Navigating the intricacies of personal finance involves a crucial exploration of the “Average Net Worth by Age for Americans.”

This metric serves as a compass, providing valuable insights into one’s financial standing within their age group.

Beyond being a simple numerical figure, average net worth encapsulates the sum total of an individual’s assets minus their debts, offering a comprehensive snapshot of financial health.

As we dissect the data from the Federal Reserve, a fascinating narrative emerges, revealing how Americans in different age brackets fare in the realm of net worth.

From the financial ascent of those under 35 to the seasoned prosperity of individuals aged 75 and older, understanding these averages becomes a pivotal tool for individuals to benchmark their progress, set realistic goals, and pave the way for a financially fulfilling future.

Embarking on a journey into personal finance necessitates a keen awareness of how your financial standing aligns with others in your age bracket.

Net worth, the ultimate arbiter of financial health, stands out as a crucial metric – it’s the sum total of your assets minus your debts.

This not only quantifies your financial position but serves as a dynamic gauge for tracking progress towards your financial aspirations.

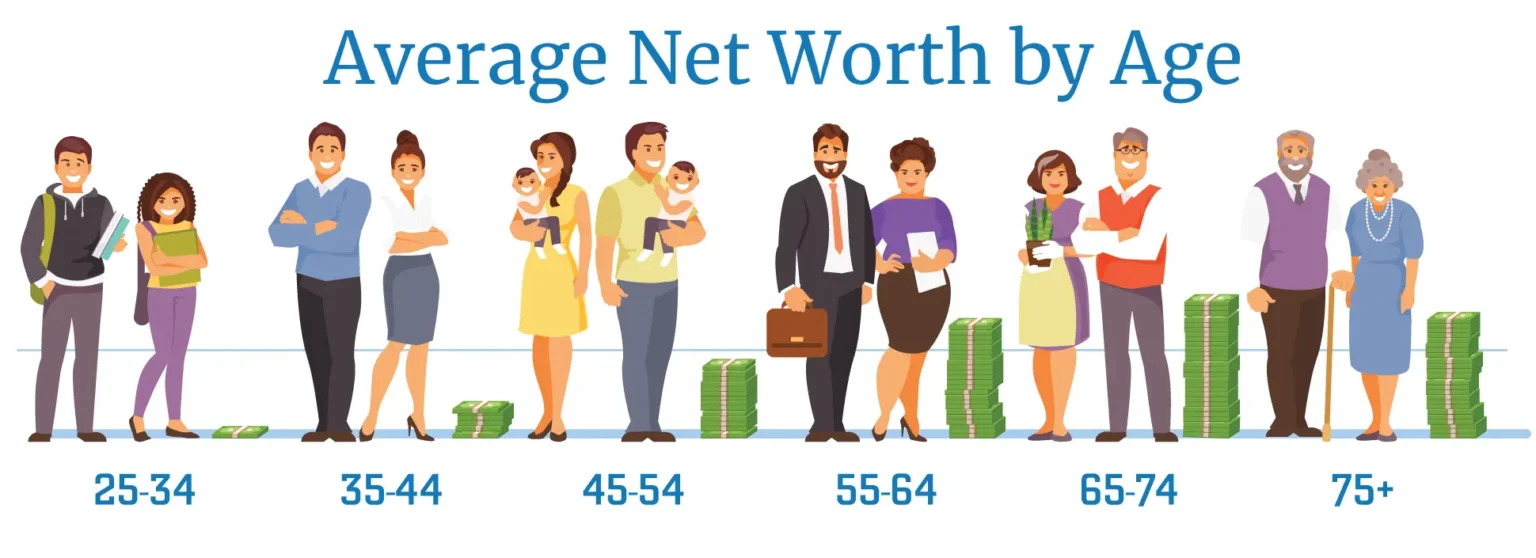

A Glimpse into Average Net Worth Across Age Groups

Delve into the financial landscapes of different age brackets in the United States as we unveil the average net worth, drawing insights from the Federal Reserve’s comprehensive data:

1. Under 35: The Rising Tide of $76,200

Individuals under 35 are riding the financial wave with an average net worth of $76,200, inclusive of diverse assets like retirement accounts and home equity.

2. 35-44: Ascending to $288,700 Heights

A financial ascent characterizes the 35 to 44 age group, boasting an average net worth of $288,700.

Their active workforce participation often translates into higher incomes, contributing to this financial elevation.

3. 45-54: Navigating the $727,500 Realm

Navigating financial waters, those aged 45 to 54 command an impressive average net worth of $727,500.

With substantial assets like homes and robust retirement accounts, they represent a financial powerhouse.

4. 55-64: Approaching Retirement with $1,167,400

As retirement beckons, individuals between 55 and 64 showcase an average net worth of $1,167,400.

The accumulation of additional assets over their careers sets the stage for a financially fulfilling retirement.

5. 65-74: Relishing $1,066,000 in Retirement

Embracing retirement, the 65 to 74 age group enjoys an average net worth of $1,066,000, relying on the fruits of their retirement savings.

6. 75 and older: Sustaining Prosperity at $1,067,000

The seasoned individuals aged 75 and above sustain prosperity with an average net worth of $1,067,000.

Accumulated wealth, supported by savings and investments, paints a picture of financial contentment.

Teen spending habbit statistics for 2023

Strategies for Elevating Your Net Worth

Unhappy with your current net worth? Fear not! Here are compelling strategies to elevate your financial standing:

1. Increase Your Income: Skyrocket Your Wealth

Fuel your financial growth by increasing your income – negotiate a raise, explore a side business, or embrace a part-time job to unlock new financial horizons.

2. Reduce Your Expenses: Trim, Save, Thrive

Slash unnecessary spending, negotiate bills, and discover ingenious ways to cut everyday expenses. A frugal approach can be a game-changer in wealth accumulation.

3. Invest Wisely: The Art of Wealth Multiplication

Navigate the path to financial success by making astute investment decisions. Diversify your portfolio with stocks, bonds, and assets aligned with your risk tolerance and goals.

In Conclusion: Mastering Your Financial Symphony

Understanding your net worth and navigating the financial landscapes of your age group is a captivating journey.

Empower yourself by taking proactive steps to boost income, curtail expenses, and make informed investments.

Your financial symphony awaits – play the notes of progress and watch your net worth crescendo towards your financial dreams.

FAQs

What is the average net worth for a 25-year-old?

The average networth for a 25-year-old is around $10,400. This is largely due to the fact that many people in this age group are just starting out in their careers and may not have accumulated many assets yet.

How does net worth differ from income?

Net worth is the difference between your assets and liabilities, while income is the amount of money you earn in a given period of time. Networth provides a more complete picture of your financial health because it takes into account all of your assets and liabilities, not just your income.

How can I calculate my net worth?

To calculate your net worth, add up the value of all of your assets, including your home, retirement accounts, and other investments. Then subtract your liabilities, such as your mortgage, credit card debt, and other loans. The result is your networth.

What should I do if my net worth is negative?

If your net worth is negative, it’s important to take steps to improve your financial situation. This might include reducing your expenses, increasing your income, and paying down debt. Working with a financial advisor can also be helpful in developing a plan to improve your networth over time.

What other factors should I consider when assessing my financial health?

In addition to net worth, there are other factors that can impact your financial health, such as your credit score, debt-to-income ratio, and savings rate. It’s important to take a comprehensive approach to assessing your financial health and develop a plan that takes all of these factors into account.