Moving to the U.S. is an exciting opportunity, but for many immigrants, navigating the financial system can be overwhelming, especially when it comes to Credit Repair for Immigrants. A good credit score is essential for renting an apartment, getting a car loan, applying for...

Have you ever considered how a natural disaster could affect your credit? When a hurricane, wildfire, or flood strikes, most people focus on immediate survival and rebuilding. However, financial recovery is just as critical. Many disaster victims find themselves falling behind on payments, maxing out credit...

Is Cosigning 101 a loan a smart financial decision, or is it a risk that could harm your credit? Many people agree to cosign for a friend, family member, or spouse without fully understanding the financial responsibilities involved. While cosigning can help someone qualify for a...

Have you ever wondered if paying your rent and utility bills on time could actually help improve your credit score? Many people assume that credit scores only change when you use a credit card or take out a loan, but that’s not entirely true. While traditional credit scoring models primarily focus...

Which is better for improving your finances: credit counseling or credit repair? Many people assume these services are the same, but they serve very different purposes. Choosing the right one depends on whether you are struggling with debt management or need to fix errors on your credit...

Can medical debt hurt your credit score? Many people assume that unpaid medical bills only affect their relationship with healthcare providers, but medical debt can significantly impact credit health. In fact, medical collections have historically been one of the most common negative marks...

Have you ever looked at your credit report and felt completely lost? You are not alone. Many people struggle to understand credit report sections, codes, and what lenders see when they review their credit history. A credit report is more than just a list of accounts, it...

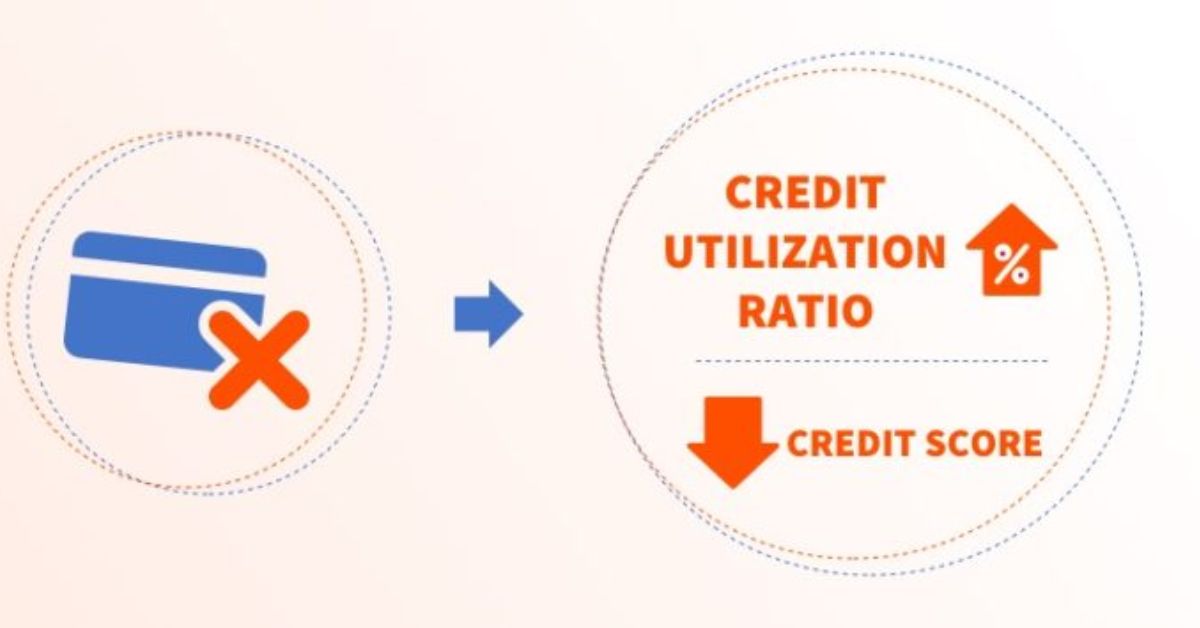

Your credit utilization ratio plays a pivotal role in determining your credit score. It represents the percentage of your total available credit that you are actively using. A high utilization ratio can signal to lenders that you may be overextended financially, which...

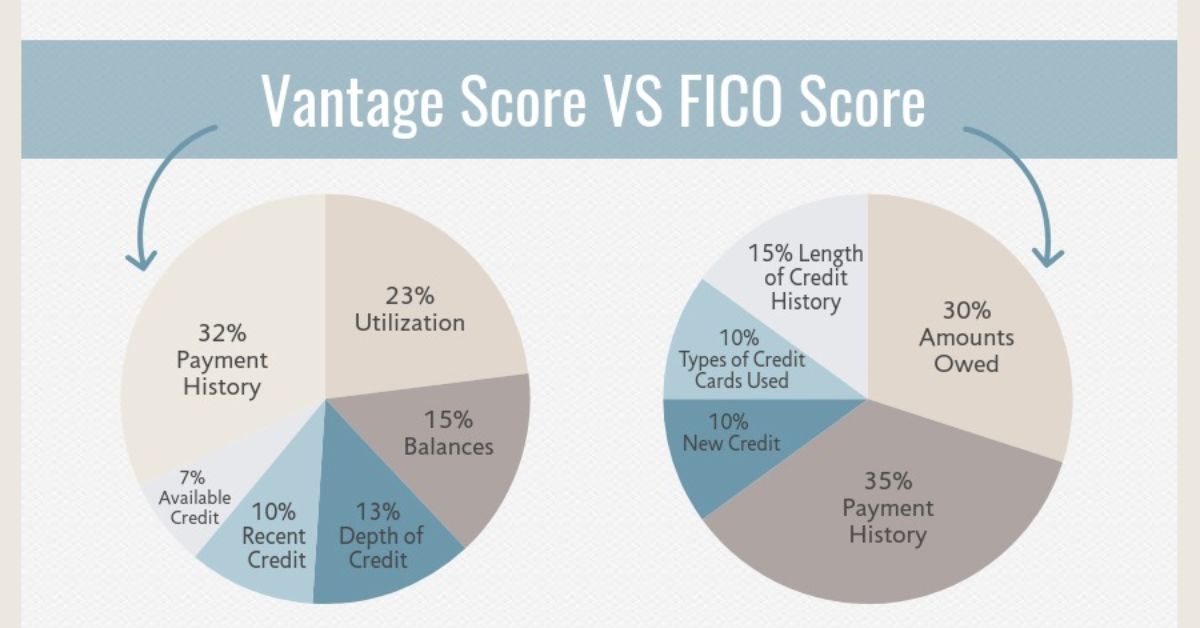

When it comes to managing your credit, two names that frequently pop up are FICO and Vantage Score. These credit scoring models are like the “heartbeats” of your credit health they determine your creditworthiness and ultimately decide if you’ll qualify for loans, credit cards, or even...

If you want to understand what credit scores are, then you have landed on the right page. However, with this technological advancement, the use of artificial intelligence (AI) in improving the credit scoring algorithm has become a reality. The application of AI to this very purpose is...