is higher.

What Does This Mean for You?

When you’re looking at your credit score, it’s important to remember that not all lenders use the same scoring model. Some will pull FICO, while others will pull Vantage Score. Depending on which model they use, your credit score could be slightly different.

That’s why it’s crucial to check both of your scores. Sure, it’s important to focus on improving your overall credit health, but being aware of the differences between FICO vs. Vantage Score can help you understand where you stand and better prepare for situations where you need credit.

Why Does the Score Range Differences Matter?

I know it can feel like I’m getting into the weeds here, but trust me, these score range differences can have a big impact on your life. Think about it: your credit score affects everything from the interest rate on your mortgage to the approval process for a credit card.

Even if both scores show you as being in the “Good” or “Fair” range, the specific category and score range they fall into can influence how lenders view you. It’s like how different restaurants may have different definitions of what “spicy” means, one place’s “spicy” could be another’s “mild.”

For me, understanding the range differences helped me manage expectations when applying for credit. It made me more aware of what I could get approved for, and also helped me focus on strategies for improving my scores in both models.

A Quick Recap of Score Differences

So, to quickly summarize:

- FICO ranges from 300 to 850, with a more traditional classification system.

- Vantage Score also ranges from 300 to 850, but it has a different breakdown that may make your score appear better or worse depending on which one you’re looking at.

Does One Score Hold More Weight Than the Other?

Now, you’re probably wondering, “Does it matter which score lenders use?” Well, the answer is: it depends.

For many years, FICO has been the industry standard, and most lenders still rely on it for major financial decisions like mortgages. However, Vantage Score is gaining popularity and is now being used by a growing number of lenders.

While FICO may still be the more widely accepted score, Vantage Score is catching up, especially in consumer-facing applications like credit card approvals or loan offers.

How This Affects Your Financial Decisions?

For me, once I understood how the two scores differ, I was able to navigate the credit world a little more confidently. I knew that some lenders might favor one score over the other, so I worked on improving both models. This meant making my payments on time, reducing credit card balances, and keeping an eye on how my credit activity would impact my scores.

It also helped me strategize better when applying for loans. I knew that if a lender was pulling FICO, I might want to make sure my score is in the Good to Very Good range, but if they were pulling Vantage Score, I could get away with a slightly lower score and still get a great deal.

In the end, having a strong credit score is all about consistency and making the right financial moves at the right time. By understanding the differences between FICO vs. Vantage Score, you can better prepare yourself for what lies ahead on your credit journey.

How Credit Score Models Differ in Terms of Scoring Factors?

When it comes to FICO vs. Vantage Score, the scoring factors used to calculate your credit score are one of the key elements that set them apart. If you’ve ever wondered why your score differs slightly depending on which model is used, it’s because these two models give different levels of importance to various aspects of your credit history.

I remember when I first started learning about credit scores, I felt a little lost. I thought it was all about making payments on time and paying off debts, but there’s so much more involved. Each credit model weighs different factors slightly differently, which means that FICO vs. Vantage Score might score you in different ways depending on how these factors are prioritized. Let’s dive into this and see how both models assess your creditworthiness.

FICO Scoring Model

Let’s start with the FICO scoring model, which is the more traditional one. FICO is used by most lenders and has been around for decades. In fact, FICO scores were created in the 1950s by a company called Fair Isaac Corporation. Over the years, FICO has remained a staple in the credit scoring world, and its model has been refined to capture a detailed snapshot of your credit habits.

The FICO scoring model uses five primary factors to determine your score. They are:

| Factor | Percentage of Score |

| Payment History | 35% |

| Amounts Owed | 30% |

| Length of Credit History | 15% |

| Types of Credit Used | 10% |

| New Credit | 10% |

I remember feeling a little overwhelmed when I first looked at this table. But then I realized, the most important factor here is payment history, it’s the biggest chunk of your score, making up 35%.

So if you’ve been on top of your bills and made payments on time, you’re in good shape. This factor considers whether you’ve missed any payments, how late they were, and whether you have any accounts in collections. So, on-time payments? Huge deal!

The second biggest factor is amounts owed (30%). This is where credit utilization comes in. Essentially, this is the total amount of credit you’ve used compared to your available credit.

If you’re constantly maxing out your cards, that’s going to hurt your score. On the flip side, if you’re keeping your credit utilization low (ideally under 30%), you’re doing yourself a favor.

Vantage Score Scoring Model

Now, let’s talk about Vantage Score, which was created by the three major credit bureaus, Equifax, Experian, and TransUnion. Vantage Score was introduced in 2006 as an alternative to FICO, and over time, it has gained popularity, especially in consumer-facing services.

Unlike FICO, which was traditionally used for big loans like mortgages, Vantage Score is often used for smaller loans, credit card approvals, and by certain financial institutions.

When you check your score on websites like Credit Karma, you’re most likely looking at your Vantage Score, so it’s helpful to understand how it works. Just like FICO, Vantage Score uses five factors to assess your creditworthiness, but they’re weighted a little differently:

| Factor | Percentage of Score |

| Payment History | 40% |

| Age and Type of Credit | 21% |

| Credit Utilization | 20% |

| Total Balances and Debt | 11% |

| Recent Credit Behavior | 5% |

As you can see, payment history is still the most important factor, but it makes up 40% of your score in Vantage Score, compared to 35% in FICO. This shows that Vantage Score places an even higher emphasis on your ability to pay bills on time.

For me, when I looked at this difference, I realized that Vantage Score might be a little more forgiving when it comes to certain elements of your credit history, but timely payments are still the golden rule.

One of the big differences between the two models is how they evaluate credit utilization and amounts owed. While FICO lumps both into one factor (amounts owed), Vantage Score separates them into two. Credit utilization, which makes up 20% of your Vantage Score, is directly related to how much of your available credit you’re using.

The less you use, the better. If you’re carrying a high balance month-to-month, this will hurt you in both models, but especially with Vantage Score because of the weight it gives to credit utilization.

In Vantage Score, another factor that stands out is the age and type of credit (21%). This factor looks at the diversity of your credit accounts and how long you’ve been using them. The longer you’ve had credit accounts and the more variety you have (credit cards, loans, etc.), the better your score.

This was something I overlooked when I first started thinking about my credit. I assumed that just having a credit card and using it was enough, but in reality, having a mix of credit accounts over time looks better to both scoring models.

How Does This All Impact You?

Now that we know how these two models work, you might be thinking, “Okay, but how does this actually affect me in real life?” Well, for starters, it can impact the kind of loan you qualify for, the interest rates you get, and even whether you get approved at all.

I remember when I was looking for a car loan, I didn’t realize that the lender was pulling a FICO score. I had a pretty decent Vantage Score, but my FICO score was a little lower because of my credit utilization. So when I got my loan offer, I was hit with a higher interest rate than I expected. If I had known how the FICO model worked, I would have focused a little more on reducing my credit utilization before applying.

It’s also important to know that some lenders might use both scores in different stages of the approval process. For instance, Credit Karma will show you your Vantage Score, but when you apply for a mortgage or car loan, the lender may pull a FICO score. That’s why it’s important to stay on top of both scores.

So, Which One Is Better for You?

At the end of the day, whether you’re focused on FICO vs. Vantage Score doesn’t matter as much as building good credit habits. Both models will reward you for on-time payments, keeping credit utilization low, and having a mix of credit accounts. But knowing the differences can help you navigate situations where one score might be more beneficial than the other.

What I’ve learned from my own experiences is that FICO is still the most commonly used score by lenders for major loans, while Vantage Score is great for monitoring your day-to-day credit status. By improving both scores, I’ve been able to open up more options for myself, from getting approved for lower interest rates to securing new credit cards.

FICO vs. Vantage Score isn’t as much of a competition as it is a complementary pair. Stay informed, keep building your credit, and you’ll be on the right path no matter which score is used!

Which Score Should You Use to Monitor Your Credit: FICO or Vantage Score?

At this point, after exploring the differences between FICO vs. Vantage Score, you might be wondering which one you should be focusing on to track your credit health. The answer isn’t exactly straightforward because both models have their own strengths, and understanding how they work can help you make more informed decisions.

I remember the first time I pulled my credit report and saw that my Vantage Score was higher than my FICO score. I was confused at first, why was there a difference? After digging deeper into both models, I learned that each scoring model uses slightly different criteria, which led to the variation in my scores. So, let’s break down why you might want to monitor both scores and what each one can offer you in different situations.

FICO Score: The Classic Choice for Big Loans

Let’s start with FICO, the gold standard in credit scoring. FICO is widely used by most lenders when you’re applying for things like mortgages, auto loans, or credit cards. If you’re aiming for big-ticket loans in the future, your FICO score is going to be what matters most.

Think of the FICO score as the big brother of credit scores. It’s the score that’s been around for decades and is trusted by the majority of lenders for major financial decisions. So, if you’re applying for a home mortgage or a large loan, FICO will almost certainly be the one that determines whether or not you get approved, and what your interest rate will look like.

In my experience, I’ve found that when you’re planning for big life events like buying a home or refinancing a car loan, it’s the FICO score that will really determine the outcome. For example, I once had a great Vantage Score, but when I applied for a mortgage, I was told that the lender would be pulling my FICO score. The difference? The FICO score was a bit lower, which led to a slightly higher interest rate than I expected. But it also gave me a heads-up that I needed to work on improving my credit utilization and make timely payments more consistently.

If you’re eyeing those big financial milestones, it’s always good to check your FICO score because it’s what lenders will focus on when you apply for loans that have serious financial consequences.

Vantage Score: Ideal for Everyday Monitoring

On the other hand, Vantage Score is a great tool for daily credit monitoring. In fact, services like Credit Karma provide you with your Vantage Score, making it a convenient way to keep track of your credit habits and see where you stand without necessarily applying for a loan. Many of us check our credit scores frequently, and Vantage Score is a reliable tool for this purpose.

The reason Vantage Score can be so valuable is that it’s more accessible for consumers. It’s commonly used by smaller lenders and is frequently pulled by credit card companies when they evaluate whether you should receive a credit card offer. So, if you’re monitoring your credit and keeping an eye on your spending habits, Vantage Score will give you a solid indication of where you stand without getting bogged down in the details of large loans.

I often find myself checking my Vantage Score when I’m thinking about applying for a new credit card or simply want to see how well I’m maintaining my credit. Since Vantage Score places a significant weight on payment history and credit utilization, it gives me a good sense of where I might need to improve before taking the next step.

Monitoring Both Scores: Why It’s a Good Idea

I can’t stress enough that it’s not a bad idea to monitor both scores. By checking both, you get a more well-rounded view of your credit health. You might find that one score is a little higher than the other, but you’ll have the information to improve in all areas.

For example, when I was planning to buy a car, I checked my Vantage Score to get a sense of my overall credit health. However, I also made sure to pull my FICO score because I knew that’s what the car dealer would use. It turned out my Vantage Score was in the good range, but my FICO score was slightly lower due to my credit utilization being a bit too high. This helped me focus on bringing that number down before making any major financial decisions.

When to Focus on FICO Score vs. Vantage Score

It can be difficult to know when to focus on one score over the other. But here’s a simple way to think about it:

- Focus on FICO if:

- You are preparing for large loans such as a mortgage or auto loan.

- You want to get a low interest rate for major loans.

- You’re dealing with lenders who commonly use FICO (e.g., banks, mortgage lenders).

- Focus on Vantage Score if:

- You are checking your credit status frequently or need to track short-term financial health.

- You want to keep tabs on your credit for smaller loans, like personal loans or credit cards.

- You want to monitor how well you’re managing credit utilization and payment history on an ongoing basis.

In my own experience, I’ve found that checking both scores has allowed me to be more proactive with my credit. For instance, I make sure to keep track of my Vantage Score through apps, while also working on improving my FICO score for long-term financial planning.

What Affects Both FICO and Vantage Score Differently?

Both scores are ultimately impacted by the same core factors, payment history, credit utilization, and credit length, but they weight them differently. This can be confusing at first, but once you understand how these factors are measured, it becomes clear.

Here’s a quick breakdown of how they differ:

| Scoring Model | Payment History | Credit Utilization | Length of Credit History | New Credit | Credit Mix |

| FICO | 35% | 30% | 15% | 10% | 10% |

| Vantage Score | 40% | 20% | 21% | 5% | 11% |

As you can see, Vantage Score puts a little more emphasis on your payment history (40%) than FICO does (35%). It also weighs credit mix more heavily (11% for Vantage vs. 10% for FICO). The biggest difference, however, is in the credit utilization section, where FICO weighs it heavier (30%) compared to Vantage Score’s 20%.

This difference explains why I noticed higher credit utilization was more of a problem when tracking my FICO score than when I checked my Vantage Score. So, knowing where each model places its weight can help you target specific areas for improvement.

The Bottom Line: Tracking Both Is Key

In the end, FICO vs. Vantage Score is a tale of two tools, both valuable in their own right. If you’re focusing on long-term goals, like buying a home, focus on FICO. But for day-to-day monitoring and small loans, Vantage Score is your friend.

By keeping an eye on both, you’re not only preparing for future goals, but you’re also staying informed about your credit health in real-time.

I’ve found that understanding both scores and how they differ has helped me make smarter financial decisions, and I’m confident it can do the same for you.

Frequently Asked Questions

Can I use my Vantage Score to get approved for a loan?

While FICO is more widely accepted, Vantage Score is used by some lenders, especially for smaller loans and credit cards. It’s always good to check which score a lender uses before applying.

Do both FICO and Vantage Score have the same scoring range?

Yes, both models use a similar range for their credit scores. The typical range is from 300 to 850, with higher scores indicating better creditworthiness.

How do late payments affect FICO vs. Vantage Score?

Late payments negatively affect both FICO and Vantage Score, but since Vantage Score puts more weight on payment history, the impact may be slightly greater for your Vantage Score in the short term.

Which credit score is used by car dealerships?

Car dealerships generally use the FICO score for evaluating auto loan applications, though some may also use Vantage Score.

Does FICO or Vantage Score care about credit inquiries?

Yes, both scoring models consider recent credit inquiries. However, FICO gives more weight to inquiries, especially when you’re applying for a mortgage or auto loan.

How can I raise my FICO score and Vantage Score?

To raise both scores, focus on paying bills on time, lowering your credit card balances, and diversifying your credit types. Keep credit utilization under 30% to see improvements.

Can I rely on Vantage Score when applying for credit cards?

Yes, Vantage Score is commonly used by credit card companies when evaluating applications, so checking your Vantage Score is a good way to gauge your eligibility.