Are you worried about mistakes in your credit report and wondering if you can delete or correct them?

Or are you struggling with a poor credit score and looking for ways to improve it? In this article, we will discuss how credit reporting works, what can be done to correct errors, and what steps you can take to improve your credit score.

So, let’s dive in. Can Credit Be Deleted or Corrected?

Understanding Credit Reporting

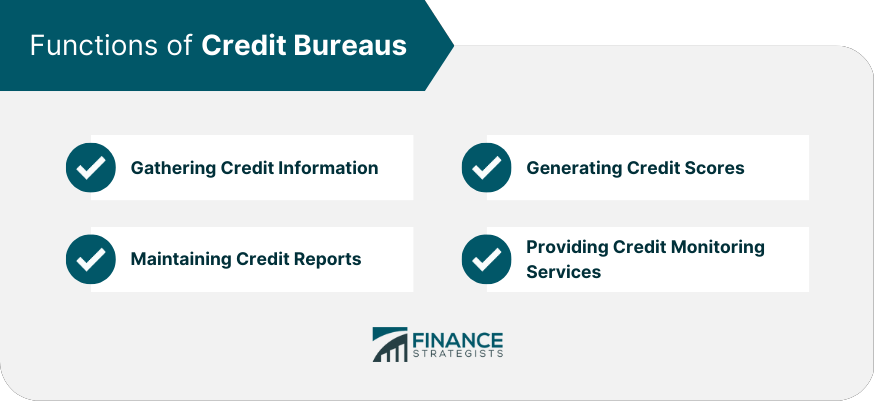

Credit reporting is the process of collecting and maintaining information about an individual’s credit history.

Credit reporting agencies, also known as credit bureaus, collect data from various sources, such as lenders, credit card companies, and public records, to create a credit report for each individual. Can Credit Be Deleted or Corrected?

A person’s credit report will detail their account balances, payment histories, debts, bankruptcies, and any other pertinent financial information.

This information is then used by lenders, employers, and other entities to evaluate an individual’s creditworthiness. Can Credit Be Deleted or Corrected?

Can Credit Be Deleted?

If there is an error in your credit report, such as an account that does not belong to you or a payment that was incorrectly reported as late, then you can request the credit reporting agency to correct the mistake. This process is known as a credit dispute and can be done online or by sending a letter to the credit bureau. Can Credit Be Deleted or Corrected?

The credit bureau then has 30 days to investigate your dispute and make the necessary corrections. If the dispute is valid, the credit bureau will update your credit report accordingly.

However, if the information in your credit report is accurate, then it cannot be deleted. This includes negative information such as missed payments, defaults, and bankruptcies, which can stay on your credit report for up to 10 years.

How to Improve Your Credit Score

Now that you know that credit cannot be deleted, let’s talk about how you can improve your credit score. The information in your credit report is used to determine your credit score, which is a three-digit number. A higher number indicates a more favorable credit history and can vary from 300 to 850.

In order to raise your credit rating, consider the following:

Pay Your Bills on Time

Payment history is the most important factor in your credit score, accounting for 35% of the total score. Don’t be late with any payments, whether they’re for a loan, a credit card, or the utilities. Can Credit Be Deleted or Corrected?

Keep Your Credit Utilization Low

The term “credit utilization” refers to the ratio of used credit to the total amount of available credit. Never use more than 30% of your available credit at once. For example, if you have a credit limit of $10,000, try to use no more than $3,000.

Don’t Close Your Credit Accounts

Closing a credit account can lower your credit score, especially if it was a long-standing account with a good payment history. Instead of closing an account, consider keeping it open and using it sparingly. Can Credit Be Deleted or Corrected?

Monitor Your Credit Report

If you check your credit report frequently, you can catch mistakes sooner and take action to fix them. Once a year, you may visit AnnualCreditReport.com to acquire a free copy of your credit report from each of the three major credit reporting agencies.Can Credit Be Deleted or Corrected?

Conclusion

In conclusion, credit cannot be deleted unless there is an error in your credit report. However, you can take steps to improve your credit score, such as paying your bills on time, keeping your credit utilization low, not closing your credit accounts, and monitoring your credit report regularly.

Remember, a good credit score is important for obtaining credit, securing loans, and even getting a job. So, take the necessary steps to improve your credit score and ensure that your credit report is accurate. By following the tips mentioned above and being responsible with your credit, you can build a strong credit history and improve your financial well-being.

FAQs

Can I delete negative information from my credit report?

No, negative information such as missed payments, defaults, and bankruptcies cannot be deleted if it is accurate. However, you can dispute errors in your credit report and have them corrected. Can Credit Be Deleted or Corrected?

When a credit report has bad information, how long does it stay there?

The length of time negative information remains on your credit report ranges from seven to ten years. For example, missed payments and defaults can stay on your credit report for 7 years, while bankruptcies can stay for up to 10 years.

Will disputing errors in my credit report improve my credit score?

If the dispute results in corrections to your credit report, then it can improve your credit score. However, the impact on your score may vary depending on the nature of the error and other factors in your credit history.

How often should I check my credit report?

You should check your credit report at least once a year to ensure that it is accurate and to identify any errors or fraudulent activity. Once a year, you may visit AnnualCreditReport.com to acquire a free copy of your credit report from each of the three major credit reporting agencies.

What is a good credit score?

A good credit score typically ranges from 670 to 739, while an excellent score is 740 or higher. However, credit scoring models may vary, and lenders may have different criteria for approving loans and credit applications.