What are credit scores statistics in 2026, and what can we learn about the financial health in the United States? This year’s credit trends reveal how borrowing, debt, and payment patterns are shaping lenders’ perceptions of consumers. Whether you’re looking to buy a home, get a credit card, or simply want to raise your credit score, these new statistics will help you decipher what’s really going on behind those three numbers.

What Is a Credit Score?

A credit score is a three-digit number ranging from 300 to 850 that tells how good you are at repaying your loans. It’s based on your credit report information, including your payment history, total debt, credit utilization, length of credit history, new credit inquiries, and your credit mix. Banks, lenders, and financial institutions use your score to decide whether to give you loans, credit cards, or mortgages, and at what interest rates.

Source: Fisco

Credit Score Statistics 2026

Average Credit Score in 2026

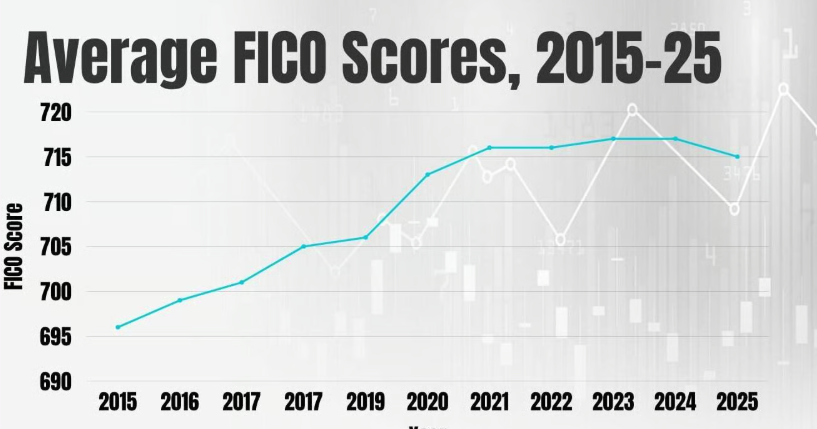

As of late 2025 and likely all the way through early 2026, the average FICO® Score for the U.S. is at 715, according to Experian’s FICO® Score Report. This stability is after the years of stable growth, taking a slight downturn in 2024-2025.

VantageScore Average

The VantageScore CreditGauge averaged 702 in early 2025, which indicates that the health of consumer credit is stable even with more debt.

The number of Americans with excellent credit is 23%

About 23 percent of consumers have a FICO Score of more than 800 and also fall in the “exceptional” grouping of consumers.

4-8. Score Distribution in 2026

Distribution of US consumers by score band:

Poor (300-579): 14.2%

Fair (580-669): 14.9%

Good (670-739): 20.4%

Very Good (740-799): 27.5%

Exceptional (800-850): 23%

Period of the Generation Gap in Credit Ratings

The younger generation is just catching up. The average credit score, broken down by generation:

Gen Z (18-25): 680

Millennials (26-41): 690

Gen X (42-57): 709

Baby Boomers (58-76): 745

Silent Generation (77+): 760

States With Highest & Lowest Scores

The states that have the highest mean scores remain Minnesota (742) and Vermont (738). The lowest averages are those for Mississippi (680) and Louisiana (682). (Experian)

Payment History Is and Remains the Ultimate Winner

Payment history still makes up 35% of a FICO Score – one missed payment can sink your score by 50 – 100 points.

Credit Utilization Caps Average 35.5%

The average utilization rate (the ratio of balance due to credit card use divided by available credit) increased to 35.5% in 2025, showing that consumers are switching to credit cards more in times of inflation.

Credit Card Delinquencies on the increase

Serious delinquencies (90 or more days) increased slightly up to 2025 and are forecast to grow moderately in 2026.

Influence of Student Loans on Score

When federal student loans resumed paying in late 2024, people’s credit scores went slightly down across the nation. (NY Post)

Average Credit Limit in 2026: $30,000

And the limit of credit cards for each consumer averaged almost $30,000 in one year, 2025 itself. (Experian)

Average Credit Card Debt: $6,360

The average American has $6,360 worth of credit card debt – up from $5,900 in 2024. (Federal Reserve)

Mortgage Borrowers Have Score Averages Of 760

The average score when clearing mortgage borrowers is 760, which is the result of tightening underwriting standards.

Auto Loan Borrowers Average 715

The average auto loan borrower today is around 715, whereas subprime borrowers (<600) pay much more in interest.

Credit Scores are Updated on a Monthly Basis

In the majority of instances, credit scores are updated once every month, but depending on activity in your report, such as failing to pay or opening a new account, it can result in more frequent updates to your score.

20-25. Fast Facts for 2026

- 68% of Americans have a good or excellent credit rating

- About 90 per cent of the top lenders are using FICO Scores.

- 45% of consumers monitor their score each and every month.

- 33% use credit monitoring apps

- The results indicated a 12% increase in scores among Americans in the year 2025.

- Less because of increased utilization was the concern for 19%

Checking Your Score Doesn’t Hurt It

Soft inquiries (e.g., checking your own credit score) have no bearing on your credit score.

Flawed Credit Score Myths Remain in Vogue

There’s a widely held belief that carrying a balance improves a score; it doesn’t. Making a total payment is a credit that is responsible

Credit Ratings and Insurance Rates

Good credit drivers pay up to 25% less in insurance as compared to bad credit drivers.

Credit and Employment

Approximately 16% of employers check the credit report (not marks) for jobs where money or money trust is involved.

The Outlook for 2026

The national average credit score is also projected to sit in the range of 713-717 by the end of 2026, where slow recovery is likely to occur even when inflation subsides and delinquencies stabilize. (FICO)

Final Thoughts

Credit scores are nonetheless a good indicator of financial stability. Going into 2026, paying bills on time, keeping credit usage low, and managing debt sensibly are still the best ways of building up your credit score and establishing financial stability.