What are credit scores statistics in 2026, and what can we learn about the financial health in the United States? This year’s credit trends reveal how borrowing, debt, and payment patterns are shaping lenders’ perceptions of consumers. Whether you’re looking to buy a...

Improving your credit score isn’t magic; it’s about being consistent, making wise financial decisions, and learning how credit works. Whether you’re thinking of buying a home, getting a loan, or just want more financial stability, learning how to improve your credit score could...

Why is PayPal 4029357733 showing on my credit card statement? Has 402-935-7733 ever raised its ugly head on your credit card statement? It is not one to worry about. This number registers through PayPal’s payment process. It’s a familiar sign of safe online payments. It’s a...

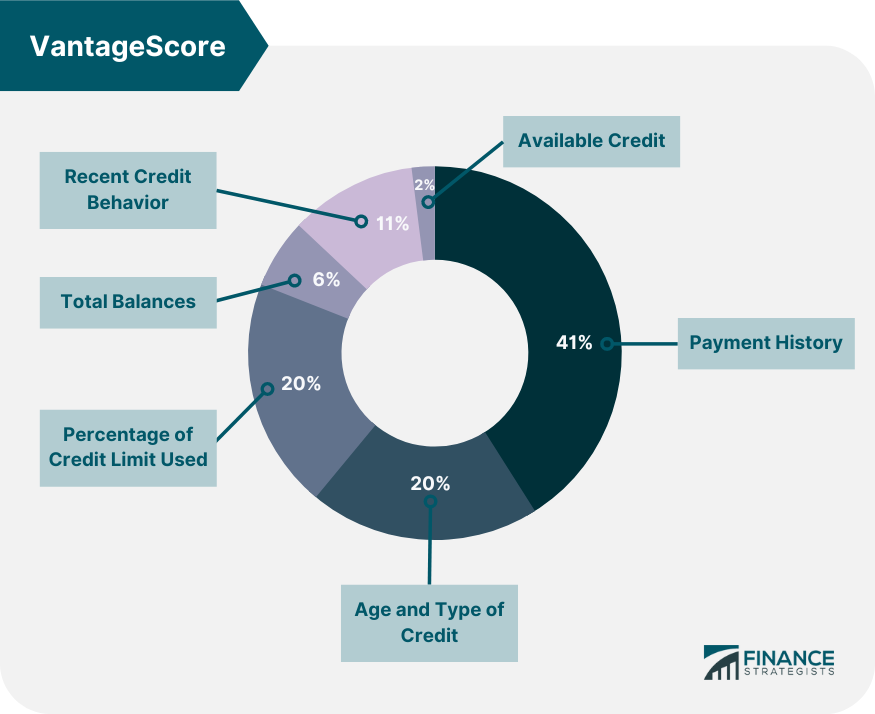

In the modern financial landscape, a strong credit score is vital for accessing credit cards, loans, and favorable financial terms. Discover 12 effective credit hacks to rapidly enhance your credit score. A robust credit score is essential for financial well-being, influencing access to credit cards,...

In 2023, staying informed about your financial well-being is paramount, and our guide on “15 Credit Facts Everyone Needs to Know in 2023” is your compass to navigate the complex landscape of credit. From the nuances of improving credit scores to understanding the impact...

In the contemporary landscape, credit cards play a vital role in facilitating swift and convenient transactions, granting individuals easy access to credit. With diverse options available, each credit card type boasts unique benefits and features. This comprehensive overview explores 18 distinct credit cards...

In 2023, grasping global welfare is vital. “50 Important Welfare Statistics for 2023” offers insights. Explore these stats for a deep understanding of welfare’s impact on poverty, healthcare, education, employment, and the environment. Stay informed for inclusive and sustainable decisions shaping the global...

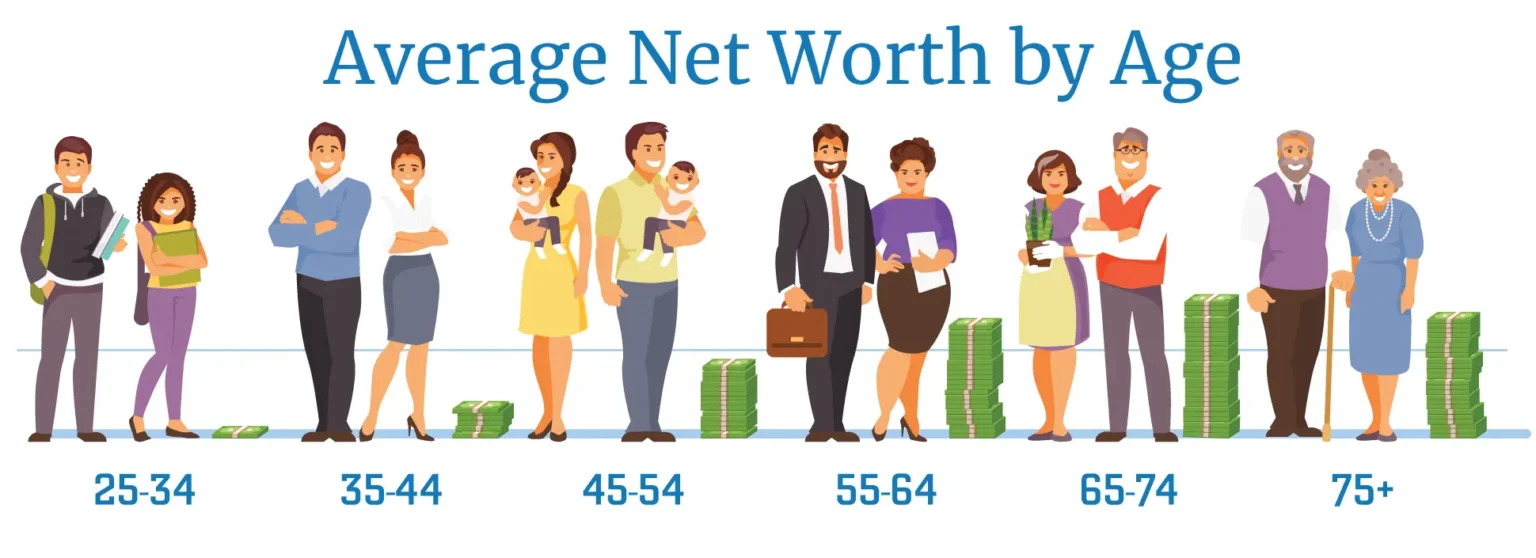

Navigating the intricacies of personal finance involves a crucial exploration of the “Average Net Worth by Age for Americans.” This metric serves as a compass, providing valuable insights into one’s financial standing within their age group. Beyond being a simple numerical figure, average...

Bankruptcy vs Debt Relief When you find yourself in a financial crisis, it can be challenging to know what to do next. Two of the most common options for resolving debt problems are bankruptcy and debt relief. In this article, we’ll explore the...

Buckle up, America” serves as a powerful call to action, urging individuals across the nation to prioritize safety on the roads. This simple yet impactful phrase encapsulates the importance of wearing seat belts, not just as a legal requirement but as a vital...