Your credit score plays a significant role in many aspects of your financial life, including your ability to secure loans, mortgages, and credit cards. But did you know that credit score can affect car insurance rates? Many insurance companies use credit-based insurance scores as...

Are you considering filing for Chapter 7 bankruptcy? The question then becomes how long it will take. While there is no one-size-fits-all answer, as every case is different, understanding the general timeline can help you prepare for what’s to come. In this article,...

Navigating the aftermath of an eviction involves understanding its enduring impact on your record. You’ve probably wondered how long does an eviction stay on record, and this article delves into the intricacies to provide clarity and empower individuals facing this challenge. The Seven-Year Mark:...

Filing for bankruptcy can provide individuals and businesses with a financial fresh start. However, before deciding to file, it is important to understand the costs involved. While the exact cost of filing for bankruptcy can vary depending on factors such as the complexity of the...

How Old Do You Have to Be to Get a Credit Card? The minimum age to apply for a credit card is 18 years old in most countries, including the United States. However, there are specific rules and requirements depending on your age and financial...

Bankruptcy can be a challenging and overwhelming experience, but it doesn’t mean you’re completely barred from accessing financial assistance in the future. If you need a personal loan after going through bankruptcy, there are still options available to you. This article will guide...

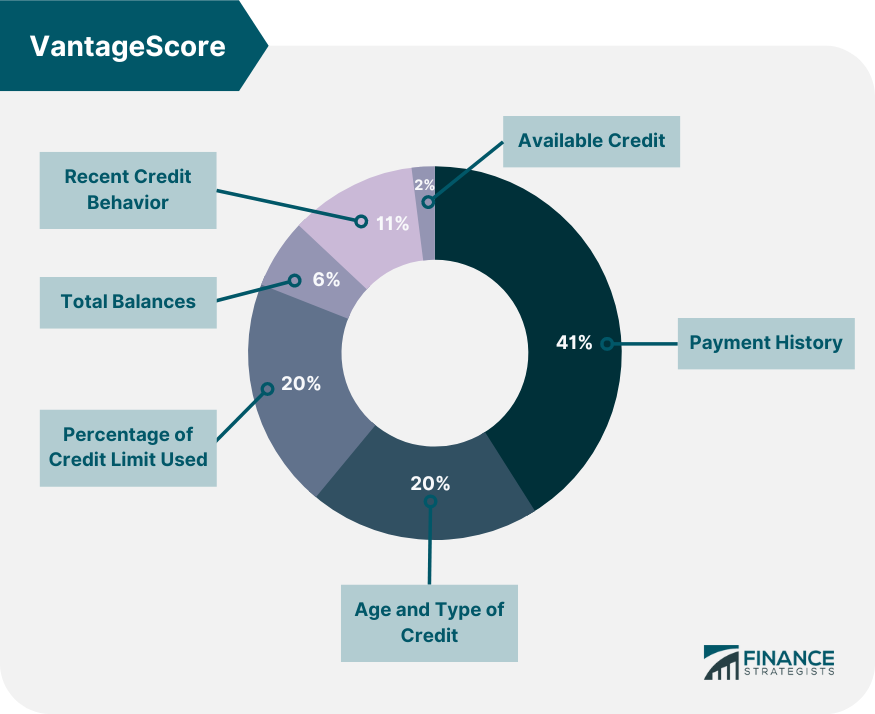

Your credit score plays a crucial role in your financial life. It determines your ability to access loans, secure favorable interest rates, and even rent an apartment. Despite its importance, many people find themselves with a less-than-ideal credit score. The good news is...

Maintaining a good credit score is crucial for financial success. Unfortunately, sometimes our credit reports contain inquiries that can negatively impact our scores. Whether these inquiries are legitimate or not, it’s important to address them and remove them from our credit reports. Understanding...

If you’re in the process of applying for a mortgage, you may be asked to write a letter of explanation to clarify certain aspects of your financial history. This can be a daunting task, but with the right guidance, it can be done...

Joint Credit Cards: What They Are and How They Work Joint credit cards can be a powerful financial tool for couples, family members, or even friends who want to share expenses and build credit together. These cards allow two individuals to co-own a...